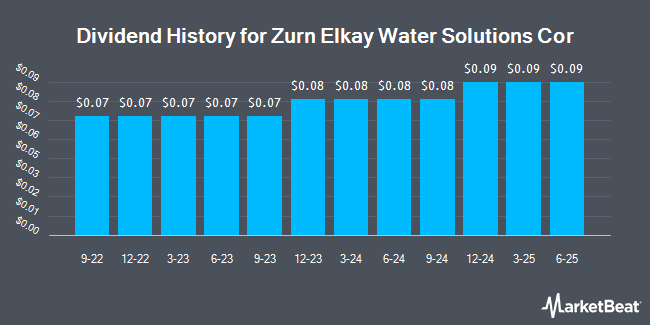

Zurn Elkay Water Solutions Co. (NYSE:ZWS - Get Free Report) declared a dividend on Wednesday, October 23rd, NASDAQ reports. Shareholders of record on Wednesday, November 20th will be given a dividend of 0.09 per share on Friday, December 6th. The ex-dividend date is Wednesday, November 20th.

Zurn Elkay Water Solutions has decreased its dividend by an average of 3.2% per year over the last three years. Zurn Elkay Water Solutions has a payout ratio of 24.2% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect Zurn Elkay Water Solutions to earn $1.33 per share next year, which means the company should continue to be able to cover its $0.32 annual dividend with an expected future payout ratio of 24.1%.

Zurn Elkay Water Solutions Price Performance

ZWS traded up $0.17 during midday trading on Thursday, hitting $36.30. 936,476 shares of the company traded hands, compared to its average volume of 1,117,772. The company has a current ratio of 2.84, a quick ratio of 1.75 and a debt-to-equity ratio of 0.31. The company has a market capitalization of $6.20 billion, a price-to-earnings ratio of 46.63, a PEG ratio of 1.96 and a beta of 1.14. Zurn Elkay Water Solutions has a 52-week low of $25.09 and a 52-week high of $38.11. The business has a 50 day simple moving average of $34.00 and a two-hundred day simple moving average of $32.11.

Zurn Elkay Water Solutions (NYSE:ZWS - Get Free Report) last issued its earnings results on Tuesday, July 30th. The company reported $0.33 EPS for the quarter, beating analysts' consensus estimates of $0.31 by $0.02. The business had revenue of $412.00 million during the quarter, compared to analysts' expectations of $409.14 million. Zurn Elkay Water Solutions had a net margin of 8.80% and a return on equity of 12.82%. The company's quarterly revenue was up 2.2% compared to the same quarter last year. During the same period in the prior year, the business earned $0.24 earnings per share. On average, equities analysts forecast that Zurn Elkay Water Solutions will post 1.21 earnings per share for the current fiscal year.

Insider Buying and Selling at Zurn Elkay Water Solutions

In other Zurn Elkay Water Solutions news, VP Sudhanshu Chhabra sold 52,851 shares of Zurn Elkay Water Solutions stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $32.55, for a total transaction of $1,720,300.05. Following the completion of the sale, the vice president now directly owns 80,151 shares in the company, valued at $2,608,915.05. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. In other Zurn Elkay Water Solutions news, Director Timothy J. Jahnke sold 20,000 shares of Zurn Elkay Water Solutions stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $37.59, for a total transaction of $751,800.00. Following the completion of the sale, the director now directly owns 345,017 shares in the company, valued at $12,969,189.03. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, VP Sudhanshu Chhabra sold 52,851 shares of the firm's stock in a transaction that occurred on Thursday, September 12th. The shares were sold at an average price of $32.55, for a total transaction of $1,720,300.05. Following the completion of the transaction, the vice president now directly owns 80,151 shares of the company's stock, valued at approximately $2,608,915.05. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 102,572 shares of company stock worth $3,473,472 over the last three months. Insiders own 3.80% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have recently commented on ZWS shares. Oppenheimer increased their target price on shares of Zurn Elkay Water Solutions from $37.00 to $40.00 and gave the company an "outperform" rating in a research report on Tuesday. Deutsche Bank Aktiengesellschaft raised their price objective on shares of Zurn Elkay Water Solutions from $35.00 to $37.00 and gave the stock a "buy" rating in a research report on Thursday, August 1st. Finally, Stifel Nicolaus raised their price objective on shares of Zurn Elkay Water Solutions from $34.00 to $36.00 and gave the stock a "hold" rating in a research report on Wednesday, October 16th. Three investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $37.40.

View Our Latest Stock Report on ZWS

Zurn Elkay Water Solutions Company Profile

(

Get Free Report)

Zurn Elkay Water Solutions Corporation engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally. It offers water safety and control products, such as backflow preventers, fire system valves, pressure reducing valves, thermostatic mixing valves, PEX pipings, fittings, and installation tools under the Zurn and Wilkins brand names.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zurn Elkay Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zurn Elkay Water Solutions wasn't on the list.

While Zurn Elkay Water Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.