Occidental Petroleum (NYSE:OXY - Get Free Report) had its price objective cut by equities researchers at Citigroup from $57.00 to $56.00 in a report released on Tuesday,Benzinga reports. The brokerage presently has a "neutral" rating on the oil and gas producer's stock. Citigroup's price target points to a potential upside of 12.43% from the stock's previous close.

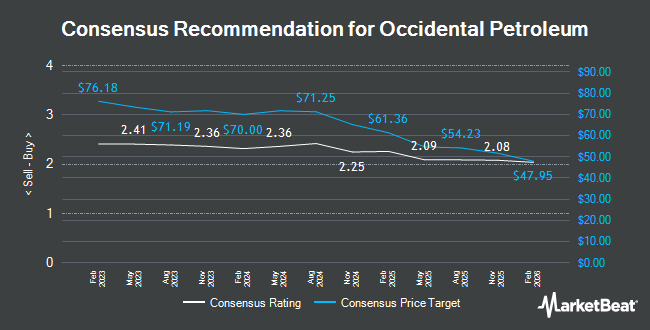

A number of other brokerages have also recently issued reports on OXY. Mizuho lowered their price objective on Occidental Petroleum from $76.00 to $72.00 and set a "neutral" rating on the stock in a research note on Monday, September 16th. Scotiabank cut their target price on Occidental Petroleum from $80.00 to $65.00 and set a "sector outperform" rating for the company in a research note on Thursday, October 10th. Bank of America assumed coverage on Occidental Petroleum in a research note on Thursday, October 17th. They issued a "neutral" rating and a $57.00 target price for the company. Jefferies Financial Group increased their price objective on Occidental Petroleum from $53.00 to $54.00 and gave the company a "hold" rating in a research note on Tuesday, November 12th. Finally, Raymond James increased their price objective on Occidental Petroleum from $77.00 to $78.00 and gave the company a "strong-buy" rating in a research note on Thursday, November 21st. One equities research analyst has rated the stock with a sell rating, thirteen have issued a hold rating, six have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $63.25.

View Our Latest Stock Report on OXY

Occidental Petroleum Stock Performance

NYSE:OXY traded down $0.63 during mid-day trading on Tuesday, reaching $49.81. 12,275,427 shares of the company's stock were exchanged, compared to its average volume of 9,394,206. Occidental Petroleum has a one year low of $48.42 and a one year high of $71.18. The firm has a market capitalization of $46.74 billion, a PE ratio of 12.97 and a beta of 1.58. The business's fifty day simple moving average is $51.72 and its two-hundred day simple moving average is $56.72. The company has a debt-to-equity ratio of 0.96, a quick ratio of 0.76 and a current ratio of 1.00.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of OXY. Fortitude Family Office LLC raised its stake in shares of Occidental Petroleum by 160.0% in the third quarter. Fortitude Family Office LLC now owns 494 shares of the oil and gas producer's stock worth $25,000 after buying an additional 304 shares during the period. Mizuho Securities Co. Ltd. bought a new position in Occidental Petroleum in the 3rd quarter valued at $32,000. LRI Investments LLC bought a new position in Occidental Petroleum in the 1st quarter valued at $44,000. New Covenant Trust Company N.A. bought a new position in Occidental Petroleum in the 1st quarter valued at $44,000. Finally, Transamerica Financial Advisors Inc. bought a new position in Occidental Petroleum in the 3rd quarter valued at $50,000. 88.70% of the stock is owned by hedge funds and other institutional investors.

Occidental Petroleum Company Profile

(

Get Free Report)

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, and North Africa. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas.

Further Reading

Before you consider Occidental Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Occidental Petroleum wasn't on the list.

While Occidental Petroleum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.