WESCO International (NYSE:WCC - Free Report) had its price objective increased by Royal Bank of Canada from $186.00 to $199.00 in a research note published on Friday, Benzinga reports. Royal Bank of Canada currently has a sector perform rating on the technology company's stock.

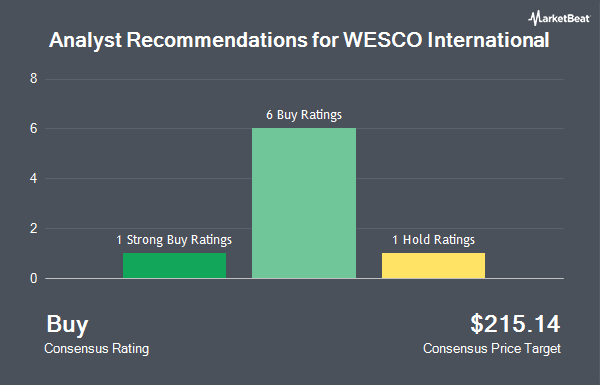

A number of other analysts have also recently issued reports on WCC. Robert W. Baird boosted their price objective on WESCO International from $215.00 to $223.00 and gave the company an "outperform" rating in a research report on Friday. Stephens restated an "overweight" rating and issued a $190.00 price objective on shares of WESCO International in a research note on Monday, August 5th. Oppenheimer raised their price objective on shares of WESCO International from $205.00 to $225.00 and gave the stock an "outperform" rating in a report on Friday. Loop Capital upped their target price on shares of WESCO International from $190.00 to $210.00 and gave the company a "buy" rating in a research note on Friday, September 27th. Finally, Baird R W upgraded shares of WESCO International from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, October 16th. Two investment analysts have rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $206.71.

Check Out Our Latest Report on WESCO International

WESCO International Stock Performance

WESCO International stock traded down $3.80 during mid-day trading on Friday, reaching $188.17. The company had a trading volume of 915,241 shares, compared to its average volume of 700,988. The company has a quick ratio of 1.34, a current ratio of 2.28 and a debt-to-equity ratio of 1.07. The firm has a market cap of $9.25 billion, a price-to-earnings ratio of 14.61, a PEG ratio of 1.48 and a beta of 2.03. The company has a 50 day moving average of $168.15 and a 200-day moving average of $167.47. WESCO International has a 52 week low of $131.38 and a 52 week high of $195.99.

WESCO International (NYSE:WCC - Get Free Report) last released its earnings results on Thursday, October 31st. The technology company reported $3.58 earnings per share for the quarter, beating the consensus estimate of $3.22 by $0.36. WESCO International had a net margin of 3.30% and a return on equity of 14.44%. The business had revenue of $5.49 billion during the quarter, compared to analysts' expectations of $5.46 billion. During the same quarter last year, the company earned $4.49 earnings per share. The firm's revenue was down 2.7% on a year-over-year basis. On average, sell-side analysts expect that WESCO International will post 12.04 EPS for the current fiscal year.

WESCO International Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Friday, September 13th were paid a $0.4125 dividend. This represents a $1.65 dividend on an annualized basis and a dividend yield of 0.88%. The ex-dividend date of this dividend was Friday, September 13th. WESCO International's dividend payout ratio (DPR) is currently 12.81%.

Insider Transactions at WESCO International

In related news, Director Steven A. Raymund sold 5,819 shares of the firm's stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $171.56, for a total transaction of $998,307.64. Following the completion of the sale, the director now directly owns 27,004 shares of the company's stock, valued at $4,632,806.24. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. In other WESCO International news, Director Steven A. Raymund sold 5,819 shares of the stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $171.56, for a total transaction of $998,307.64. Following the sale, the director now owns 27,004 shares of the company's stock, valued at $4,632,806.24. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Nelson John Squires III sold 10,000 shares of the firm's stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $190.00, for a total transaction of $1,900,000.00. Following the completion of the sale, the executive vice president now owns 54,621 shares of the company's stock, valued at $10,377,990. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. 3.10% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the company. AEGON ASSET MANAGEMENT UK Plc raised its holdings in WESCO International by 0.5% during the 3rd quarter. AEGON ASSET MANAGEMENT UK Plc now owns 186,081 shares of the technology company's stock worth $31,258,000 after purchasing an additional 983 shares during the last quarter. Innealta Capital LLC grew its position in shares of WESCO International by 68.0% during the 3rd quarter. Innealta Capital LLC now owns 1,606 shares of the technology company's stock worth $270,000 after buying an additional 650 shares during the period. Van ECK Associates Corp raised its stake in shares of WESCO International by 128.3% during the third quarter. Van ECK Associates Corp now owns 29,666 shares of the technology company's stock worth $5,182,000 after buying an additional 16,673 shares during the last quarter. Harbor Capital Advisors Inc. raised its position in shares of WESCO International by 142.8% during the third quarter. Harbor Capital Advisors Inc. now owns 30,063 shares of the technology company's stock worth $5,050,000 after purchasing an additional 17,682 shares during the period. Finally, EMC Capital Management lifted its holdings in shares of WESCO International by 580.8% during the 3rd quarter. EMC Capital Management now owns 16,094 shares of the technology company's stock valued at $2,703,000 after purchasing an additional 13,730 shares in the last quarter. Institutional investors and hedge funds own 93.76% of the company's stock.

WESCO International Company Profile

(

Get Free Report)

WESCO International, Inc provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally. It operates through three segments: Electrical & Electronic Solutions (EES), Communications & Security Solutions (CSS), and Utility and Broadband Solutions (UBS).

Read More

Before you consider WESCO International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WESCO International wasn't on the list.

While WESCO International currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.