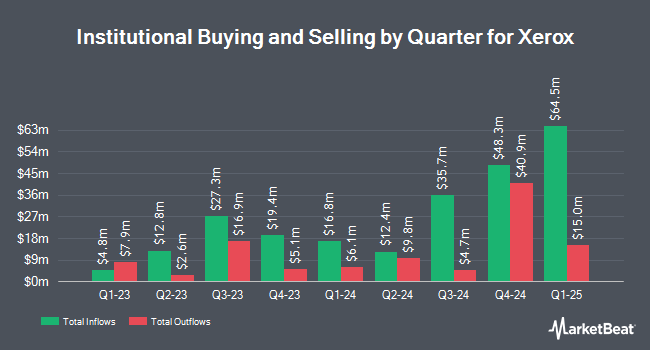

Allspring Global Investments Holdings LLC increased its stake in Xerox Holdings Co. (NYSE:XRX - Free Report) by 1,960.4% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 163,163 shares of the information technology services provider's stock after acquiring an additional 155,244 shares during the quarter. Allspring Global Investments Holdings LLC owned about 0.13% of Xerox worth $1,694,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors also recently made changes to their positions in XRX. SummerHaven Investment Management LLC increased its holdings in Xerox by 2.4% in the second quarter. SummerHaven Investment Management LLC now owns 47,430 shares of the information technology services provider's stock worth $551,000 after purchasing an additional 1,110 shares in the last quarter. Texas Permanent School Fund Corp increased its holdings in Xerox by 1.4% in the first quarter. Texas Permanent School Fund Corp now owns 98,961 shares of the information technology services provider's stock worth $1,771,000 after purchasing an additional 1,323 shares in the last quarter. Los Angeles Capital Management LLC increased its holdings in Xerox by 5.9% in the second quarter. Los Angeles Capital Management LLC now owns 23,930 shares of the information technology services provider's stock worth $278,000 after purchasing an additional 1,327 shares in the last quarter. CWM LLC increased its holdings in Xerox by 155.5% in the second quarter. CWM LLC now owns 2,264 shares of the information technology services provider's stock worth $26,000 after purchasing an additional 1,378 shares in the last quarter. Finally, Covestor Ltd increased its holdings in Xerox by 16.2% in the first quarter. Covestor Ltd now owns 10,512 shares of the information technology services provider's stock worth $188,000 after purchasing an additional 1,464 shares in the last quarter. 85.36% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

XRX has been the subject of several recent research reports. Morgan Stanley decreased their price objective on Xerox from $10.00 to $8.00 and set an "underweight" rating for the company in a report on Wednesday. StockNews.com upgraded Xerox from a "hold" rating to a "buy" rating in a report on Thursday, September 5th. Loop Capital decreased their price target on Xerox from $14.00 to $11.00 and set a "hold" rating for the company in a report on Wednesday, August 14th. Finally, JPMorgan Chase & Co. decreased their price target on Xerox from $11.00 to $8.00 and set an "underweight" rating for the company in a report on Wednesday. Three investment analysts have rated the stock with a sell rating, one has issued a hold rating and one has given a buy rating to the company's stock. According to MarketBeat, Xerox presently has an average rating of "Hold" and a consensus target price of $9.50.

Get Our Latest Stock Report on XRX

Xerox Stock Performance

Shares of NYSE XRX traded down $0.06 during trading on Thursday, reaching $8.17. 3,262,623 shares of the stock traded hands, compared to its average volume of 2,206,119. Xerox Holdings Co. has a 52-week low of $8.02 and a 52-week high of $19.78. The company has a debt-to-equity ratio of 1.34, a current ratio of 1.49 and a quick ratio of 1.13. The company has a 50-day moving average of $10.37 and a 200-day moving average of $11.88. The stock has a market capitalization of $1.02 billion, a P/E ratio of -0.74 and a beta of 1.57.

Xerox (NYSE:XRX - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The information technology services provider reported $0.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.53 by ($0.28). The company had revenue of $1.53 billion for the quarter, compared to analysts' expectations of $1.63 billion. Xerox had a positive return on equity of 7.33% and a negative net margin of 1.60%. The business's revenue for the quarter was down 7.5% on a year-over-year basis. During the same period last year, the company posted $0.46 EPS. Analysts forecast that Xerox Holdings Co. will post 1.72 EPS for the current fiscal year.

Xerox Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 31st. Shareholders of record on Tuesday, December 31st will be paid a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 12.24%. Xerox's dividend payout ratio is currently -9.06%.

Xerox Profile

(

Free Report)

Xerox Holdings Corporation, together with its subsidiaries, operates as a workplace technology company that integrates hardware, services, and software for enterprises in the Americas, Europe, the Middle East, Africa, India, and internationally. The company operates through two segments, Print and Other; and FITTLE.

Recommended Stories

Before you consider Xerox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xerox wasn't on the list.

While Xerox currently has a "Strong Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.