Iridian Asset Management LLC CT boosted its stake in Wolfspeed, Inc. (NYSE:WOLF - Free Report) by 319.9% during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 521,158 shares of the company's stock after acquiring an additional 397,057 shares during the period. Wolfspeed accounts for about 1.1% of Iridian Asset Management LLC CT's holdings, making the stock its 26th biggest position. Iridian Asset Management LLC CT owned approximately 0.41% of Wolfspeed worth $5,055,000 as of its most recent filing with the Securities & Exchange Commission.

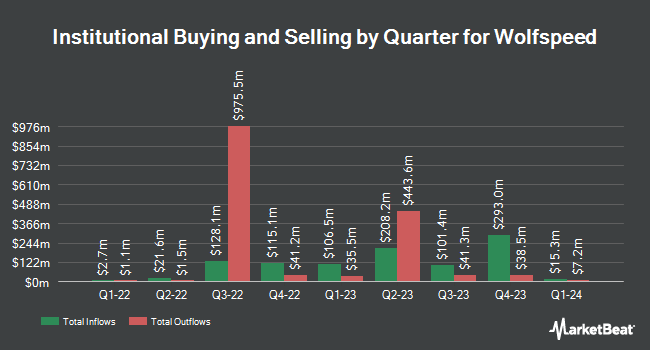

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Primecap Management Co. CA boosted its holdings in shares of Wolfspeed by 15.3% in the second quarter. Primecap Management Co. CA now owns 6,045,310 shares of the company's stock valued at $137,591,000 after acquiring an additional 800,540 shares in the last quarter. Vanguard Group Inc. raised its position in Wolfspeed by 3.6% in the first quarter. Vanguard Group Inc. now owns 13,079,067 shares of the company's stock worth $385,832,000 after acquiring an additional 449,732 shares in the last quarter. Samlyn Capital LLC boosted its position in shares of Wolfspeed by 51.6% during the 2nd quarter. Samlyn Capital LLC now owns 1,009,137 shares of the company's stock worth $22,968,000 after purchasing an additional 343,277 shares in the last quarter. Rheos Capital Works Inc. grew its stake in shares of Wolfspeed by 140.8% during the 3rd quarter. Rheos Capital Works Inc. now owns 427,500 shares of the company's stock worth $4,147,000 after purchasing an additional 250,000 shares during the period. Finally, Dimensional Fund Advisors LP lifted its stake in shares of Wolfspeed by 30.5% in the second quarter. Dimensional Fund Advisors LP now owns 637,581 shares of the company's stock valued at $14,513,000 after purchasing an additional 149,093 shares during the period.

Analyst Ratings Changes

A number of research analysts have issued reports on WOLF shares. Canaccord Genuity Group dropped their target price on shares of Wolfspeed from $45.00 to $25.00 and set a "buy" rating for the company in a report on Thursday, August 29th. The Goldman Sachs Group reduced their price objective on Wolfspeed from $48.00 to $28.00 and set a "buy" rating for the company in a report on Thursday, August 22nd. Mizuho lowered Wolfspeed from a "neutral" rating to an "underperform" rating and lowered their target price for the company from $17.00 to $8.00 in a report on Thursday, October 3rd. Bank of America cut their price target on Wolfspeed from $25.00 to $15.00 and set an "underperform" rating for the company in a research note on Friday, August 23rd. Finally, Susquehanna lowered their price objective on shares of Wolfspeed from $23.00 to $16.00 and set a "neutral" rating on the stock in a research note on Thursday, August 22nd. Two investment analysts have rated the stock with a sell rating, ten have given a hold rating and four have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Wolfspeed has a consensus rating of "Hold" and an average price target of $22.43.

Get Our Latest Research Report on WOLF

Wolfspeed Stock Down 11.6 %

Shares of WOLF traded down $1.75 during midday trading on Thursday, reaching $13.30. 11,342,477 shares of the company were exchanged, compared to its average volume of 6,423,736. The company has a current ratio of 4.51, a quick ratio of 3.85 and a debt-to-equity ratio of 6.99. Wolfspeed, Inc. has a 1-year low of $7.28 and a 1-year high of $47.43. The company has a market cap of $1.69 billion, a price-to-earnings ratio of -1.92 and a beta of 1.52. The stock has a 50-day moving average price of $10.89 and a 200-day moving average price of $18.62.

Wolfspeed (NYSE:WOLF - Get Free Report) last released its quarterly earnings results on Wednesday, August 21st. The company reported ($1.06) earnings per share (EPS) for the quarter, missing the consensus estimate of ($1.03) by ($0.03). Wolfspeed had a negative return on equity of 37.76% and a negative net margin of 107.93%. The firm had revenue of $200.70 million for the quarter, compared to analysts' expectations of $201.11 million. Research analysts expect that Wolfspeed, Inc. will post -3.84 earnings per share for the current year.

Wolfspeed Company Profile

(

Free Report)

Wolfspeed, Inc operates as a powerhouse semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally. It offers silicon carbide and GaN materials, including silicon carbide bare wafers, epitaxial wafers, and GaN epitaxial layers on silicon carbide wafers to manufacture products for RF, power, and other applications.

See Also

Before you consider Wolfspeed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wolfspeed wasn't on the list.

While Wolfspeed currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.