Oddo BHF Asset Management Sas bought a new stake in shares of Elevance Health, Inc. (NYSE:ELV - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 20,928 shares of the company's stock, valued at approximately $10,883,000.

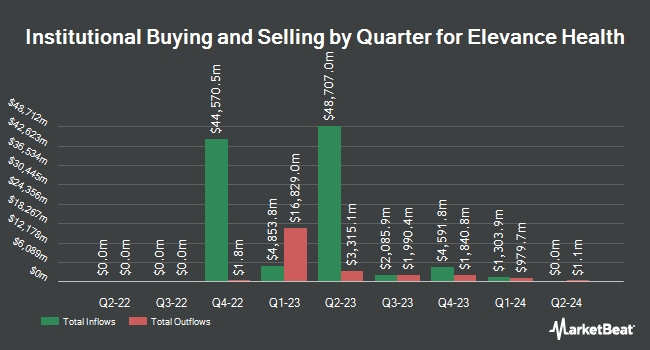

Other hedge funds have also recently bought and sold shares of the company. State Street Corp lifted its position in shares of Elevance Health by 1.2% during the 3rd quarter. State Street Corp now owns 10,687,998 shares of the company's stock valued at $5,557,759,000 after acquiring an additional 129,709 shares during the last quarter. Geode Capital Management LLC lifted its holdings in shares of Elevance Health by 1.8% during the third quarter. Geode Capital Management LLC now owns 4,848,020 shares of the company's stock valued at $2,511,814,000 after purchasing an additional 85,770 shares during the last quarter. Sanders Capital LLC boosted its position in shares of Elevance Health by 1.0% in the 3rd quarter. Sanders Capital LLC now owns 4,609,258 shares of the company's stock valued at $2,396,814,000 after purchasing an additional 44,805 shares during the period. Wellington Management Group LLP increased its stake in Elevance Health by 6.9% in the 3rd quarter. Wellington Management Group LLP now owns 4,461,585 shares of the company's stock worth $2,320,024,000 after purchasing an additional 286,905 shares in the last quarter. Finally, Ameriprise Financial Inc. raised its holdings in Elevance Health by 5.3% during the 2nd quarter. Ameriprise Financial Inc. now owns 3,791,793 shares of the company's stock worth $2,054,641,000 after buying an additional 190,118 shares during the period. 89.24% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Elevance Health

In other news, EVP Charles Morgan Kendrick, Jr. sold 7,417 shares of the company's stock in a transaction dated Friday, October 18th. The stock was sold at an average price of $432.14, for a total value of $3,205,182.38. Following the completion of the sale, the executive vice president now directly owns 8,423 shares of the company's stock, valued at $3,639,915.22. This represents a 46.82 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. 0.35% of the stock is owned by corporate insiders.

Elevance Health Price Performance

Shares of NYSE ELV traded up $2.99 during mid-day trading on Friday, hitting $381.38. 1,921,072 shares of the stock were exchanged, compared to its average volume of 1,221,416. The company has a market cap of $88.45 billion, a P/E ratio of 13.80, a PEG ratio of 1.15 and a beta of 0.83. The company has a debt-to-equity ratio of 0.56, a quick ratio of 1.50 and a current ratio of 1.50. Elevance Health, Inc. has a twelve month low of $375.29 and a twelve month high of $567.26. The stock's fifty day simple moving average is $424.53 and its two-hundred day simple moving average is $495.40.

Elevance Health (NYSE:ELV - Get Free Report) last released its quarterly earnings results on Thursday, October 17th. The company reported $8.37 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $9.66 by ($1.29). Elevance Health had a net margin of 3.68% and a return on equity of 19.56%. The business had revenue of $44.72 billion during the quarter, compared to the consensus estimate of $43.47 billion. During the same period in the prior year, the firm earned $8.99 earnings per share. The business's quarterly revenue was up 5.3% compared to the same quarter last year. As a group, analysts forecast that Elevance Health, Inc. will post 32.96 EPS for the current fiscal year.

Elevance Health Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Thursday, December 5th will be paid a $1.63 dividend. This represents a $6.52 annualized dividend and a dividend yield of 1.71%. The ex-dividend date of this dividend is Thursday, December 5th. Elevance Health's dividend payout ratio (DPR) is presently 23.77%.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on ELV shares. Morgan Stanley reduced their price objective on Elevance Health from $643.00 to $551.00 and set an "overweight" rating for the company in a research note on Wednesday, October 23rd. Mizuho decreased their price target on shares of Elevance Health from $585.00 to $505.00 and set an "outperform" rating for the company in a report on Tuesday, November 5th. Argus lowered shares of Elevance Health from a "buy" rating to a "hold" rating in a research note on Friday, October 18th. TD Cowen decreased their target price on shares of Elevance Health from $589.00 to $484.00 and set a "buy" rating for the company in a research note on Monday, October 21st. Finally, UBS Group dropped their price target on shares of Elevance Health from $605.00 to $555.00 and set a "buy" rating on the stock in a research note on Friday, October 18th. One analyst has rated the stock with a sell rating, two have given a hold rating, thirteen have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $539.20.

Read Our Latest Stock Analysis on ELV

Elevance Health Profile

(

Free Report)

Elevance Health, Inc, together with its subsidiaries, operates as a health benefits company in the United States. The company operates through four segments: Health Benefits, CarelonRx, Carelon Services, and Corporate & Other. It offers a variety of health plans and services to program members; health products; an array of fee-based administrative managed care services; and specialty and other insurance products and services, such as stop loss, dental, vision, life, disability, and supplemental health insurance benefits.

See Also

Before you consider Elevance Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elevance Health wasn't on the list.

While Elevance Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.