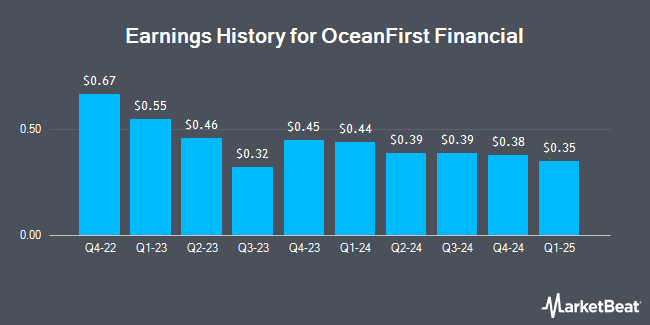

OceanFirst Financial (NASDAQ:OCFC - Get Free Report) is projected to announce its earnings results before the market opens on Thursday, April 17th. Analysts expect OceanFirst Financial to post earnings of $0.35 per share and revenue of $95.66 million for the quarter. Parties interested in listening to the company's conference call can do so using this link.

OceanFirst Financial (NASDAQ:OCFC - Get Free Report) last released its quarterly earnings data on Thursday, January 23rd. The savings and loans company reported $0.38 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.36 by $0.02. OceanFirst Financial had a net margin of 14.45% and a return on equity of 5.75%. On average, analysts expect OceanFirst Financial to post $2 EPS for the current fiscal year and $2 EPS for the next fiscal year.

OceanFirst Financial Trading Up 1.6 %

OCFC stock traded up $0.25 during mid-day trading on Tuesday, reaching $15.54. The company had a trading volume of 246,793 shares, compared to its average volume of 295,374. The firm has a 50 day moving average of $16.98 and a 200 day moving average of $18.21. The company has a debt-to-equity ratio of 0.79, a current ratio of 1.01 and a quick ratio of 1.00. OceanFirst Financial has a 12 month low of $14.03 and a 12 month high of $21.87. The company has a market capitalization of $925.39 million, a PE ratio of 9.42 and a beta of 0.94.

OceanFirst Financial Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, February 14th. Investors of record on Monday, February 3rd were paid a $0.20 dividend. The ex-dividend date of this dividend was Monday, February 3rd. This represents a $0.80 annualized dividend and a yield of 5.15%. OceanFirst Financial's dividend payout ratio (DPR) is currently 48.48%.

Analyst Ratings Changes

Several equities research analysts have weighed in on OCFC shares. Hovde Group lowered their target price on OceanFirst Financial from $23.00 to $22.00 and set an "outperform" rating for the company in a report on Monday, January 27th. Stephens reaffirmed an "equal weight" rating and issued a $22.00 price objective on shares of OceanFirst Financial in a research note on Friday, January 24th. Finally, Raymond James cut their target price on shares of OceanFirst Financial from $24.00 to $21.00 and set a "strong-buy" rating on the stock in a research report on Wednesday, April 2nd. Five investment analysts have rated the stock with a hold rating, one has given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, OceanFirst Financial has a consensus rating of "Hold" and a consensus price target of $21.00.

Check Out Our Latest Report on OceanFirst Financial

OceanFirst Financial Company Profile

(

Get Free Report)

OceanFirst Financial Corp. operates as the bank holding company for OceanFirst Bank N.A. that provides community banking services to retail and commercial customers. It accepts money market accounts, savings accounts, interest-bearing checking accounts, non-interest-bearing accounts, and time deposits, that includes brokered deposits to retail, government, and business customers.

Read More

Before you consider OceanFirst Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OceanFirst Financial wasn't on the list.

While OceanFirst Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.