Wyndham Hotels & Resorts (NYSE:WH - Get Free Report) was upgraded by equities researchers at StockNews.com from a "sell" rating to a "hold" rating in a report issued on Tuesday.

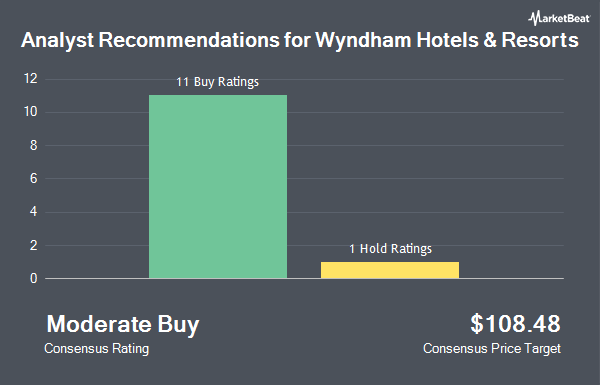

A number of other equities analysts also recently commented on the company. The Goldman Sachs Group assumed coverage on Wyndham Hotels & Resorts in a research note on Wednesday, September 18th. They issued a "buy" rating and a $96.00 price target for the company. Barclays lifted their target price on Wyndham Hotels & Resorts from $88.00 to $90.00 and gave the stock an "overweight" rating in a research report on Friday, July 26th. Robert W. Baird set a $92.00 price target on Wyndham Hotels & Resorts in a research report on Thursday, October 17th. Stifel Nicolaus decreased their price objective on shares of Wyndham Hotels & Resorts from $91.50 to $89.00 and set a "buy" rating for the company in a report on Thursday, July 25th. Finally, Truist Financial lowered their target price on shares of Wyndham Hotels & Resorts from $104.00 to $103.00 and set a "buy" rating for the company in a research note on Monday, October 14th. Two equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $90.63.

Get Our Latest Research Report on Wyndham Hotels & Resorts

Wyndham Hotels & Resorts Stock Up 0.8 %

NYSE WH traded up $0.67 during mid-day trading on Tuesday, reaching $83.36. 1,355,899 shares of the company's stock traded hands, compared to its average volume of 739,452. The company has a current ratio of 0.90, a quick ratio of 0.90 and a debt-to-equity ratio of 3.83. Wyndham Hotels & Resorts has a 1-year low of $67.67 and a 1-year high of $83.38. The company has a fifty day simple moving average of $78.53 and a 200-day simple moving average of $74.71. The company has a market cap of $6.72 billion, a price-to-earnings ratio of 29.56, a P/E/G ratio of 2.87 and a beta of 1.33.

Wyndham Hotels & Resorts (NYSE:WH - Get Free Report) last released its quarterly earnings results on Wednesday, July 24th. The company reported $1.13 earnings per share for the quarter, topping analysts' consensus estimates of $1.03 by $0.10. The business had revenue of $367.00 million during the quarter, compared to the consensus estimate of $370.58 million. Wyndham Hotels & Resorts had a net margin of 18.28% and a return on equity of 47.05%. The business's quarterly revenue was up 1.4% compared to the same quarter last year. During the same quarter last year, the company earned $0.93 earnings per share. As a group, equities research analysts expect that Wyndham Hotels & Resorts will post 4.26 EPS for the current year.

Insider Activity

In related news, CAO Nicola Rossi sold 7,297 shares of the company's stock in a transaction dated Friday, July 26th. The shares were sold at an average price of $76.70, for a total value of $559,679.90. Following the completion of the sale, the chief accounting officer now owns 4,107 shares of the company's stock, valued at $315,006.90. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. In other news, CAO Nicola Rossi sold 7,297 shares of the business's stock in a transaction on Friday, July 26th. The stock was sold at an average price of $76.70, for a total value of $559,679.90. Following the sale, the chief accounting officer now owns 4,107 shares of the company's stock, valued at approximately $315,006.90. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, insider Monica Melancon sold 5,040 shares of the firm's stock in a transaction dated Friday, September 6th. The shares were sold at an average price of $77.66, for a total value of $391,406.40. Following the transaction, the insider now directly owns 10,606 shares of the company's stock, valued at $823,661.96. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 12,640 shares of company stock valued at $974,351. Insiders own 2.79% of the company's stock.

Institutional Trading of Wyndham Hotels & Resorts

A number of large investors have recently added to or reduced their stakes in WH. Retirement Systems of Alabama lifted its position in shares of Wyndham Hotels & Resorts by 40.1% during the 1st quarter. Retirement Systems of Alabama now owns 231,671 shares of the company's stock valued at $17,781,000 after acquiring an additional 66,266 shares during the last quarter. TimesSquare Capital Management LLC purchased a new stake in shares of Wyndham Hotels & Resorts during the first quarter valued at $1,382,000. Van ECK Associates Corp acquired a new position in shares of Wyndham Hotels & Resorts in the 1st quarter valued at $2,292,000. Hsbc Holdings PLC purchased a new position in Wyndham Hotels & Resorts in the 2nd quarter worth about $1,425,000. Finally, Thrivent Financial for Lutherans increased its stake in Wyndham Hotels & Resorts by 377.5% in the 2nd quarter. Thrivent Financial for Lutherans now owns 1,240,702 shares of the company's stock worth $91,812,000 after purchasing an additional 980,848 shares in the last quarter. 93.46% of the stock is currently owned by institutional investors.

About Wyndham Hotels & Resorts

(

Get Free Report)

Wyndham Hotels & Resorts, Inc operates as a hotel franchisor in the United States and internationally. It operates through Hotel Franchising and Hotel Management segments. The Hotel Franchising segment licenses its lodging brands and provides related services to third-party hotel owners and others.

Featured Articles

Before you consider Wyndham Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wyndham Hotels & Resorts wasn't on the list.

While Wyndham Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.