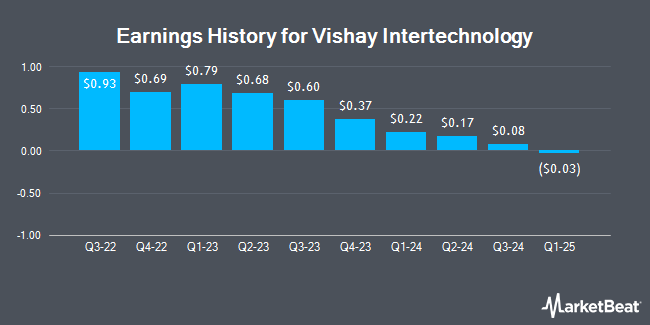

Vishay Intertechnology (NYSE:VSH - Get Free Report) will release its earnings data before the market opens on Wednesday, November 6th. Analysts expect Vishay Intertechnology to post earnings of $0.15 per share for the quarter. Vishay Intertechnology has set its Q3 2024 guidance at EPS.Investors that are interested in registering for the company's conference call can do so using this link.

Vishay Intertechnology (NYSE:VSH - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The semiconductor company reported $0.17 EPS for the quarter, topping the consensus estimate of $0.16 by $0.01. The firm had revenue of $741.20 million during the quarter, compared to analysts' expectations of $754.71 million. Vishay Intertechnology had a return on equity of 8.72% and a net margin of 5.48%. The firm's revenue for the quarter was down 16.9% on a year-over-year basis. During the same period in the previous year, the business earned $0.68 earnings per share. On average, analysts expect Vishay Intertechnology to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Vishay Intertechnology Trading Down 3.2 %

NYSE VSH traded down $0.57 on Wednesday, reaching $17.45. 941,878 shares of the company were exchanged, compared to its average volume of 1,208,879. The business's fifty day moving average price is $18.52 and its 200 day moving average price is $21.12. The stock has a market capitalization of $2.39 billion, a P/E ratio of 14.18 and a beta of 1.09. The company has a current ratio of 2.98, a quick ratio of 1.98 and a debt-to-equity ratio of 0.38. Vishay Intertechnology has a fifty-two week low of $17.42 and a fifty-two week high of $24.72.

Vishay Intertechnology Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Thursday, September 26th. Shareholders of record on Tuesday, September 10th were paid a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a yield of 2.29%. The ex-dividend date was Tuesday, September 10th. Vishay Intertechnology's dividend payout ratio (DPR) is currently 32.52%.

Analyst Upgrades and Downgrades

Separately, TD Cowen lowered their price objective on Vishay Intertechnology from $24.00 to $22.00 and set a "hold" rating on the stock in a research note on Thursday, August 8th.

Check Out Our Latest Analysis on VSH

Vishay Intertechnology Company Profile

(

Get Free Report)

Vishay Intertechnology, Inc manufactures and sells discrete semiconductors and passive electronic components in Asia, Europe, and the Americas. The company operates through Metal Oxide Semiconductor Field Effect Transistors (MOSFETs), Diodes, Optoelectronic Components, Resistors, Inductors, and Capacitors segments.

Featured Articles

Before you consider Vishay Intertechnology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vishay Intertechnology wasn't on the list.

While Vishay Intertechnology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.