Oddo BHF Asset Management Sas bought a new stake in CyberArk Software Ltd. (NASDAQ:CYBR - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund bought 3,893 shares of the technology company's stock, valued at approximately $1,135,000.

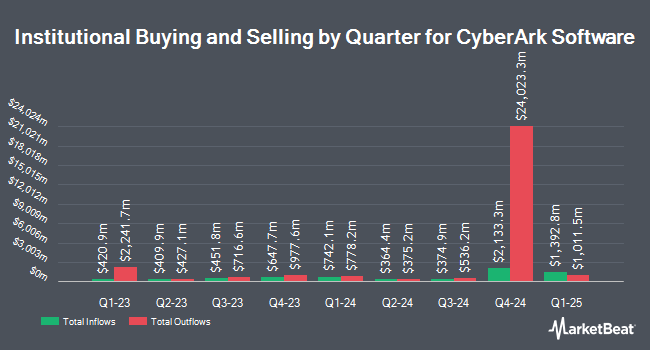

Other institutional investors and hedge funds have also made changes to their positions in the company. Wealth Enhancement Advisory Services LLC boosted its holdings in CyberArk Software by 11.3% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 2,202 shares of the technology company's stock valued at $602,000 after purchasing an additional 223 shares in the last quarter. ORG Partners LLC acquired a new position in CyberArk Software during the second quarter worth $33,000. Assenagon Asset Management S.A. raised its position in CyberArk Software by 13.1% in the second quarter. Assenagon Asset Management S.A. now owns 1,682 shares of the technology company's stock worth $460,000 after acquiring an additional 195 shares in the last quarter. Hennion & Walsh Asset Management Inc. lifted its holdings in CyberArk Software by 35.6% in the second quarter. Hennion & Walsh Asset Management Inc. now owns 5,920 shares of the technology company's stock valued at $1,619,000 after acquiring an additional 1,553 shares during the period. Finally, 1620 Investment Advisors Inc. purchased a new stake in shares of CyberArk Software during the 2nd quarter worth $39,000. 91.84% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently issued reports on CYBR shares. Wedbush increased their price target on shares of CyberArk Software from $300.00 to $325.00 and gave the company an "outperform" rating in a report on Tuesday, October 1st. Scotiabank began coverage on shares of CyberArk Software in a research report on Monday, October 21st. They set a "sector outperform" rating and a $340.00 price target for the company. UBS Group upped their price target on CyberArk Software from $340.00 to $360.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Truist Financial reaffirmed a "buy" rating and set a $350.00 price objective (up from $300.00) on shares of CyberArk Software in a report on Thursday, November 14th. Finally, Mizuho lifted their target price on shares of CyberArk Software from $345.00 to $365.00 and gave the stock an "outperform" rating in a research report on Friday. One equities research analyst has rated the stock with a hold rating and twenty-six have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $333.00.

Get Our Latest Stock Analysis on CyberArk Software

CyberArk Software Trading Down 2.5 %

NASDAQ:CYBR traded down $8.18 during mid-day trading on Friday, hitting $313.36. The company had a trading volume of 385,814 shares, compared to its average volume of 517,724. CyberArk Software Ltd. has a 1 year low of $198.01 and a 1 year high of $333.32. The business has a fifty day simple moving average of $302.84 and a 200-day simple moving average of $278.70. The firm has a market capitalization of $13.65 billion, a price-to-earnings ratio of 1,160.64 and a beta of 1.13.

CyberArk Software (NASDAQ:CYBR - Get Free Report) last announced its earnings results on Wednesday, November 13th. The technology company reported $0.94 EPS for the quarter, beating the consensus estimate of $0.46 by $0.48. The business had revenue of $240.10 million for the quarter, compared to the consensus estimate of $234.10 million. CyberArk Software had a return on equity of 2.29% and a net margin of 1.38%. The company's revenue was up 25.6% on a year-over-year basis. During the same period last year, the business posted ($0.31) EPS. As a group, research analysts anticipate that CyberArk Software Ltd. will post -0.58 earnings per share for the current year.

About CyberArk Software

(

Free Report)

CyberArk Software Ltd., together with its subsidiaries, develops, markets, and sells software-based identity security solutions and services in the United States, Europe, the Middle East, Africa, and internationally. Its solutions include Privileged Access Manager, which offers risk-based credential security and session; Vendor Privileged Access Manager combines Privileged Access Manager and Remote Access to provide secure access to third-party vendors; Dynamic Privileged Access, a SaaS solution that provides just-in-time access to Linux Virtual Machines; Endpoint Privilege Manager, a SaaS solution that secures privileges on the endpoint; and Secure Desktop, a solution that protects access to endpoints.

Further Reading

Before you consider CyberArk Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CyberArk Software wasn't on the list.

While CyberArk Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.