Point72 Asset Management L.P. lowered its stake in Ocular Therapeutix, Inc. (NASDAQ:OCUL - Free Report) by 24.6% during the third quarter, according to its most recent 13F filing with the SEC. The firm owned 2,040,620 shares of the biopharmaceutical company's stock after selling 666,043 shares during the quarter. Point72 Asset Management L.P. owned 1.31% of Ocular Therapeutix worth $17,753,000 as of its most recent filing with the SEC.

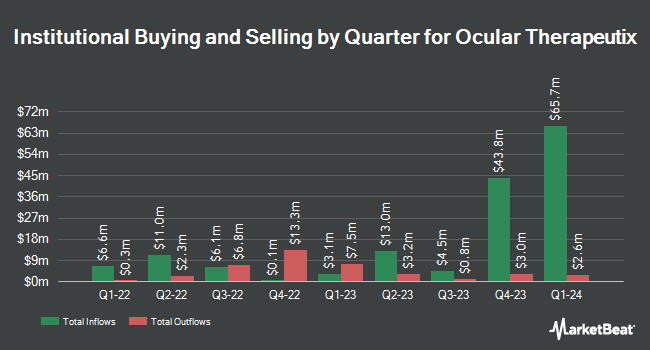

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the stock. Assenagon Asset Management S.A. purchased a new position in Ocular Therapeutix during the third quarter valued at $24,584,000. Nantahala Capital Management LLC acquired a new position in shares of Ocular Therapeutix during the 2nd quarter worth about $6,840,000. Avoro Capital Advisors LLC lifted its stake in Ocular Therapeutix by 12.7% in the 2nd quarter. Avoro Capital Advisors LLC now owns 8,060,000 shares of the biopharmaceutical company's stock valued at $55,130,000 after buying an additional 911,064 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in Ocular Therapeutix by 146.6% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,110,460 shares of the biopharmaceutical company's stock worth $9,661,000 after buying an additional 660,080 shares during the last quarter. Finally, Braidwell LP increased its stake in Ocular Therapeutix by 36.3% during the 3rd quarter. Braidwell LP now owns 2,239,770 shares of the biopharmaceutical company's stock worth $19,486,000 after buying an additional 596,000 shares in the last quarter. Hedge funds and other institutional investors own 59.21% of the company's stock.

Insiders Place Their Bets

In related news, insider Jeffrey S. Heier sold 2,948 shares of the firm's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $9.01, for a total transaction of $26,561.48. Following the completion of the sale, the insider now directly owns 269,059 shares in the company, valued at approximately $2,424,221.59. This trade represents a 1.08 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. 3.50% of the stock is currently owned by corporate insiders.

Ocular Therapeutix Price Performance

Shares of OCUL stock traded up $0.44 during trading hours on Friday, reaching $9.62. The company had a trading volume of 575,174 shares, compared to its average volume of 968,167. Ocular Therapeutix, Inc. has a 12-month low of $3.24 and a 12-month high of $11.77. The company has a debt-to-equity ratio of 0.19, a quick ratio of 12.94 and a current ratio of 13.01. The company has a market capitalization of $1.51 billion, a price-to-earnings ratio of -7.29 and a beta of 1.19. The stock has a fifty day moving average of $10.06 and a 200-day moving average of $8.36.

Wall Street Analysts Forecast Growth

OCUL has been the topic of several research reports. Scotiabank initiated coverage on Ocular Therapeutix in a research report on Wednesday, October 16th. They issued a "sector outperform" rating and a $22.00 target price on the stock. HC Wainwright reissued a "buy" rating and issued a $15.00 price objective on shares of Ocular Therapeutix in a research note on Tuesday. One analyst has rated the stock with a sell rating, one has given a hold rating and six have given a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $16.71.

View Our Latest Analysis on OCUL

About Ocular Therapeutix

(

Free Report)

Ocular Therapeutix, Inc, a biopharmaceutical company, focuses on the formulation, development, and commercialization of therapies for diseases and conditions of the eye using its bioresorbable hydrogel-based formulation technology in the United States. The company markets DEXTENZA, a dexamethasone ophthalmic insert to treat post-surgical ocular inflammation and pain following ophthalmic surgery, as well as allergic conjunctivitis.

Featured Articles

Before you consider Ocular Therapeutix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ocular Therapeutix wasn't on the list.

While Ocular Therapeutix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.