Oaktree Capital Management LP cut its stake in shares of Daqo New Energy Corp. (NYSE:DQ - Free Report) by 8.9% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 551,007 shares of the semiconductor company's stock after selling 53,932 shares during the period. Oaktree Capital Management LP owned 0.83% of Daqo New Energy worth $10,712,000 at the end of the most recent reporting period.

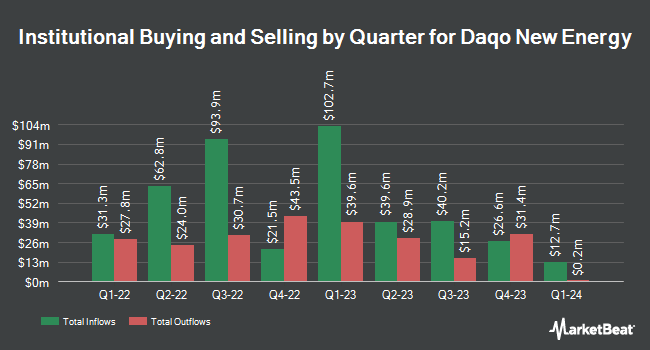

Other large investors also recently modified their holdings of the company. Generali Investments CEE investicni spolecnost a.s. purchased a new position in Daqo New Energy during the fourth quarter worth about $52,000. Daiwa Securities Group Inc. boosted its position in shares of Daqo New Energy by 15.4% during the 3rd quarter. Daiwa Securities Group Inc. now owns 10,500 shares of the semiconductor company's stock valued at $214,000 after acquiring an additional 1,400 shares during the last quarter. Point72 Asia Singapore Pte. Ltd. grew its holdings in shares of Daqo New Energy by 66.1% during the third quarter. Point72 Asia Singapore Pte. Ltd. now owns 14,000 shares of the semiconductor company's stock worth $285,000 after purchasing an additional 5,570 shares in the last quarter. Van ECK Associates Corp increased its position in shares of Daqo New Energy by 7.6% in the fourth quarter. Van ECK Associates Corp now owns 20,067 shares of the semiconductor company's stock worth $390,000 after purchasing an additional 1,410 shares during the last quarter. Finally, Geode Capital Management LLC raised its stake in Daqo New Energy by 9.2% in the third quarter. Geode Capital Management LLC now owns 33,546 shares of the semiconductor company's stock valued at $683,000 after purchasing an additional 2,813 shares in the last quarter. 47.22% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Separately, StockNews.com raised shares of Daqo New Energy to a "sell" rating in a research note on Tuesday, March 18th. One equities research analyst has rated the stock with a sell rating, one has given a hold rating, four have issued a buy rating and three have issued a strong buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $22.26.

Get Our Latest Report on Daqo New Energy

Daqo New Energy Price Performance

NYSE DQ traded down $1.80 on Thursday, reaching $16.35. 771,330 shares of the company's stock traded hands, compared to its average volume of 1,023,322. The stock has a market cap of $1.08 billion, a PE ratio of -8.84 and a beta of 0.41. Daqo New Energy Corp. has a 12 month low of $13.62 and a 12 month high of $30.85. The stock has a 50-day simple moving average of $19.56 and a 200 day simple moving average of $19.79.

Daqo New Energy (NYSE:DQ - Get Free Report) last issued its earnings results on Thursday, February 27th. The semiconductor company reported ($2.71) EPS for the quarter, missing analysts' consensus estimates of ($0.69) by ($2.02). Daqo New Energy had a negative return on equity of 1.90% and a negative net margin of 9.16%. The business had revenue of $195.36 million during the quarter, compared to analysts' expectations of $153.54 million. As a group, analysts anticipate that Daqo New Energy Corp. will post -3.5 EPS for the current year.

About Daqo New Energy

(

Free Report)

Daqo New Energy Corp., together with its subsidiaries, manufactures and sells polysilicon to photovoltaic product manufacturers in the People's Republic of China. Its products are used in ingots, wafers, cells, and modules for solar power solutions. The company was formerly known as Mega Stand International Limited and changed its name to Daqo New Energy Corp.

Featured Articles

Before you consider Daqo New Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Daqo New Energy wasn't on the list.

While Daqo New Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.