Palliser Capital UK Ltd increased its stake in United States Steel Co. (NYSE:X - Free Report) by 112.1% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 332,100 shares of the basic materials company's stock after acquiring an additional 175,500 shares during the period. United States Steel comprises approximately 7.9% of Palliser Capital UK Ltd's portfolio, making the stock its 5th largest position. Palliser Capital UK Ltd owned about 0.15% of United States Steel worth $11,733,000 as of its most recent filing with the SEC.

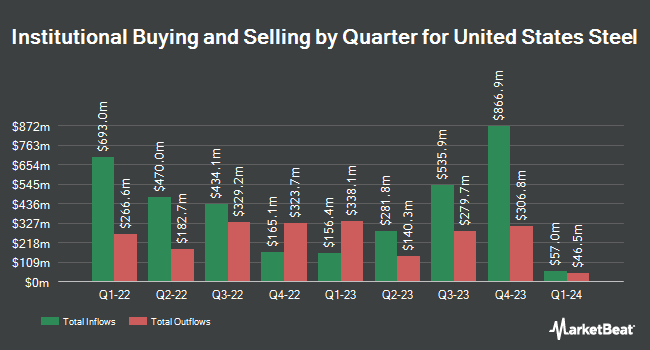

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Donald Smith & CO. Inc. lifted its stake in United States Steel by 7.4% in the third quarter. Donald Smith & CO. Inc. now owns 4,719,845 shares of the basic materials company's stock worth $166,752,000 after purchasing an additional 326,876 shares during the last quarter. KGH Ltd lifted its stake in United States Steel by 68.2% in the second quarter. KGH Ltd now owns 4,255,000 shares of the basic materials company's stock worth $160,839,000 after purchasing an additional 1,724,670 shares during the last quarter. Massachusetts Financial Services Co. MA lifted its stake in United States Steel by 4,305.6% in the second quarter. Massachusetts Financial Services Co. MA now owns 3,634,364 shares of the basic materials company's stock worth $137,379,000 after purchasing an additional 3,551,870 shares during the last quarter. Alpine Associates Management Inc. lifted its stake in United States Steel by 13.5% in the second quarter. Alpine Associates Management Inc. now owns 2,667,932 shares of the basic materials company's stock worth $100,848,000 after purchasing an additional 316,800 shares during the last quarter. Finally, Murchinson Ltd. lifted its stake in United States Steel by 66.5% in the first quarter. Murchinson Ltd. now owns 2,100,000 shares of the basic materials company's stock worth $85,638,000 after purchasing an additional 838,653 shares during the last quarter. 81.92% of the stock is currently owned by hedge funds and other institutional investors.

United States Steel Stock Down 0.6 %

Shares of X traded down $0.22 on Friday, hitting $38.63. 6,798,935 shares of the stock traded hands, compared to its average volume of 2,377,362. The company has a market capitalization of $8.69 billion, a PE ratio of 25.41 and a beta of 1.86. The company has a debt-to-equity ratio of 0.36, a quick ratio of 1.14 and a current ratio of 1.72. The business has a 50 day simple moving average of $36.52 and a 200 day simple moving average of $37.69. United States Steel Co. has a one year low of $26.92 and a one year high of $50.20.

United States Steel (NYSE:X - Get Free Report) last announced its quarterly earnings results on Thursday, August 1st. The basic materials company reported $0.84 earnings per share for the quarter, beating the consensus estimate of $0.72 by $0.12. The company had revenue of $4.12 billion during the quarter, compared to the consensus estimate of $4.01 billion. United States Steel had a net margin of 2.41% and a return on equity of 6.06%. The firm's quarterly revenue was down 17.8% compared to the same quarter last year. During the same quarter last year, the firm earned $1.92 earnings per share. As a group, equities analysts forecast that United States Steel Co. will post 2.17 earnings per share for the current fiscal year.

United States Steel Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, December 11th. Investors of record on Monday, November 11th will be issued a $0.05 dividend. This represents a $0.20 annualized dividend and a yield of 0.52%. The ex-dividend date is Friday, November 8th. United States Steel's dividend payout ratio is currently 13.16%.

Wall Street Analyst Weigh In

Several equities analysts have recently commented on X shares. Morgan Stanley upped their price objective on shares of United States Steel from $48.00 to $49.00 and gave the company an "overweight" rating in a research note on Thursday, August 15th. BNP Paribas raised shares of United States Steel from a "neutral" rating to an "outperform" rating and set a $40.00 price objective for the company in a research note on Friday, September 6th. JPMorgan Chase & Co. raised shares of United States Steel from a "neutral" rating to an "overweight" rating and upped their price objective for the company from $40.00 to $42.00 in a research note on Monday, September 9th. BMO Capital Markets lowered their price objective on shares of United States Steel from $45.00 to $43.00 and set an "outperform" rating for the company in a research note on Friday. Finally, StockNews.com started coverage on shares of United States Steel in a research report on Monday, August 19th. They set a "hold" rating on the stock. Two analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $42.80.

View Our Latest Report on X

United States Steel Company Profile

(

Free Report)

United States Steel Corporation produces and sells flat-rolled and tubular steel products primarily in North America and Europe. The company operates through North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular) segments. The Flat-Rolled segment offers slabs, strip mill plates, sheets, and tin mill products, as well as iron ore and coke.

Featured Stories

Before you consider United States Steel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United States Steel wasn't on the list.

While United States Steel currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.