Oddo BHF Asset Management Sas bought a new position in Salesforce, Inc. (NYSE:CRM - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund bought 58,061 shares of the CRM provider's stock, valued at approximately $15,894,000.

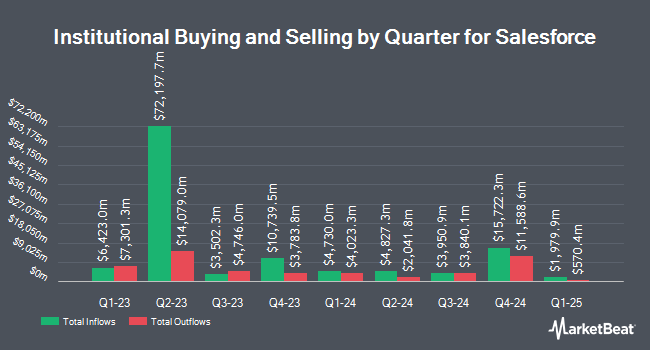

Several other hedge funds also recently made changes to their positions in the company. Infrastructure Capital Advisors LLC bought a new stake in Salesforce in the third quarter valued at $27,000. Clear Investment Research LLC boosted its holdings in Salesforce by 816.7% in the second quarter. Clear Investment Research LLC now owns 110 shares of the CRM provider's stock valued at $28,000 after acquiring an additional 98 shares in the last quarter. Stephens Consulting LLC boosted its holdings in Salesforce by 3,125.0% in the second quarter. Stephens Consulting LLC now owns 129 shares of the CRM provider's stock valued at $33,000 after acquiring an additional 125 shares in the last quarter. Strategic Investment Solutions Inc. IL bought a new stake in Salesforce in the second quarter valued at $33,000. Finally, Godsey & Gibb Inc. boosted its holdings in Salesforce by 300.0% in the third quarter. Godsey & Gibb Inc. now owns 120 shares of the CRM provider's stock valued at $33,000 after acquiring an additional 90 shares in the last quarter. 80.43% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on CRM. Truist Financial restated a "buy" rating and set a $400.00 target price (up previously from $380.00) on shares of Salesforce in a report on Wednesday, December 4th. Scotiabank boosted their target price on shares of Salesforce from $425.00 to $440.00 and gave the company a "sector outperform" rating in a report on Wednesday, December 4th. Jefferies Financial Group upped their price target on shares of Salesforce from $400.00 to $425.00 and gave the stock a "buy" rating in a research note on Wednesday, December 4th. Royal Bank of Canada upped their price target on shares of Salesforce from $300.00 to $420.00 and gave the stock an "outperform" rating in a research note on Wednesday, December 4th. Finally, FBN Securities upgraded shares of Salesforce to a "strong-buy" rating in a research note on Thursday, August 29th. Eight research analysts have rated the stock with a hold rating, thirty have issued a buy rating and four have given a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $377.24.

Read Our Latest Report on Salesforce

Insider Transactions at Salesforce

In other news, insider Miguel Milano sold 719 shares of the company's stock in a transaction on Monday, November 25th. The shares were sold at an average price of $342.81, for a total transaction of $246,480.39. Following the transaction, the insider now directly owns 4,659 shares of the company's stock, valued at $1,597,151.79. This represents a 13.37 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, COO Brian Millham sold 60,522 shares of the company's stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of $300.00, for a total transaction of $18,156,600.00. The disclosure for this sale can be found here. Insiders have sold a total of 138,498 shares of company stock valued at $40,983,349 in the last ninety days. 3.20% of the stock is currently owned by company insiders.

Salesforce Stock Performance

CRM stock traded down $3.73 on Friday, hitting $354.30. The company's stock had a trading volume of 5,536,744 shares, compared to its average volume of 6,407,457. The firm has a 50 day moving average of $316.14 and a two-hundred day moving average of $275.00. Salesforce, Inc. has a 1 year low of $212.00 and a 1 year high of $369.00. The stock has a market cap of $339.07 billion, a price-to-earnings ratio of 58.27, a price-to-earnings-growth ratio of 3.21 and a beta of 1.30. The company has a current ratio of 1.11, a quick ratio of 1.11 and a debt-to-equity ratio of 0.14.

Salesforce (NYSE:CRM - Get Free Report) last announced its quarterly earnings data on Tuesday, December 3rd. The CRM provider reported $2.41 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.44 by ($0.03). The firm had revenue of $9.44 billion during the quarter, compared to analyst estimates of $9.35 billion. Salesforce had a net margin of 15.96% and a return on equity of 12.34%. The business's quarterly revenue was up 8.3% compared to the same quarter last year. During the same period in the prior year, the firm posted $1.62 earnings per share. Equities analysts predict that Salesforce, Inc. will post 7.48 EPS for the current fiscal year.

Salesforce Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 9th. Shareholders of record on Wednesday, December 18th will be paid a $0.40 dividend. The ex-dividend date is Wednesday, December 18th. This represents a $1.60 annualized dividend and a yield of 0.45%. Salesforce's dividend payout ratio is currently 26.32%.

Salesforce Company Profile

(

Free Report)

Salesforce, Inc provides Customer Relationship Management (CRM) technology that brings companies and customers together worldwide. The company's service includes sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and artificial intelligence, and deliver quotes, contracts, and invoices; and service that enables companies to deliver trusted and highly personalized customer support at scale.

Read More

Before you consider Salesforce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Salesforce wasn't on the list.

While Salesforce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.