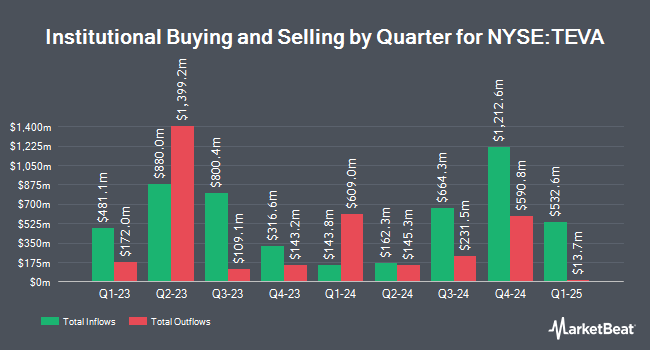

Okabena Investment Services Inc. purchased a new position in Teva Pharmaceutical Industries Limited (NYSE:TEVA - Free Report) in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 58,776 shares of the company's stock, valued at approximately $1,059,000.

Other large investors have also recently made changes to their positions in the company. State Board of Administration of Florida Retirement System boosted its stake in Teva Pharmaceutical Industries by 13.4% during the first quarter. State Board of Administration of Florida Retirement System now owns 62,018 shares of the company's stock valued at $875,000 after buying an additional 7,335 shares during the period. Vanguard Group Inc. boosted its stake in Teva Pharmaceutical Industries by 3.5% during the first quarter. Vanguard Group Inc. now owns 825,537 shares of the company's stock valued at $11,648,000 after buying an additional 28,071 shares during the period. O Shaughnessy Asset Management LLC bought a new stake in Teva Pharmaceutical Industries during the first quarter valued at $166,000. UniSuper Management Pty Ltd boosted its stake in Teva Pharmaceutical Industries by 109.2% during the first quarter. UniSuper Management Pty Ltd now owns 15,900 shares of the company's stock valued at $224,000 after buying an additional 8,300 shares during the period. Finally, CANADA LIFE ASSURANCE Co boosted its stake in Teva Pharmaceutical Industries by 25.9% during the first quarter. CANADA LIFE ASSURANCE Co now owns 480,299 shares of the company's stock valued at $6,778,000 after buying an additional 98,710 shares during the period. 54.05% of the stock is owned by institutional investors.

Teva Pharmaceutical Industries Trading Up 0.2 %

NYSE:TEVA traded up $0.04 during mid-day trading on Friday, reaching $17.12. 7,441,607 shares of the company's stock traded hands, compared to its average volume of 7,721,805. Teva Pharmaceutical Industries Limited has a 12-month low of $9.35 and a 12-month high of $19.31. The firm has a market capitalization of $19.40 billion, a price-to-earnings ratio of -20.14, a PEG ratio of 1.33 and a beta of 0.87. The company has a debt-to-equity ratio of 2.57, a current ratio of 0.89 and a quick ratio of 0.61. The company has a 50 day moving average price of $17.67 and a 200-day moving average price of $17.34.

Insider Activity at Teva Pharmaceutical Industries

In other Teva Pharmaceutical Industries news, EVP Christine Fox sold 19,388 shares of Teva Pharmaceutical Industries stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $16.87, for a total transaction of $327,075.56. Following the sale, the executive vice president now directly owns 44,104 shares of the company's stock, valued at approximately $744,034.48. The trade was a 30.54 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. 0.55% of the stock is owned by company insiders.

Analysts Set New Price Targets

A number of equities research analysts have weighed in on TEVA shares. JPMorgan Chase & Co. raised their price target on Teva Pharmaceutical Industries from $16.00 to $18.00 and gave the company a "neutral" rating in a research report on Monday, October 21st. Barclays raised their price target on Teva Pharmaceutical Industries from $22.00 to $25.00 and gave the company an "overweight" rating in a research report on Wednesday, October 23rd. StockNews.com upgraded Teva Pharmaceutical Industries from a "buy" rating to a "strong-buy" rating in a research report on Thursday, October 17th. Finally, UBS Group lifted their price objective on Teva Pharmaceutical Industries from $24.00 to $26.00 and gave the stock a "buy" rating in a report on Tuesday, September 3rd. Two equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $19.67.

Get Our Latest Stock Analysis on Teva Pharmaceutical Industries

Teva Pharmaceutical Industries Company Profile

(

Free Report)

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally. It offers generic medicines in various dosage forms, such as tablets, capsules, injectables, inhalants, liquids, transdermal patches, ointments, and creams; sterile products, hormones, high-potency drugs, and cytotoxic substances in parenteral and solid dosage forms; and generic products with medical devices and combination products.

Featured Stories

Before you consider Teva Pharmaceutical Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teva Pharmaceutical Industries wasn't on the list.

While Teva Pharmaceutical Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.