Allspring Global Investments Holdings LLC increased its stake in Vornado Realty Trust (NYSE:VNO - Free Report) by 19.4% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 243,211 shares of the real estate investment trust's stock after acquiring an additional 39,481 shares during the period. Allspring Global Investments Holdings LLC owned about 0.13% of Vornado Realty Trust worth $9,583,000 as of its most recent SEC filing.

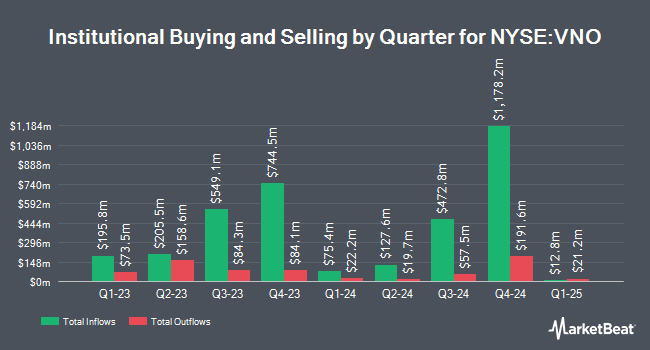

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Blue Trust Inc. boosted its holdings in shares of Vornado Realty Trust by 331.0% in the 3rd quarter. Blue Trust Inc. now owns 1,099 shares of the real estate investment trust's stock worth $43,000 after purchasing an additional 844 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. purchased a new stake in Vornado Realty Trust in the second quarter worth approximately $48,000. Fidelis Capital Partners LLC bought a new position in Vornado Realty Trust during the first quarter valued at approximately $55,000. EverSource Wealth Advisors LLC raised its stake in shares of Vornado Realty Trust by 61.0% during the first quarter. EverSource Wealth Advisors LLC now owns 2,686 shares of the real estate investment trust's stock worth $77,000 after acquiring an additional 1,018 shares in the last quarter. Finally, Northwestern Mutual Wealth Management Co. lifted its holdings in shares of Vornado Realty Trust by 98.3% in the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 4,972 shares of the real estate investment trust's stock worth $131,000 after acquiring an additional 2,465 shares during the last quarter. 90.02% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities analysts recently commented on VNO shares. Evercore ISI lifted their target price on shares of Vornado Realty Trust from $38.00 to $39.00 and gave the stock an "outperform" rating in a research report on Wednesday, August 28th. Barclays boosted their target price on Vornado Realty Trust from $21.00 to $27.00 and gave the company an "underweight" rating in a research note on Wednesday, August 14th. Scotiabank raised their price target on Vornado Realty Trust from $33.00 to $38.00 and gave the stock a "sector perform" rating in a research report on Friday. StockNews.com upgraded Vornado Realty Trust to a "sell" rating in a research report on Saturday, July 20th. Finally, BMO Capital Markets upgraded shares of Vornado Realty Trust from a "market perform" rating to an "outperform" rating and raised their target price for the stock from $29.00 to $40.00 in a report on Thursday, August 8th. Four research analysts have rated the stock with a sell rating, six have assigned a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $32.16.

Read Our Latest Analysis on Vornado Realty Trust

Vornado Realty Trust Stock Down 1.4 %

Vornado Realty Trust stock traded down $0.62 during trading hours on Friday, hitting $43.17. 850,719 shares of the stock traded hands, compared to its average volume of 2,047,421. Vornado Realty Trust has a one year low of $18.36 and a one year high of $44.00. The firm's 50-day moving average price is $37.74 and its two-hundred day moving average price is $30.53. The company has a current ratio of 5.21, a quick ratio of 5.21 and a debt-to-equity ratio of 1.78. The company has a market cap of $8.22 billion, a PE ratio of 287.80 and a beta of 1.65.

Vornado Realty Trust (NYSE:VNO - Get Free Report) last released its quarterly earnings results on Monday, August 5th. The real estate investment trust reported $0.18 earnings per share for the quarter, missing the consensus estimate of $0.55 by ($0.37). The firm had revenue of $450.27 million for the quarter, compared to the consensus estimate of $439.28 million. Vornado Realty Trust had a net margin of 4.51% and a return on equity of 3.21%. The company's revenue for the quarter was down 4.7% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.72 earnings per share. On average, research analysts forecast that Vornado Realty Trust will post 2.17 EPS for the current year.

Vornado Realty Trust Company Profile

(

Free Report)

Vornado Realty Trust is a fully - integrated equity real estate investment trust.

Featured Stories

Before you consider Vornado Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vornado Realty Trust wasn't on the list.

While Vornado Realty Trust currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.