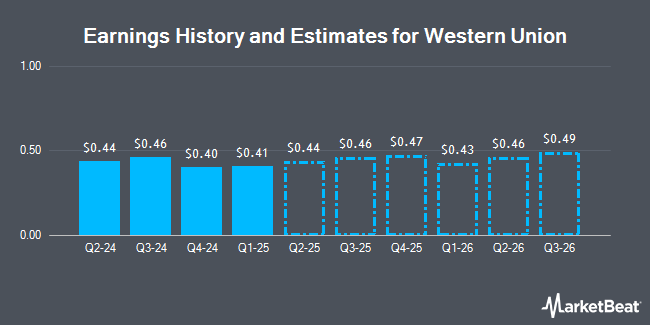

The Western Union Company (NYSE:WU - Free Report) - Stock analysts at Northland Capmk dropped their Q4 2024 earnings estimates for Western Union in a note issued to investors on Thursday, October 24th. Northland Capmk analyst M. Grondahl now expects that the credit services provider will post earnings of $0.40 per share for the quarter, down from their prior forecast of $0.42. The consensus estimate for Western Union's current full-year earnings is $1.76 per share.

A number of other brokerages have also weighed in on WU. UBS Group cut their target price on shares of Western Union from $13.50 to $12.00 and set a "neutral" rating for the company in a research report on Thursday. Royal Bank of Canada lowered their target price on shares of Western Union from $16.00 to $14.00 and set a "sector perform" rating on the stock in a report on Wednesday, July 31st. Citigroup restated a "neutral" rating and set a $13.00 target price on shares of Western Union in a research report on Wednesday, July 17th. JPMorgan Chase & Co. decreased their price objective on Western Union from $14.00 to $12.00 and set an "underweight" rating on the stock in a research note on Tuesday, August 20th. Finally, StockNews.com upgraded Western Union from a "sell" rating to a "hold" rating in a research note on Friday. Three equities research analysts have rated the stock with a sell rating and eight have given a hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $12.86.

Check Out Our Latest Stock Report on Western Union

Western Union Stock Performance

Shares of WU stock traded up $0.02 on Friday, hitting $11.18. 5,276,171 shares of the stock were exchanged, compared to its average volume of 4,070,146. Western Union has a one year low of $10.92 and a one year high of $14.19. The firm's 50 day moving average is $11.85 and its two-hundred day moving average is $12.36. The firm has a market capitalization of $3.78 billion, a PE ratio of 6.86, a P/E/G ratio of 1.74 and a beta of 0.86. The company has a current ratio of 1.05, a quick ratio of 1.05 and a debt-to-equity ratio of 5.98.

Western Union (NYSE:WU - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The credit services provider reported $0.46 EPS for the quarter, beating the consensus estimate of $0.44 by $0.02. The business had revenue of $1.04 billion for the quarter, compared to the consensus estimate of $1.03 billion. Western Union had a return on equity of 123.71% and a net margin of 13.64%. Western Union's revenue for the quarter was down 5.6% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.43 earnings per share.

Institutional Investors Weigh In On Western Union

Institutional investors and hedge funds have recently bought and sold shares of the stock. Mackenzie Financial Corp raised its position in Western Union by 30.7% during the second quarter. Mackenzie Financial Corp now owns 348,850 shares of the credit services provider's stock valued at $4,263,000 after purchasing an additional 82,018 shares in the last quarter. Insight Folios Inc purchased a new position in shares of Western Union during the 1st quarter valued at about $5,388,000. Mirae Asset Global Investments Co. Ltd. lifted its position in Western Union by 5.5% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,252,897 shares of the credit services provider's stock worth $17,516,000 after buying an additional 65,087 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its stake in Western Union by 7,569.8% in the first quarter. Price T Rowe Associates Inc. MD now owns 13,905,891 shares of the credit services provider's stock worth $194,405,000 after buying an additional 13,724,584 shares in the last quarter. Finally, OLD National Bancorp IN grew its position in Western Union by 11.9% during the third quarter. OLD National Bancorp IN now owns 704,054 shares of the credit services provider's stock valued at $8,399,000 after acquiring an additional 74,742 shares during the last quarter. 91.81% of the stock is owned by hedge funds and other institutional investors.

About Western Union

(

Get Free Report)

The Western Union Company provides money movement and payment services worldwide. The company operates through Consumer Money Transfer and Consumer Services segments. The Consumer Money Transfer segment facilitates money transfers for international cross-border and intra-country transfers, primarily through a network of retail agent locations, as well as through websites and mobile devices.

Featured Articles

Before you consider Western Union, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Union wasn't on the list.

While Western Union currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.