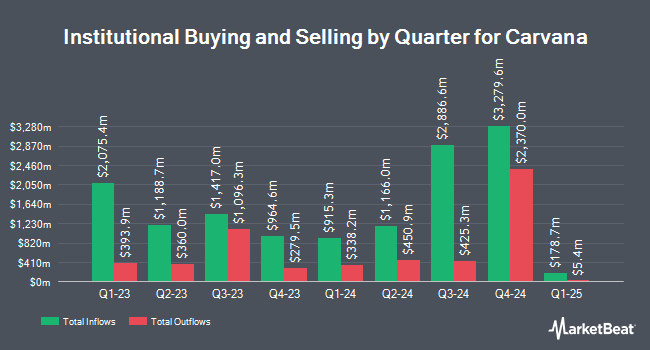

O Shaughnessy Asset Management LLC raised its position in shares of Carvana Co. (NYSE:CVNA - Free Report) by 37.9% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 6,947 shares of the company's stock after purchasing an additional 1,911 shares during the period. O Shaughnessy Asset Management LLC's holdings in Carvana were worth $1,413,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the company. Cerity Partners LLC raised its stake in shares of Carvana by 112.8% in the 3rd quarter. Cerity Partners LLC now owns 4,215 shares of the company's stock valued at $734,000 after acquiring an additional 2,234 shares in the last quarter. Townsquare Capital LLC bought a new position in shares of Carvana in the 3rd quarter valued at approximately $282,000. Rockefeller Capital Management L.P. acquired a new stake in Carvana in the 3rd quarter valued at approximately $1,772,000. Captrust Financial Advisors acquired a new stake in Carvana in the 3rd quarter valued at approximately $270,000. Finally, Centiva Capital LP acquired a new stake in Carvana in the 3rd quarter valued at approximately $555,000. 56.71% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of research firms have issued reports on CVNA. William Blair reaffirmed an "outperform" rating on shares of Carvana in a report on Thursday, February 20th. Needham & Company LLC reaffirmed a "buy" rating and issued a $340.00 target price on shares of Carvana in a report on Friday, March 7th. Royal Bank of Canada raised their target price on Carvana from $280.00 to $320.00 and gave the company an "outperform" rating in a report on Thursday, February 20th. JPMorgan Chase & Co. decreased their price objective on Carvana from $365.00 to $325.00 and set an "overweight" rating on the stock in a report on Thursday, March 27th. Finally, Stephens reissued an "overweight" rating and set a $300.00 price objective on shares of Carvana in a report on Monday, March 3rd. Six equities research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $253.59.

Check Out Our Latest Stock Report on Carvana

Insider Buying and Selling at Carvana

In other news, CFO Mark W. Jenkins sold 10,000 shares of the business's stock in a transaction on Monday, February 3rd. The stock was sold at an average price of $250.12, for a total transaction of $2,501,200.00. Following the completion of the sale, the chief financial officer now owns 219,962 shares in the company, valued at $55,016,895.44. The trade was a 4.35 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Paul W. Breaux sold 1,362 shares of the business's stock in a transaction on Monday, February 10th. The stock was sold at an average price of $270.08, for a total value of $367,848.96. Following the sale, the insider now owns 153,240 shares of the company's stock, valued at approximately $41,387,059.20. The trade was a 0.88 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 330,810 shares of company stock worth $69,243,820. 16.36% of the stock is currently owned by insiders.

Carvana Price Performance

CVNA traded down $16.25 during trading on Thursday, hitting $204.19. The company's stock had a trading volume of 2,646,902 shares, compared to its average volume of 4,069,187. The firm's 50 day moving average price is $218.19 and its two-hundred day moving average price is $219.77. The company has a quick ratio of 2.12, a current ratio of 3.64 and a debt-to-equity ratio of 3.82. Carvana Co. has a 12 month low of $67.61 and a 12 month high of $292.84. The stock has a market capitalization of $43.53 billion, a price-to-earnings ratio of 130.41 and a beta of 3.61.

Carvana (NYSE:CVNA - Get Free Report) last issued its quarterly earnings data on Wednesday, February 19th. The company reported $0.56 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.29 by $0.27. Carvana had a return on equity of 36.59% and a net margin of 1.54%. The firm had revenue of $3.55 billion during the quarter, compared to the consensus estimate of $3.32 billion. Sell-side analysts forecast that Carvana Co. will post 2.85 earnings per share for the current fiscal year.

Carvana Profile

(

Free Report)

Carvana Co, together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. Its platform allows customers to research and identify a vehicle; inspect it using company's 360-degree vehicle imaging technology; obtain financing and warranty coverage; purchase the vehicle; and schedule delivery or pick-up from their desktop or mobile devices.

Featured Articles

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.