Oak Thistle LLC lowered its stake in Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 45.7% during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 19,012 shares of the company's stock after selling 16,018 shares during the quarter. Oak Thistle LLC's holdings in Gates Industrial were worth $391,000 at the end of the most recent quarter.

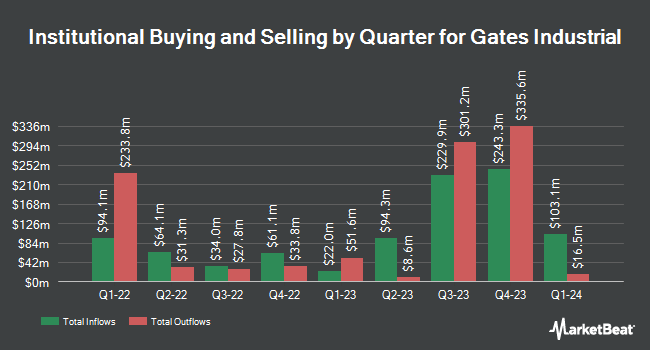

A number of other large investors have also added to or reduced their stakes in GTES. Allspring Global Investments Holdings LLC lifted its stake in shares of Gates Industrial by 2.1% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 14,929,377 shares of the company's stock worth $262,011,000 after purchasing an additional 303,353 shares during the period. FMR LLC increased its holdings in Gates Industrial by 4.5% during the third quarter. FMR LLC now owns 13,059,271 shares of the company's stock valued at $229,190,000 after buying an additional 562,643 shares during the last quarter. Dimensional Fund Advisors LP raised its position in Gates Industrial by 9.5% in the second quarter. Dimensional Fund Advisors LP now owns 11,921,356 shares of the company's stock worth $188,477,000 after acquiring an additional 1,037,741 shares during the period. State Street Corp boosted its stake in shares of Gates Industrial by 112.9% during the 3rd quarter. State Street Corp now owns 6,523,366 shares of the company's stock worth $114,485,000 after acquiring an additional 3,459,450 shares during the last quarter. Finally, Zimmer Partners LP grew its position in shares of Gates Industrial by 141.2% during the 3rd quarter. Zimmer Partners LP now owns 4,213,452 shares of the company's stock valued at $73,946,000 after acquiring an additional 2,466,543 shares during the period. Institutional investors own 98.50% of the company's stock.

Gates Industrial Price Performance

Shares of NYSE:GTES traded up $0.19 during midday trading on Friday, reaching $20.49. 1,637,575 shares of the company were exchanged, compared to its average volume of 2,393,825. The company has a current ratio of 3.02, a quick ratio of 2.11 and a debt-to-equity ratio of 0.70. The stock has a market cap of $5.22 billion, a PE ratio of 24.68 and a beta of 1.38. The business's fifty day moving average is $21.21 and its two-hundred day moving average is $18.76. Gates Industrial Corp PLC has a one year low of $12.40 and a one year high of $23.34.

Analysts Set New Price Targets

A number of equities analysts recently commented on GTES shares. Royal Bank of Canada raised their target price on Gates Industrial from $22.00 to $26.00 and gave the stock an "outperform" rating in a report on Thursday, December 12th. Barclays raised Gates Industrial from an "equal weight" rating to an "overweight" rating and raised their price objective for the stock from $21.00 to $25.00 in a research note on Thursday, December 5th. The Goldman Sachs Group increased their target price on shares of Gates Industrial from $21.00 to $24.00 and gave the stock a "neutral" rating in a report on Thursday, December 12th. Jefferies Financial Group lifted their price target on shares of Gates Industrial from $23.00 to $26.00 and gave the company a "buy" rating in a report on Friday, December 6th. Finally, KeyCorp upped their price target on shares of Gates Industrial from $22.00 to $23.00 and gave the stock an "overweight" rating in a research report on Thursday, November 21st. Three investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, Gates Industrial currently has an average rating of "Moderate Buy" and a consensus price target of $22.50.

Check Out Our Latest Research Report on GTES

Gates Industrial Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Read More

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.