Oddo BHF Asset Management Sas acquired a new stake in shares of American Express (NYSE:AXP - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm acquired 21,015 shares of the payment services company's stock, valued at approximately $5,699,000.

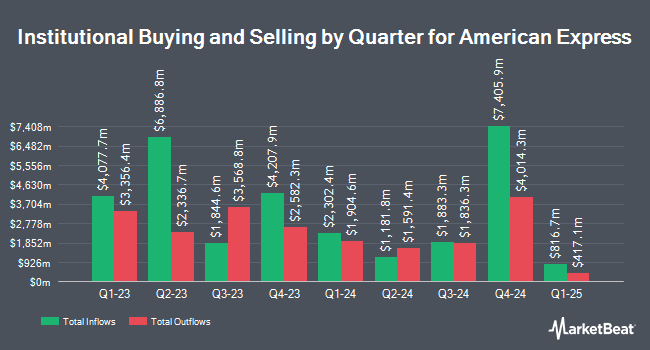

Several other institutional investors and hedge funds have also recently modified their holdings of AXP. International Assets Investment Management LLC raised its stake in shares of American Express by 26,783.5% in the third quarter. International Assets Investment Management LLC now owns 909,737 shares of the payment services company's stock valued at $2,467,210,000 after acquiring an additional 906,353 shares during the period. FMR LLC raised its position in American Express by 8.5% in the 3rd quarter. FMR LLC now owns 11,003,715 shares of the payment services company's stock worth $2,984,208,000 after purchasing an additional 866,110 shares during the period. Public Employees Retirement Association of Colorado lifted its stake in American Express by 924.2% in the second quarter. Public Employees Retirement Association of Colorado now owns 851,431 shares of the payment services company's stock worth $197,149,000 after purchasing an additional 768,301 shares during the last quarter. Pathway Financial Advisers LLC boosted its position in shares of American Express by 59,816.0% during the third quarter. Pathway Financial Advisers LLC now owns 682,443 shares of the payment services company's stock valued at $185,079,000 after buying an additional 681,304 shares during the period. Finally, Canada Pension Plan Investment Board grew its stake in shares of American Express by 71.9% during the second quarter. Canada Pension Plan Investment Board now owns 1,164,098 shares of the payment services company's stock valued at $269,547,000 after buying an additional 486,755 shares during the last quarter. Institutional investors own 84.33% of the company's stock.

American Express Trading Up 0.6 %

AXP stock traded up $1.89 during midday trading on Friday, hitting $302.19. 1,661,117 shares of the company's stock were exchanged, compared to its average volume of 2,856,218. American Express has a 1-year low of $175.60 and a 1-year high of $307.82. The company has a current ratio of 1.63, a quick ratio of 1.63 and a debt-to-equity ratio of 1.80. The stock has a market capitalization of $212.88 billion, a PE ratio of 22.23, a P/E/G ratio of 1.73 and a beta of 1.23. The business has a 50-day simple moving average of $285.93 and a two-hundred day simple moving average of $259.21.

American Express (NYSE:AXP - Get Free Report) last issued its quarterly earnings data on Friday, October 18th. The payment services company reported $3.49 EPS for the quarter, topping the consensus estimate of $3.27 by $0.22. The firm had revenue of $16.64 billion for the quarter, compared to analyst estimates of $16.68 billion. American Express had a net margin of 15.32% and a return on equity of 32.46%. The business's revenue for the quarter was up 8.2% compared to the same quarter last year. During the same period in the prior year, the business posted $3.30 EPS. On average, sell-side analysts predict that American Express will post 13.4 EPS for the current fiscal year.

American Express Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, February 10th. Shareholders of record on Friday, January 3rd will be given a $0.70 dividend. This represents a $2.80 annualized dividend and a yield of 0.93%. The ex-dividend date is Friday, January 3rd. American Express's dividend payout ratio is currently 20.60%.

Wall Street Analysts Forecast Growth

AXP has been the subject of several research analyst reports. TD Cowen lifted their target price on American Express from $260.00 to $268.00 and gave the stock a "hold" rating in a research report on Monday, October 21st. Morgan Stanley raised their price objective on American Express from $248.00 to $252.00 and gave the stock an "equal weight" rating in a report on Monday, October 21st. JPMorgan Chase & Co. increased their price target on American Express from $286.00 to $301.00 and gave the stock a "neutral" rating in a research report on Monday. Evercore ISI upped their price objective on shares of American Express from $275.00 to $290.00 and gave the stock an "in-line" rating in a research note on Monday, October 7th. Finally, Bank of America raised their target price on shares of American Express from $263.00 to $265.00 and gave the company a "neutral" rating in a research report on Tuesday, September 17th. Four analysts have rated the stock with a sell rating, thirteen have issued a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average target price of $259.45.

View Our Latest Research Report on American Express

Insider Transactions at American Express

In related news, CFO Caillec Christophe Le sold 6,000 shares of the business's stock in a transaction that occurred on Wednesday, November 27th. The stock was sold at an average price of $303.48, for a total transaction of $1,820,880.00. Following the completion of the sale, the chief financial officer now owns 6,433 shares in the company, valued at $1,952,286.84. The trade was a 48.26 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Anre D. Williams sold 77,887 shares of the firm's stock in a transaction that occurred on Tuesday, October 22nd. The stock was sold at an average price of $270.26, for a total transaction of $21,049,740.62. Following the sale, the insider now directly owns 111,656 shares in the company, valued at approximately $30,176,150.56. The trade was a 41.09 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 96,998 shares of company stock valued at $26,423,439. 0.12% of the stock is currently owned by corporate insiders.

American Express Profile

(

Free Report)

American Express Company, together with its subsidiaries, operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally. It operates through four segments: U.S. Consumer Services, Commercial Services, International Card Services, and Global Merchant and Network Services.

See Also

Before you consider American Express, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Express wasn't on the list.

While American Express currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report