XPO (NYSE:XPO - Get Free Report) had its price objective increased by stock analysts at Citigroup from $127.00 to $155.00 in a research report issued to clients and investors on Thursday, Benzinga reports. The firm currently has a "buy" rating on the transportation company's stock. Citigroup's price objective would suggest a potential upside of 18.75% from the stock's current price.

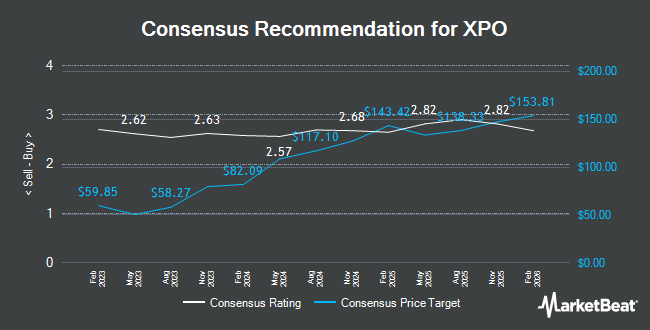

Other research analysts have also issued research reports about the stock. Benchmark reissued a "buy" rating and issued a $140.00 price target on shares of XPO in a research report on Thursday, September 19th. The Goldman Sachs Group dropped their price target on shares of XPO from $139.00 to $136.00 and set a "buy" rating for the company in a research report on Wednesday, October 9th. Oppenheimer reaffirmed an "outperform" rating and set a $140.00 price objective on shares of XPO in a research note on Friday, October 4th. TD Cowen upped their price objective on shares of XPO from $137.00 to $150.00 and gave the stock a "buy" rating in a research note on Thursday. Finally, Barclays upped their price objective on shares of XPO from $145.00 to $150.00 and gave the stock an "overweight" rating in a research note on Thursday. Two research analysts have rated the stock with a sell rating and sixteen have issued a buy rating to the company. According to MarketBeat.com, XPO currently has an average rating of "Moderate Buy" and a consensus target price of $135.82.

Check Out Our Latest Report on XPO

XPO Stock Performance

Shares of XPO traded down $3.46 during trading hours on Thursday, reaching $130.53. 1,516,561 shares of the company traded hands, compared to its average volume of 1,481,864. The stock's fifty day moving average is $112.40 and its 200 day moving average is $111.13. The stock has a market cap of $15.19 billion, a P/E ratio of 43.37, a price-to-earnings-growth ratio of 1.93 and a beta of 2.10. The company has a debt-to-equity ratio of 2.63, a quick ratio of 1.00 and a current ratio of 1.00. XPO has a 1-year low of $74.77 and a 1-year high of $138.71.

XPO (NYSE:XPO - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The transportation company reported $1.02 EPS for the quarter, beating analysts' consensus estimates of $0.89 by $0.13. The business had revenue of $2.05 billion during the quarter, compared to analyst estimates of $2.02 billion. XPO had a net margin of 4.48% and a return on equity of 32.49%. The firm's revenue for the quarter was up 3.7% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.88 earnings per share. Equities research analysts anticipate that XPO will post 3.52 earnings per share for the current fiscal year.

Hedge Funds Weigh In On XPO

Several institutional investors and hedge funds have recently made changes to their positions in XPO. Perennial Investment Advisors LLC lifted its position in XPO by 5.5% in the 2nd quarter. Perennial Investment Advisors LLC now owns 1,983 shares of the transportation company's stock valued at $210,000 after acquiring an additional 103 shares in the last quarter. Emerald Mutual Fund Advisers Trust lifted its position in XPO by 9.8% in the 2nd quarter. Emerald Mutual Fund Advisers Trust now owns 1,416 shares of the transportation company's stock valued at $150,000 after acquiring an additional 126 shares in the last quarter. Stephens Inc. AR lifted its position in XPO by 6.4% in the 3rd quarter. Stephens Inc. AR now owns 2,377 shares of the transportation company's stock valued at $256,000 after acquiring an additional 142 shares in the last quarter. Resources Management Corp CT ADV lifted its position in XPO by 1.9% in the 2nd quarter. Resources Management Corp CT ADV now owns 7,584 shares of the transportation company's stock valued at $805,000 after acquiring an additional 145 shares in the last quarter. Finally, PFG Investments LLC lifted its position in XPO by 4.3% in the 3rd quarter. PFG Investments LLC now owns 3,482 shares of the transportation company's stock valued at $374,000 after acquiring an additional 145 shares in the last quarter. Institutional investors and hedge funds own 97.73% of the company's stock.

About XPO

(

Get Free Report)

XPO, Inc provides freight transportation services in the United States, rest of North America, France, the United Kingdom, rest of Europe, and internationally. The company operates in two segments, North American LTL and European Transportation. The North American LTL segment provides customers with less-than-truckload (LTL) services, such as geographic density and day-definite domestic services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider XPO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPO wasn't on the list.

While XPO currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.