OLD National Bancorp IN decreased its stake in Merck & Co., Inc. (NYSE:MRK - Free Report) by 2.8% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 116,531 shares of the company's stock after selling 3,371 shares during the quarter. OLD National Bancorp IN's holdings in Merck & Co., Inc. were worth $11,593,000 as of its most recent filing with the Securities & Exchange Commission.

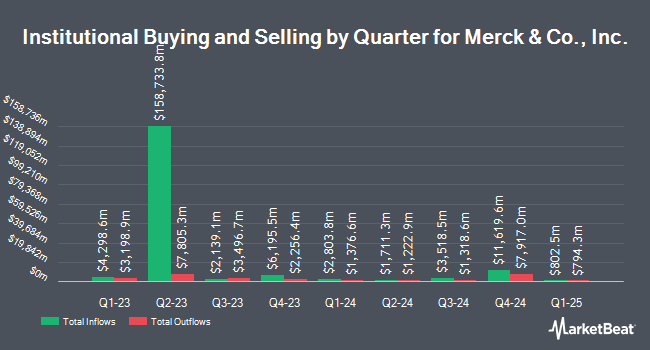

Other hedge funds and other institutional investors have also modified their holdings of the company. Wellington Management Group LLP boosted its position in Merck & Co., Inc. by 4.6% during the 3rd quarter. Wellington Management Group LLP now owns 75,809,383 shares of the company's stock worth $8,608,914,000 after acquiring an additional 3,327,404 shares during the period. International Assets Investment Management LLC boosted its position in Merck & Co., Inc. by 11,876.3% during the 3rd quarter. International Assets Investment Management LLC now owns 2,971,554 shares of the company's stock worth $337,450,000 after acquiring an additional 2,946,742 shares during the period. Two Sigma Advisers LP boosted its position in Merck & Co., Inc. by 157.9% during the 3rd quarter. Two Sigma Advisers LP now owns 4,264,100 shares of the company's stock worth $484,231,000 after acquiring an additional 2,610,800 shares during the period. Caisse DE Depot ET Placement DU Quebec boosted its position in Merck & Co., Inc. by 68.7% during the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 5,388,551 shares of the company's stock worth $611,924,000 after acquiring an additional 2,194,463 shares during the period. Finally, Geode Capital Management LLC boosted its position in Merck & Co., Inc. by 3.7% during the 3rd quarter. Geode Capital Management LLC now owns 59,155,004 shares of the company's stock worth $6,696,060,000 after acquiring an additional 2,134,296 shares during the period. Institutional investors and hedge funds own 76.07% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on MRK shares. Wells Fargo & Company decreased their price objective on Merck & Co., Inc. from $125.00 to $110.00 and set an "equal weight" rating for the company in a research report on Friday, November 1st. Bank of America reiterated a "buy" rating and set a $121.00 price target on shares of Merck & Co., Inc. in a report on Tuesday, December 10th. Barclays cut their price objective on Merck & Co., Inc. from $142.00 to $140.00 and set an "overweight" rating on the stock in a research note on Monday, October 7th. Cantor Fitzgerald reissued an "overweight" rating and issued a $155.00 price objective on shares of Merck & Co., Inc. in a research note on Thursday, October 3rd. Finally, Daiwa America downgraded Merck & Co., Inc. from a "strong-buy" rating to a "hold" rating in a research note on Monday, November 11th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating, nine have given a buy rating and four have given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $122.67.

Read Our Latest Stock Report on Merck & Co., Inc.

Merck & Co., Inc. Price Performance

MRK stock traded up $0.63 during trading on Thursday, hitting $98.91. The company had a trading volume of 10,158,282 shares, compared to its average volume of 10,964,224. The company has a fifty day moving average price of $99.86 and a two-hundred day moving average price of $108.06. The company has a current ratio of 1.36, a quick ratio of 1.15 and a debt-to-equity ratio of 0.79. The company has a market cap of $250.21 billion, a P/E ratio of 20.74, a P/E/G ratio of 1.13 and a beta of 0.39. Merck & Co., Inc. has a fifty-two week low of $94.48 and a fifty-two week high of $134.63.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The company reported $1.57 EPS for the quarter, beating the consensus estimate of $1.50 by $0.07. The business had revenue of $16.66 billion for the quarter, compared to analyst estimates of $16.47 billion. Merck & Co., Inc. had a return on equity of 36.42% and a net margin of 19.23%. Merck & Co., Inc.'s quarterly revenue was up 4.4% on a year-over-year basis. During the same quarter in the previous year, the firm earned $2.13 EPS. Equities research analysts expect that Merck & Co., Inc. will post 7.67 earnings per share for the current fiscal year.

Merck & Co., Inc. Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, April 7th. Shareholders of record on Monday, March 17th will be paid a $0.81 dividend. This represents a $3.24 dividend on an annualized basis and a yield of 3.28%. The ex-dividend date is Monday, March 17th. Merck & Co., Inc.'s dividend payout ratio is currently 67.92%.

Merck & Co., Inc. announced that its board has approved a share repurchase plan on Tuesday, January 28th that authorizes the company to repurchase $10.00 billion in shares. This repurchase authorization authorizes the company to buy up to 4.1% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's management believes its stock is undervalued.

Merck & Co., Inc. Profile

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Read More

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report