O Brien Greene & Co. Inc acquired a new position in Cboe Global Markets, Inc. (NASDAQ:CBOE - Free Report) in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 39,961 shares of the company's stock, valued at approximately $8,187,000. Cboe Global Markets makes up about 2.5% of O Brien Greene & Co. Inc's investment portfolio, making the stock its 12th largest holding.

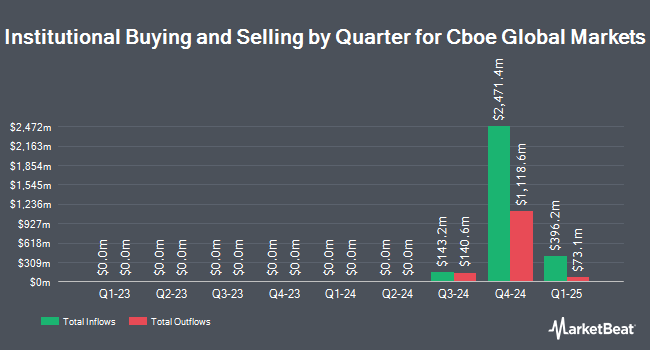

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in CBOE. Benjamin Edwards Inc. grew its position in Cboe Global Markets by 5,967.5% during the third quarter. Benjamin Edwards Inc. now owns 30,277 shares of the company's stock valued at $6,203,000 after buying an additional 29,778 shares during the period. Janus Henderson Group PLC boosted its stake in Cboe Global Markets by 0.3% in the third quarter. Janus Henderson Group PLC now owns 1,528,295 shares of the company's stock valued at $313,090,000 after acquiring an additional 5,216 shares during the last quarter. Worldquant Millennium Advisors LLC bought a new position in shares of Cboe Global Markets during the 3rd quarter valued at approximately $5,664,000. Y Intercept Hong Kong Ltd purchased a new stake in shares of Cboe Global Markets during the 3rd quarter worth approximately $6,089,000. Finally, Erste Asset Management GmbH bought a new stake in shares of Cboe Global Markets in the 3rd quarter worth approximately $11,191,000. Hedge funds and other institutional investors own 82.67% of the company's stock.

Analysts Set New Price Targets

A number of analysts have issued reports on CBOE shares. StockNews.com raised Cboe Global Markets from a "sell" rating to a "hold" rating in a research report on Thursday, November 14th. Barclays cut Cboe Global Markets from an "overweight" rating to an "equal weight" rating and lowered their price objective for the company from $230.00 to $220.00 in a research note on Monday.

Get Our Latest Report on Cboe Global Markets

Cboe Global Markets Stock Down 0.9 %

CBOE traded down $1.85 on Monday, hitting $202.14. The company's stock had a trading volume of 856,537 shares, compared to its average volume of 838,572. The company has a current ratio of 1.39, a quick ratio of 1.39 and a debt-to-equity ratio of 0.34. Cboe Global Markets, Inc. has a 12 month low of $166.13 and a 12 month high of $221.66. The company has a market cap of $21.16 billion, a PE ratio of 27.36, a price-to-earnings-growth ratio of 1.72 and a beta of 0.66.

Cboe Global Markets Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be given a $0.63 dividend. This represents a $2.52 annualized dividend and a dividend yield of 1.25%. The ex-dividend date is Friday, November 29th. Cboe Global Markets's dividend payout ratio (DPR) is presently 34.33%.

About Cboe Global Markets

(

Free Report)

Cboe Global Markets, Inc is one of the largest stock exchange operators by volume in the United States and a leading market globally for ETP trading. Cboe offers trading across a diverse range of products in multiple asset classes and geographies, including options, futures, U.S. and European equities, exchange-traded products (ETPs), global foreign exchange (FX) and multi-asset volatility products based on the VIX Index.

Read More

Before you consider Cboe Global Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cboe Global Markets wasn't on the list.

While Cboe Global Markets currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.