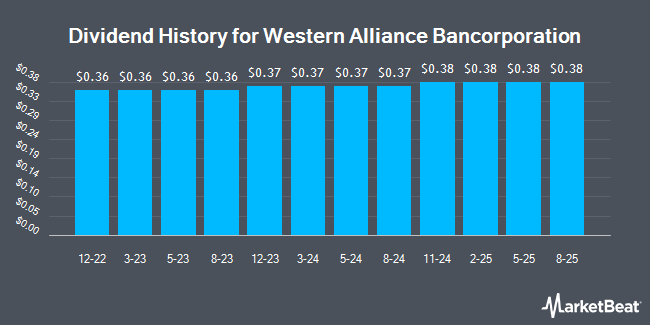

Western Alliance Bancorporation (NYSE:WAL - Get Free Report) announced a quarterly dividend on Thursday, October 31st, Wall Street Journal reports. Investors of record on Friday, November 15th will be given a dividend of 0.38 per share by the financial services provider on Friday, November 29th. This represents a $1.52 dividend on an annualized basis and a yield of 1.84%. The ex-dividend date of this dividend is Friday, November 15th. This is a boost from Western Alliance Bancorporation's previous quarterly dividend of $0.37.

Western Alliance Bancorporation has raised its dividend payment by an average of 13.2% per year over the last three years. Western Alliance Bancorporation has a payout ratio of 16.5% indicating that its dividend is sufficiently covered by earnings. Equities analysts expect Western Alliance Bancorporation to earn $8.91 per share next year, which means the company should continue to be able to cover its $1.48 annual dividend with an expected future payout ratio of 16.6%.

Western Alliance Bancorporation Price Performance

WAL stock traded down $0.90 during trading on Monday, hitting $82.41. The stock had a trading volume of 828,651 shares, compared to its average volume of 1,310,252. The stock has a market cap of $9.07 billion, a price-to-earnings ratio of 12.72, a price-to-earnings-growth ratio of 1.30 and a beta of 1.44. The company has a debt-to-equity ratio of 1.07, a quick ratio of 0.85 and a current ratio of 0.88. The company's 50 day moving average price is $83.80 and its two-hundred day moving average price is $72.60. Western Alliance Bancorporation has a 1-year low of $43.20 and a 1-year high of $94.28.

Analysts Set New Price Targets

WAL has been the subject of several recent analyst reports. Truist Financial lowered their price target on Western Alliance Bancorporation from $100.00 to $95.00 and set a "buy" rating for the company in a report on Monday, October 21st. Royal Bank of Canada set a $99.00 price target on shares of Western Alliance Bancorporation and gave the stock an "outperform" rating in a research report on Friday, October 18th. Wells Fargo & Company lifted their price target on shares of Western Alliance Bancorporation from $85.00 to $92.00 and gave the company an "equal weight" rating in a report on Tuesday, October 1st. StockNews.com cut shares of Western Alliance Bancorporation from a "hold" rating to a "sell" rating in a research note on Tuesday, August 13th. Finally, Stephens reaffirmed an "overweight" rating and issued a $102.00 target price on shares of Western Alliance Bancorporation in a research report on Friday, October 18th. One research analyst has rated the stock with a sell rating, one has assigned a hold rating and fourteen have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $92.60.

Get Our Latest Stock Analysis on Western Alliance Bancorporation

Insiders Place Their Bets

In related news, Director Robert P. Latta sold 2,996 shares of the business's stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $82.75, for a total value of $247,919.00. Following the completion of the sale, the director now directly owns 4,056 shares of the company's stock, valued at $335,634. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. In other news, insider Barbara Kennedy sold 11,083 shares of the firm's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $81.59, for a total value of $904,261.97. Following the transaction, the insider now directly owns 7,977 shares in the company, valued at approximately $650,843.43. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, Director Robert P. Latta sold 2,996 shares of the business's stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $82.75, for a total transaction of $247,919.00. Following the sale, the director now directly owns 4,056 shares of the company's stock, valued at approximately $335,634. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 2.75% of the stock is owned by company insiders.

Western Alliance Bancorporation Company Profile

(

Get Free Report)

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates through Commercial and Consumer Related segments. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; demand deposits; and treasury management and residential mortgage products and services.

Further Reading

Before you consider Western Alliance Bancorporation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Alliance Bancorporation wasn't on the list.

While Western Alliance Bancorporation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.