Olin (NYSE:OLN - Get Free Report) is expected to be announcing its Q1 2025 earnings results after the market closes on Thursday, May 1st. Analysts expect the company to announce earnings of ($0.07) per share and revenue of $1.58 billion for the quarter.

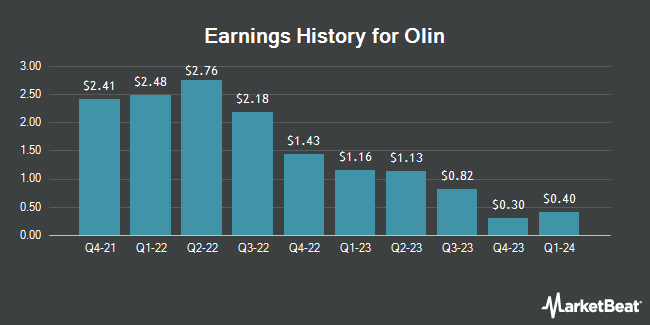

Olin (NYSE:OLN - Get Free Report) last issued its earnings results on Thursday, January 30th. The specialty chemicals company reported $0.09 earnings per share for the quarter, beating the consensus estimate of ($0.01) by $0.10. Olin had a return on equity of 5.10% and a net margin of 1.66%. On average, analysts expect Olin to post $1 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Olin Price Performance

Shares of Olin stock opened at $21.11 on Thursday. The company has a debt-to-equity ratio of 1.32, a current ratio of 1.27 and a quick ratio of 0.77. Olin has a one year low of $17.66 and a one year high of $57.10. The business's 50 day simple moving average is $23.61 and its two-hundred day simple moving average is $32.91. The stock has a market capitalization of $2.43 billion, a P/E ratio of 23.46 and a beta of 1.50.

Olin Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, March 14th. Investors of record on Thursday, March 6th were paid a $0.20 dividend. This represents a $0.80 annualized dividend and a dividend yield of 3.79%. The ex-dividend date of this dividend was Thursday, March 6th. Olin's payout ratio is 88.89%.

Insider Transactions at Olin

In related news, CEO Kenneth Todd Lane purchased 7,250 shares of the company's stock in a transaction dated Tuesday, February 4th. The shares were purchased at an average cost of $28.06 per share, with a total value of $203,435.00. Following the transaction, the chief executive officer now directly owns 7,250 shares in the company, valued at $203,435. This trade represents a ∞ increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 1.60% of the company's stock.

Analyst Upgrades and Downgrades

OLN has been the subject of several analyst reports. Morgan Stanley dropped their price target on shares of Olin from $31.00 to $28.00 and set an "underweight" rating for the company in a research report on Tuesday, February 4th. Royal Bank of Canada lowered shares of Olin from an "outperform" rating to a "sector perform" rating and dropped their target price for the stock from $45.00 to $30.00 in a report on Tuesday, February 4th. Wells Fargo & Company reduced their price target on Olin from $25.00 to $19.00 and set an "equal weight" rating on the stock in a report on Wednesday, April 9th. Bank of America upgraded Olin from a "neutral" rating to a "buy" rating and dropped their price objective for the stock from $48.00 to $40.00 in a report on Tuesday, January 14th. Finally, JPMorgan Chase & Co. cut Olin from an "overweight" rating to a "neutral" rating and reduced their target price for the company from $50.00 to $28.00 in a research note on Thursday, February 27th. One investment analyst has rated the stock with a sell rating, eleven have given a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $33.25.

Read Our Latest Research Report on OLN

About Olin

(

Get Free Report)

Olin Corporation manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada. It operates through three segments: Chlor Alkali Products and Vinyls; Epoxy; and Winchester. The Chlor Alkali Products and Vinyls segment offers chlorine and caustic soda, ethylene dichloride and vinyl chloride monomers, methyl chloride, methylene chloride, chloroform, carbon tetrachloride, perchloroethylene, hydrochloric acid, hydrogen, bleach products, potassium hydroxide, and chlorinated organics intermediates and solvents.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Olin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Olin wasn't on the list.

While Olin currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.