Adams Diversified Equity Fund Inc. raised its holdings in shares of Vistra Corp. (NYSE:VST - Free Report) by 78.9% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 27,200 shares of the company's stock after purchasing an additional 12,000 shares during the period. Adams Diversified Equity Fund Inc.'s holdings in Vistra were worth $3,224,000 as of its most recent SEC filing.

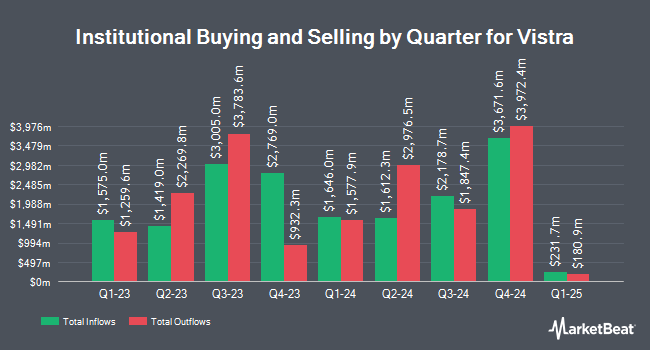

A number of other large investors also recently modified their holdings of the business. Castle Hook Partners LP boosted its position in Vistra by 470.0% during the 1st quarter. Castle Hook Partners LP now owns 3,769,842 shares of the company's stock valued at $262,569,000 after purchasing an additional 3,108,511 shares during the period. TD Asset Management Inc grew its position in shares of Vistra by 9,668.5% during the first quarter. TD Asset Management Inc now owns 2,940,113 shares of the company's stock worth $204,779,000 after acquiring an additional 2,910,015 shares during the last quarter. Massachusetts Financial Services Co. MA increased its holdings in shares of Vistra by 115.3% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 2,532,657 shares of the company's stock worth $217,758,000 after acquiring an additional 1,356,488 shares during the period. Thrivent Financial for Lutherans lifted its position in Vistra by 1,358.2% in the 2nd quarter. Thrivent Financial for Lutherans now owns 1,228,144 shares of the company's stock valued at $105,596,000 after purchasing an additional 1,143,918 shares during the last quarter. Finally, Marshall Wace LLP boosted its stake in Vistra by 315.9% during the 2nd quarter. Marshall Wace LLP now owns 1,175,811 shares of the company's stock valued at $101,096,000 after purchasing an additional 893,093 shares during the period. 90.88% of the stock is currently owned by institutional investors.

Vistra Stock Down 1.1 %

NYSE VST traded down $1.45 during trading on Wednesday, reaching $125.21. 2,202,667 shares of the company's stock were exchanged, compared to its average volume of 6,899,844. The firm has a market capitalization of $43.51 billion, a PE ratio of 76.16 and a beta of 1.10. Vistra Corp. has a fifty-two week low of $32.34 and a fifty-two week high of $143.87. The company has a current ratio of 0.98, a quick ratio of 0.88 and a debt-to-equity ratio of 2.89. The company's fifty day simple moving average is $106.31 and its 200-day simple moving average is $91.86.

Vistra (NYSE:VST - Get Free Report) last announced its quarterly earnings data on Thursday, August 8th. The company reported $0.90 EPS for the quarter, missing analysts' consensus estimates of $1.59 by ($0.69). The company had revenue of $3.85 billion for the quarter, compared to analysts' expectations of $4.04 billion. Vistra had a net margin of 4.61% and a return on equity of 21.05%. During the same period in the previous year, the firm posted $1.03 earnings per share. Sell-side analysts predict that Vistra Corp. will post 4.02 EPS for the current year.

Wall Street Analysts Forecast Growth

VST has been the topic of a number of recent analyst reports. JPMorgan Chase & Co. initiated coverage on shares of Vistra in a research note on Thursday, October 17th. They set an "overweight" rating and a $178.00 price objective on the stock. Morgan Stanley boosted their target price on Vistra from $110.00 to $132.00 and gave the stock an "overweight" rating in a report on Monday, September 23rd. BNP Paribas began coverage on Vistra in a report on Monday, October 14th. They set an "outperform" rating and a $231.00 target price on the stock. Jefferies Financial Group boosted their price target on shares of Vistra from $99.00 to $137.00 and gave the stock a "buy" rating in a research report on Tuesday, September 24th. Finally, UBS Group reduced their price objective on Vistra from $157.00 to $150.00 and set a "buy" rating for the company in a research note on Tuesday, October 22nd. Ten research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the stock presently has an average rating of "Buy" and an average price target of $145.40.

View Our Latest Stock Report on Vistra

Vistra Profile

(

Free Report)

Vistra Corp., together with its subsidiaries, operates as an integrated retail electricity and power generation company. The company operates through six segments: Retail, Texas, East, West, Sunset, and Asset Closure. It retails electricity and natural gas to residential, commercial, and industrial customers across states in the United States and the District of Columbia.

See Also

Before you consider Vistra, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vistra wasn't on the list.

While Vistra currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.