O Shaughnessy Asset Management LLC bought a new position in shares of Monarch Casino & Resort, Inc. (NASDAQ:MCRI - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund bought 6,079 shares of the company's stock, valued at approximately $480,000.

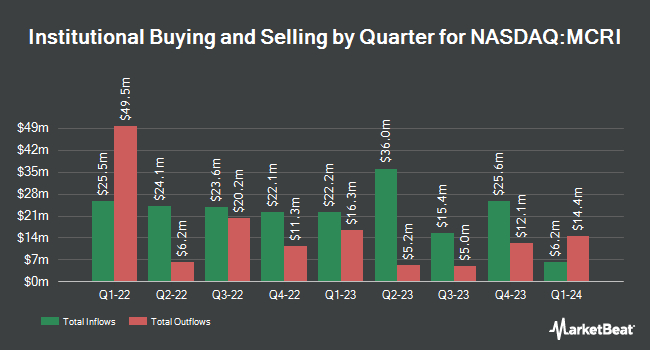

A number of other large investors have also added to or reduced their stakes in the business. Golden State Wealth Management LLC acquired a new position in Monarch Casino & Resort in the 4th quarter valued at $53,000. KBC Group NV boosted its position in shares of Monarch Casino & Resort by 67.8% in the fourth quarter. KBC Group NV now owns 980 shares of the company's stock valued at $77,000 after acquiring an additional 396 shares during the period. Independence Bank of Kentucky acquired a new position in shares of Monarch Casino & Resort in the fourth quarter valued at about $93,000. Nisa Investment Advisors LLC increased its position in Monarch Casino & Resort by 30.9% during the fourth quarter. Nisa Investment Advisors LLC now owns 1,693 shares of the company's stock worth $134,000 after acquiring an additional 400 shares during the period. Finally, Pacer Advisors Inc. raised its stake in Monarch Casino & Resort by 49.8% in the 4th quarter. Pacer Advisors Inc. now owns 2,760 shares of the company's stock worth $218,000 after purchasing an additional 917 shares in the last quarter. Institutional investors own 62.37% of the company's stock.

Analyst Ratings Changes

MCRI has been the topic of several recent research reports. Wells Fargo & Company raised their target price on shares of Monarch Casino & Resort from $79.00 to $82.00 and gave the stock an "underweight" rating in a report on Wednesday, February 12th. Stifel Nicolaus lifted their price objective on Monarch Casino & Resort from $80.00 to $90.00 and gave the company a "hold" rating in a report on Wednesday, February 12th. Truist Financial upgraded Monarch Casino & Resort from a "hold" rating to a "buy" rating and raised their price target for the stock from $82.00 to $100.00 in a research report on Tuesday, January 14th. Jefferies Financial Group upped their price objective on shares of Monarch Casino & Resort from $73.00 to $88.00 and gave the stock a "hold" rating in a research report on Friday, January 3rd. Finally, StockNews.com lowered shares of Monarch Casino & Resort from a "strong-buy" rating to a "buy" rating in a report on Wednesday, February 12th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and two have assigned a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and an average price target of $87.20.

Get Our Latest Stock Report on Monarch Casino & Resort

Monarch Casino & Resort Trading Up 2.1 %

NASDAQ MCRI traded up $1.58 during trading on Tuesday, hitting $75.58. 43,816 shares of the company's stock were exchanged, compared to its average volume of 118,122. The company has a market cap of $1.40 billion, a PE ratio of 15.27 and a beta of 1.57. Monarch Casino & Resort, Inc. has a fifty-two week low of $64.50 and a fifty-two week high of $96.11. The stock's 50 day moving average price is $83.96 and its two-hundred day moving average price is $82.14.

Monarch Casino & Resort (NASDAQ:MCRI - Get Free Report) last issued its earnings results on Tuesday, February 11th. The company reported $1.36 earnings per share for the quarter, beating analysts' consensus estimates of $1.13 by $0.23. Monarch Casino & Resort had a net margin of 18.01% and a return on equity of 18.27%. During the same period last year, the company earned $1.03 EPS. Analysts forecast that Monarch Casino & Resort, Inc. will post 5.13 earnings per share for the current fiscal year.

Monarch Casino & Resort Profile

(

Free Report)

Monarch Casino & Resort, Inc engages in the ownership and operation of the Atlantis Casino Resort Spa, a hotel and casino facility in Reno, Nevada, and the Monarch Black Hawk Casino in Black Hawk, Colorado. The company was founded in 1993 and is headquartered in Reno, NV.

Further Reading

Before you consider Monarch Casino & Resort, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monarch Casino & Resort wasn't on the list.

While Monarch Casino & Resort currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.