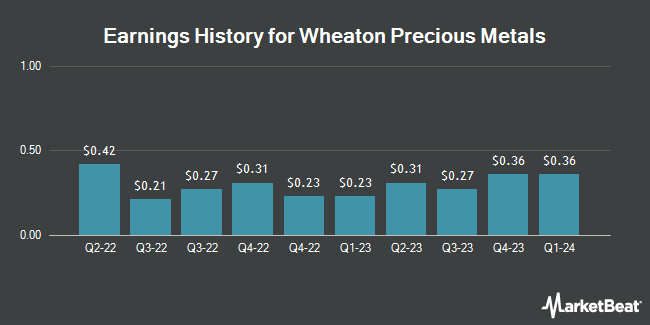

Wheaton Precious Metals (NYSE:WPM - Get Free Report) is scheduled to post its quarterly earnings results after the market closes on Thursday, November 7th. Analysts expect Wheaton Precious Metals to post earnings of $0.37 per share for the quarter. Parties that wish to register for the company's conference call can do so using this link.

Wheaton Precious Metals (NYSE:WPM - Get Free Report) last posted its earnings results on Wednesday, August 7th. The company reported $0.33 earnings per share for the quarter, beating analysts' consensus estimates of $0.29 by $0.04. Wheaton Precious Metals had a return on equity of 8.54% and a net margin of 50.44%. The company had revenue of $299.06 million for the quarter, compared to analyst estimates of $309.54 million. During the same quarter last year, the company earned $0.31 earnings per share. The company's revenue for the quarter was up 12.9% on a year-over-year basis. On average, analysts expect Wheaton Precious Metals to post $1 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Wheaton Precious Metals Price Performance

Shares of WPM stock traded down $1.52 during trading hours on Thursday, reaching $66.03. The company had a trading volume of 4,929,344 shares, compared to its average volume of 1,772,838. Wheaton Precious Metals has a 12 month low of $38.57 and a 12 month high of $68.64. The business has a fifty day simple moving average of $62.37 and a 200-day simple moving average of $57.99. The company has a market cap of $29.95 billion, a price-to-earnings ratio of 50.79, a price-to-earnings-growth ratio of 2.41 and a beta of 0.78.

Wheaton Precious Metals Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Wednesday, September 4th. Stockholders of record on Wednesday, August 21st were issued a $0.155 dividend. The ex-dividend date was Wednesday, August 21st. This represents a $0.62 dividend on an annualized basis and a dividend yield of 0.94%. Wheaton Precious Metals's dividend payout ratio is presently 47.69%.

Analyst Upgrades and Downgrades

A number of analysts recently commented on WPM shares. Scotiabank increased their price target on Wheaton Precious Metals from $66.50 to $72.00 and gave the company a "sector outperform" rating in a research report on Monday, August 19th. National Bank Financial raised Wheaton Precious Metals from a "sector perform" rating to an "outperform" rating in a research report on Thursday, October 10th. TD Securities decreased their price target on Wheaton Precious Metals from $71.00 to $70.00 and set a "buy" rating for the company in a research report on Thursday, August 15th. CIBC increased their price target on Wheaton Precious Metals from $75.00 to $80.00 and gave the company an "outperformer" rating in a research report on Wednesday, July 10th. Finally, Stifel Canada downgraded Wheaton Precious Metals from a "strong-buy" rating to a "hold" rating in a research report on Monday, October 21st. One equities research analyst has rated the stock with a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat.com, Wheaton Precious Metals has a consensus rating of "Moderate Buy" and an average target price of $70.25.

Read Our Latest Analysis on Wheaton Precious Metals

About Wheaton Precious Metals

(

Get Free Report)

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Read More

Before you consider Wheaton Precious Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wheaton Precious Metals wasn't on the list.

While Wheaton Precious Metals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.