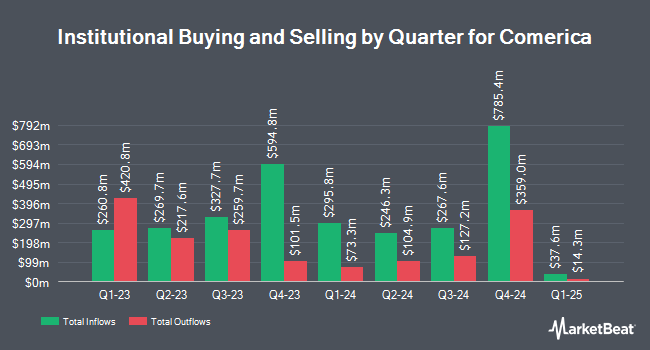

Oakworth Capital Inc. raised its position in shares of Comerica Incorporated (NYSE:CMA - Free Report) by 1.5% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 247,766 shares of the financial services provider's stock after purchasing an additional 3,720 shares during the period. Comerica accounts for about 1.1% of Oakworth Capital Inc.'s investment portfolio, making the stock its 22nd largest position. Oakworth Capital Inc. owned approximately 0.19% of Comerica worth $15,324,000 at the end of the most recent reporting period.

Several other institutional investors have also made changes to their positions in CMA. Citigroup Inc. grew its holdings in Comerica by 390.6% during the third quarter. Citigroup Inc. now owns 761,601 shares of the financial services provider's stock valued at $45,628,000 after purchasing an additional 606,375 shares during the last quarter. Vaughan Nelson Investment Management L.P. grew its stake in Comerica by 31.3% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 2,408,820 shares of the financial services provider's stock valued at $144,312,000 after buying an additional 574,516 shares during the last quarter. JPMorgan Chase & Co. raised its holdings in Comerica by 134.0% in the 3rd quarter. JPMorgan Chase & Co. now owns 856,431 shares of the financial services provider's stock worth $51,309,000 after acquiring an additional 490,468 shares during the period. Primecap Management Co. CA acquired a new position in Comerica during the 3rd quarter worth $26,630,000. Finally, Holocene Advisors LP bought a new stake in Comerica during the third quarter valued at about $16,272,000. 80.74% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities analysts recently weighed in on CMA shares. Stephens boosted their price objective on Comerica from $64.00 to $70.00 and gave the stock an "overweight" rating in a research report on Monday, October 21st. Royal Bank of Canada reduced their price objective on Comerica from $78.00 to $76.00 and set an "outperform" rating for the company in a research report on Thursday, January 23rd. Truist Financial raised shares of Comerica to a "hold" rating in a research report on Monday, January 6th. Robert W. Baird dropped their price objective on shares of Comerica from $80.00 to $75.00 and set an "outperform" rating on the stock in a report on Thursday, January 23rd. Finally, JPMorgan Chase & Co. reduced their target price on shares of Comerica from $73.00 to $70.00 and set a "neutral" rating for the company in a research note on Tuesday, January 7th. Three equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating and eight have given a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $68.33.

Check Out Our Latest Report on Comerica

Comerica Stock Down 2.0 %

NYSE CMA traded down $1.36 on Monday, reaching $66.24. The company had a trading volume of 1,828,652 shares, compared to its average volume of 2,209,969. The company's fifty day moving average is $64.72 and its 200-day moving average is $61.86. Comerica Incorporated has a 1-year low of $45.32 and a 1-year high of $73.45. The firm has a market capitalization of $8.71 billion, a price-to-earnings ratio of 13.19 and a beta of 1.25. The company has a debt-to-equity ratio of 1.09, a quick ratio of 0.97 and a current ratio of 0.97.

Comerica (NYSE:CMA - Get Free Report) last posted its quarterly earnings results on Wednesday, January 22nd. The financial services provider reported $1.20 EPS for the quarter, missing analysts' consensus estimates of $1.25 by ($0.05). Comerica had a return on equity of 12.04% and a net margin of 13.98%. During the same period in the prior year, the firm posted $1.46 EPS. On average, research analysts forecast that Comerica Incorporated will post 5.34 earnings per share for the current fiscal year.

Comerica declared that its Board of Directors has approved a stock repurchase plan on Tuesday, November 5th that permits the company to repurchase 10,000,000 shares. This repurchase authorization permits the financial services provider to purchase shares of its stock through open market purchases. Stock repurchase plans are often a sign that the company's management believes its shares are undervalued.

Comerica Company Profile

(

Free Report)

Comerica Incorporated, through its subsidiaries, provides various financial products and services. The company operates through Commercial Bank, Retail Bank, Wealth Management, and Finance segments. The Commercial Bank segment offers various products and services, including commercial loans and lines of credit, deposits, cash management, payment solutions, card services, capital market products, international trade finance, letters of credit, foreign exchange management services, and loan syndication services for small and middle market businesses, multinational corporations, and governmental entities.

Further Reading

Before you consider Comerica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comerica wasn't on the list.

While Comerica currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.