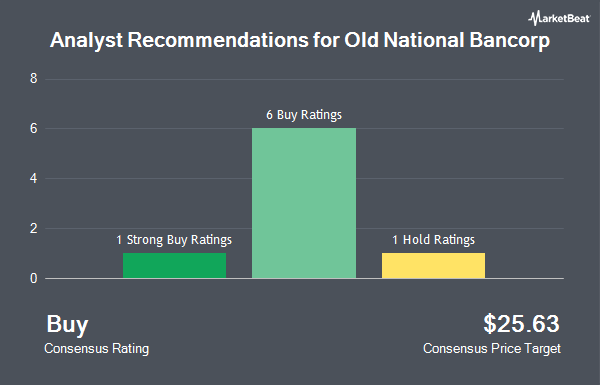

Old National Bancorp (NASDAQ:ONB - Get Free Report) was upgraded by stock analysts at Raymond James from a "market perform" rating to a "strong-buy" rating in a research report issued to clients and investors on Tuesday, Marketbeat Ratings reports. The firm currently has a $28.00 target price on the bank's stock. Raymond James' target price suggests a potential upside of 19.97% from the stock's current price.

A number of other brokerages have also weighed in on ONB. StockNews.com raised Old National Bancorp from a "sell" rating to a "hold" rating in a research report on Monday. Barclays boosted their price objective on shares of Old National Bancorp from $22.00 to $24.00 and gave the company an "overweight" rating in a report on Friday, September 27th. Two equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, Old National Bancorp has an average rating of "Moderate Buy" and an average price target of $23.44.

Check Out Our Latest Stock Report on ONB

Old National Bancorp Stock Up 1.7 %

Shares of NASDAQ:ONB traded up $0.40 during trading on Tuesday, reaching $23.34. 3,556,579 shares of the stock traded hands, compared to its average volume of 2,121,705. Old National Bancorp has a 52-week low of $14.32 and a 52-week high of $23.76. The stock has a market cap of $7.44 billion, a P/E ratio of 14.15 and a beta of 0.82. The stock has a 50-day moving average of $19.63 and a two-hundred day moving average of $18.52. The company has a debt-to-equity ratio of 0.83, a quick ratio of 0.92 and a current ratio of 0.92.

Old National Bancorp (NASDAQ:ONB - Get Free Report) last issued its earnings results on Tuesday, October 22nd. The bank reported $0.46 EPS for the quarter, meeting the consensus estimate of $0.46. The business had revenue of $485.86 million for the quarter, compared to the consensus estimate of $482.20 million. Old National Bancorp had a return on equity of 10.10% and a net margin of 17.93%. The company's revenue was up 6.5% compared to the same quarter last year. During the same period last year, the business posted $0.51 EPS. As a group, sell-side analysts expect that Old National Bancorp will post 1.84 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Old National Bancorp

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Wealth Enhancement Advisory Services LLC increased its holdings in Old National Bancorp by 188.4% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 51,458 shares of the bank's stock worth $885,000 after acquiring an additional 33,615 shares in the last quarter. Busey Bank increased its stake in shares of Old National Bancorp by 41.6% in the second quarter. Busey Bank now owns 38,519 shares of the bank's stock worth $662,000 after purchasing an additional 11,316 shares in the last quarter. Comerica Bank raised its position in shares of Old National Bancorp by 11.9% during the 1st quarter. Comerica Bank now owns 299,561 shares of the bank's stock valued at $5,215,000 after purchasing an additional 31,937 shares during the period. Retirement Systems of Alabama lifted its stake in shares of Old National Bancorp by 6.1% during the 2nd quarter. Retirement Systems of Alabama now owns 389,750 shares of the bank's stock valued at $6,700,000 after buying an additional 22,249 shares in the last quarter. Finally, Fisher Asset Management LLC boosted its holdings in Old National Bancorp by 2.9% in the 3rd quarter. Fisher Asset Management LLC now owns 3,186,132 shares of the bank's stock worth $59,453,000 after buying an additional 90,747 shares during the period. 83.66% of the stock is currently owned by hedge funds and other institutional investors.

About Old National Bancorp

(

Get Free Report)

Old National Bancorp operates as the bank holding company for Old National Bank that provides various financial services to individual and commercial customers in the United States. It accepts deposit accounts, including noninterest-bearing demand, interest-bearing checking, negotiable order of withdrawal, savings and money market, and time deposits; and offers loans, such as home equity lines of credit, residential real estate loans, consumer loans, commercial loans, commercial real estate loans, agricultural loans, letters of credit, and lease financing.

See Also

Before you consider Old National Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old National Bancorp wasn't on the list.

While Old National Bancorp currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.