Intact Investment Management Inc. lifted its stake in shares of Veren Inc. (NYSE:VRN - Free Report) by 46.7% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 5,458,686 shares of the company's stock after acquiring an additional 1,737,840 shares during the quarter. Veren accounts for about 1.1% of Intact Investment Management Inc.'s portfolio, making the stock its 25th largest position. Intact Investment Management Inc. owned 0.88% of Veren worth $33,624,000 as of its most recent filing with the Securities and Exchange Commission.

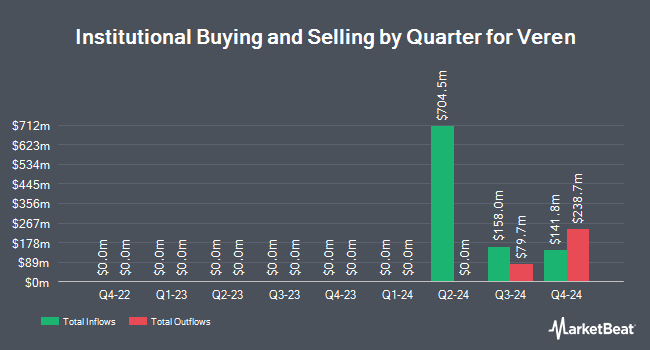

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the stock. Pacifica Partners Inc. purchased a new position in shares of Veren in the 2nd quarter valued at about $61,000. Dixon Mitchell Investment Counsel Inc. acquired a new position in Veren during the 2nd quarter worth approximately $36,000. SG Americas Securities LLC purchased a new stake in shares of Veren in the 2nd quarter valued at approximately $293,000. Perkins Coie Trust Co purchased a new stake in shares of Veren in the 2nd quarter valued at approximately $205,000. Finally, Dynamic Advisor Solutions LLC acquired a new stake in shares of Veren in the 2nd quarter valued at $234,000. 49.37% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several equities analysts recently commented on VRN shares. Raymond James began coverage on Veren in a report on Friday, October 18th. They issued a "strong-buy" rating and a $13.00 target price on the stock. Scotiabank dropped their price objective on Veren from $16.00 to $15.00 and set a "sector outperform" rating on the stock in a report on Friday, July 12th. Finally, Royal Bank of Canada cut their target price on Veren from $12.00 to $10.00 and set an "outperform" rating on the stock in a research report on Friday.

View Our Latest Research Report on Veren

Veren Stock Up 3.2 %

VRN traded up $0.16 on Monday, reaching $5.13. The company had a trading volume of 12,073,503 shares, compared to its average volume of 4,579,813. The company has a debt-to-equity ratio of 0.36, a current ratio of 0.49 and a quick ratio of 0.49. Veren Inc. has a 1 year low of $4.90 and a 1 year high of $9.28. The company has a market cap of $3.16 billion, a PE ratio of 3.64 and a beta of 2.17. The stock's 50-day simple moving average is $6.39.

Veren Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Sunday, December 15th will be paid a dividend of $0.085 per share. This represents a $0.34 dividend on an annualized basis and a yield of 6.63%. The ex-dividend date of this dividend is Friday, December 13th. This is an increase from Veren's previous quarterly dividend of $0.08. Veren's dividend payout ratio (DPR) is currently 24.29%.

Veren Company Profile

(

Free Report)

Veren Inc explores, develops, and produces oil and gas properties in Canada and the United States. The company focuses on crude oil, tight oil, natural gas liquids, shale gas, and natural gas reserves. Its properties are located in the provinces of Saskatchewan, Alberta, British Columbia, and Manitoba; and the states of North Dakota.

See Also

Before you consider Veren, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veren wasn't on the list.

While Veren currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.