Western Alliance Bancorporation (NYSE:WAL - Get Free Report) had its price target lowered by Barclays from $110.00 to $105.00 in a report issued on Tuesday, Benzinga reports. The firm currently has an "overweight" rating on the financial services provider's stock. Barclays's price objective points to a potential upside of 27.52% from the company's current price.

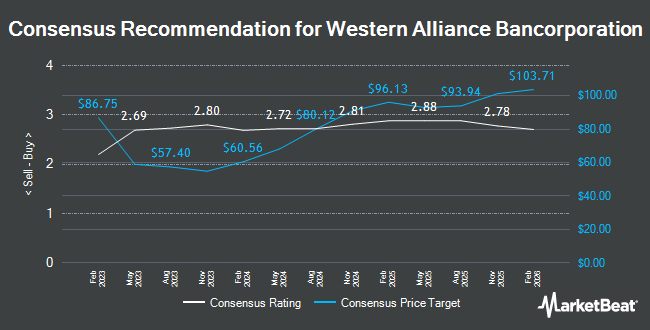

Several other brokerages also recently weighed in on WAL. JPMorgan Chase & Co. lowered their target price on Western Alliance Bancorporation from $107.00 to $105.00 and set an "overweight" rating on the stock in a research note on Monday. Stephens reaffirmed an "overweight" rating and issued a $102.00 target price on shares of Western Alliance Bancorporation in a report on Friday. Deutsche Bank Aktiengesellschaft raised shares of Western Alliance Bancorporation from a "hold" rating to a "buy" rating and increased their price target for the stock from $83.00 to $101.00 in a report on Monday, October 7th. Wedbush lifted their price objective on Western Alliance Bancorporation from $90.00 to $105.00 and gave the company an "outperform" rating in a report on Tuesday, September 24th. Finally, StockNews.com downgraded Western Alliance Bancorporation from a "hold" rating to a "sell" rating in a research note on Tuesday, August 13th. One analyst has rated the stock with a sell rating, one has assigned a hold rating and fourteen have assigned a buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $92.60.

View Our Latest Stock Analysis on WAL

Western Alliance Bancorporation Stock Performance

Shares of NYSE:WAL traded up $1.83 on Tuesday, reaching $82.34. The company's stock had a trading volume of 2,115,613 shares, compared to its average volume of 1,324,832. The company has a debt-to-equity ratio of 1.07, a current ratio of 0.88 and a quick ratio of 0.85. Western Alliance Bancorporation has a 52-week low of $38.81 and a 52-week high of $94.28. The stock's 50-day moving average is $82.73 and its two-hundred day moving average is $70.79. The stock has a market capitalization of $9.06 billion, a P/E ratio of 12.71, a PEG ratio of 1.30 and a beta of 1.44.

Insider Activity

In other news, insider Stephen Russell Curley sold 5,070 shares of the firm's stock in a transaction dated Thursday, August 1st. The stock was sold at an average price of $76.43, for a total transaction of $387,500.10. Following the completion of the sale, the insider now directly owns 36,718 shares in the company, valued at $2,806,356.74. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In other news, insider Stephen Russell Curley sold 5,070 shares of the company's stock in a transaction dated Thursday, August 1st. The shares were sold at an average price of $76.43, for a total value of $387,500.10. Following the sale, the insider now owns 36,718 shares in the company, valued at approximately $2,806,356.74. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Robert P. Latta sold 2,996 shares of Western Alliance Bancorporation stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $82.75, for a total value of $247,919.00. Following the completion of the transaction, the director now owns 4,056 shares of the company's stock, valued at approximately $335,634. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 19,149 shares of company stock worth $1,539,681. 2.75% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Western Alliance Bancorporation

A number of institutional investors have recently modified their holdings of WAL. Cincinnati Insurance Co. acquired a new position in Western Alliance Bancorporation in the first quarter valued at approximately $46,538,000. LHM Inc. boosted its position in Western Alliance Bancorporation by 2,141.1% during the 2nd quarter. LHM Inc. now owns 757,809 shares of the financial services provider's stock valued at $47,606,000 after purchasing an additional 723,995 shares during the period. Price T Rowe Associates Inc. MD grew its stake in Western Alliance Bancorporation by 16.3% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 5,112,376 shares of the financial services provider's stock worth $328,165,000 after buying an additional 717,242 shares during the last quarter. Dimensional Fund Advisors LP lifted its stake in Western Alliance Bancorporation by 20.6% in the second quarter. Dimensional Fund Advisors LP now owns 3,722,389 shares of the financial services provider's stock valued at $233,832,000 after buying an additional 636,577 shares during the last quarter. Finally, Vanguard Group Inc. boosted its holdings in shares of Western Alliance Bancorporation by 3.9% during the first quarter. Vanguard Group Inc. now owns 10,440,410 shares of the financial services provider's stock valued at $670,170,000 after acquiring an additional 395,101 shares during the period. Institutional investors own 79.15% of the company's stock.

About Western Alliance Bancorporation

(

Get Free Report)

Western Alliance Bancorporation operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada. It operates through Commercial and Consumer Related segments. The company offers deposit products, including checking, savings, and money market accounts, as well as fixed-rate and fixed maturity certificates of deposit accounts; demand deposits; and treasury management and residential mortgage products and services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Western Alliance Bancorporation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Alliance Bancorporation wasn't on the list.

While Western Alliance Bancorporation currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.