Analysts at CICC Research began coverage on shares of ZEEKR Intelligent Technology (NYSE:ZK - Get Free Report) in a note issued to investors on Friday, Benzinga reports. The firm set an "outperform" rating and a $31.74 price target on the stock. CICC Research's target price would indicate a potential upside of 10.02% from the company's previous close.

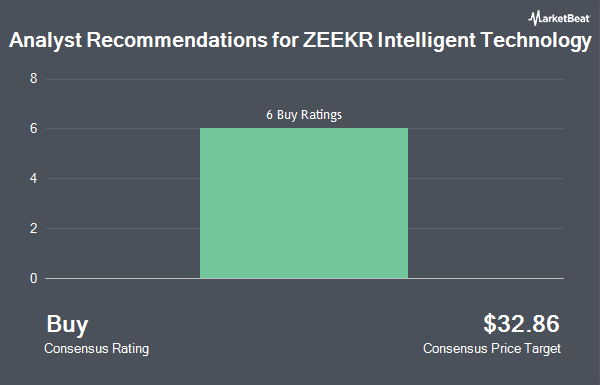

Other research analysts have also issued research reports about the stock. Macquarie initiated coverage on shares of ZEEKR Intelligent Technology in a research report on Thursday, October 3rd. They set an "outperform" rating and a $33.00 price objective for the company. Bank of America reduced their price objective on ZEEKR Intelligent Technology from $30.00 to $26.00 and set a "buy" rating for the company in a research report on Thursday, August 22nd. Six investment analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, ZEEKR Intelligent Technology presently has an average rating of "Buy" and an average target price of $32.02.

View Our Latest Analysis on ZK

ZEEKR Intelligent Technology Price Performance

ZK stock traded up $5.74 during mid-day trading on Friday, reaching $28.85. 2,660,142 shares of the stock traded hands, compared to its average volume of 779,870. The stock has a 50-day simple moving average of $19.29. ZEEKR Intelligent Technology has a 52 week low of $13.00 and a 52 week high of $32.24.

ZEEKR Intelligent Technology (NYSE:ZK - Get Free Report) last released its earnings results on Wednesday, August 21st. The company reported ($1.31) earnings per share (EPS) for the quarter. The business had revenue of $2.76 billion during the quarter. Equities analysts expect that ZEEKR Intelligent Technology will post -2.2 EPS for the current fiscal year.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the stock. Sandia Investment Management LP acquired a new stake in ZEEKR Intelligent Technology during the 2nd quarter valued at $94,000. Green Alpha Advisors LLC bought a new position in shares of ZEEKR Intelligent Technology in the third quarter valued at about $219,000. Marshall Wace LLP bought a new position in shares of ZEEKR Intelligent Technology in the second quarter worth about $347,000. Renaissance Capital LLC lifted its holdings in ZEEKR Intelligent Technology by 20.0% during the 3rd quarter. Renaissance Capital LLC now owns 22,696 shares of the company's stock worth $506,000 after buying an additional 3,789 shares in the last quarter. Finally, HITE Hedge Asset Management LLC bought a new position in ZEEKR Intelligent Technology in the second quarter valued at about $596,000.

About ZEEKR Intelligent Technology

(

Get Free Report)

ZEEKR Intelligent Technology Holding Limited, an investment holding company, engages in the research and development, production, commercialization, and sale of the electric vehicles and batteries. It offers battery electric passenger vehicles (BEVs) and SUVs. The company also produces and sells electric powertrain and battery packs for electric vehicles, such as motors and electric control systems; and provides automotive related research and development services.

Featured Stories

Before you consider ZEEKR Intelligent Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZEEKR Intelligent Technology wasn't on the list.

While ZEEKR Intelligent Technology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.