Olstein Capital Management L.P. lessened its holdings in The Shyft Group, Inc. (NASDAQ:SHYF - Free Report) by 13.7% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 244,000 shares of the company's stock after selling 38,741 shares during the period. Olstein Capital Management L.P. owned 0.71% of The Shyft Group worth $3,062,000 as of its most recent SEC filing.

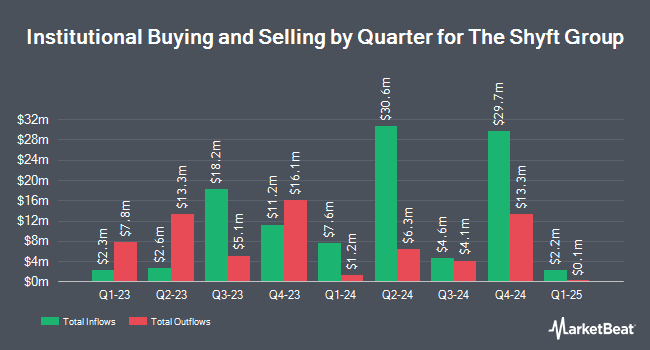

Other large investors also recently added to or reduced their stakes in the company. Allspring Global Investments Holdings LLC bought a new stake in The Shyft Group in the first quarter worth $176,000. Russell Investments Group Ltd. grew its position in shares of The Shyft Group by 8.8% in the 1st quarter. Russell Investments Group Ltd. now owns 53,304 shares of the company's stock worth $662,000 after buying an additional 4,308 shares during the period. Isthmus Partners LLC increased its stake in shares of The Shyft Group by 59.6% during the first quarter. Isthmus Partners LLC now owns 244,002 shares of the company's stock valued at $3,031,000 after purchasing an additional 91,146 shares in the last quarter. Foundry Partners LLC raised its stake in The Shyft Group by 14.4% during the first quarter. Foundry Partners LLC now owns 242,415 shares of the company's stock valued at $3,011,000 after buying an additional 30,470 shares during the last quarter. Finally, First Eagle Investment Management LLC raised its position in shares of The Shyft Group by 8.1% in the 1st quarter. First Eagle Investment Management LLC now owns 473,616 shares of the company's stock worth $5,882,000 after purchasing an additional 35,500 shares during the last quarter. Institutional investors own 85.84% of the company's stock.

The Shyft Group Stock Down 1.4 %

Shares of The Shyft Group stock traded down $0.20 on Thursday, reaching $14.60. The company's stock had a trading volume of 140,482 shares, compared to its average volume of 304,804. The company has a market capitalization of $503.61 million, a price-to-earnings ratio of -121.75 and a beta of 1.63. The company has a quick ratio of 1.16, a current ratio of 1.82 and a debt-to-equity ratio of 0.44. The Shyft Group, Inc. has a 52 week low of $9.81 and a 52 week high of $17.56. The firm's fifty day simple moving average is $12.66 and its two-hundred day simple moving average is $12.56.

The Shyft Group Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Friday, November 15th will be paid a dividend of $0.05 per share. This represents a $0.20 annualized dividend and a yield of 1.37%. The ex-dividend date is Friday, November 15th. The Shyft Group's dividend payout ratio is currently -166.67%.

Wall Street Analysts Forecast Growth

Separately, DA Davidson raised shares of The Shyft Group from a "neutral" rating to a "buy" rating and increased their price objective for the company from $12.00 to $18.00 in a research report on Monday, July 29th.

Read Our Latest Report on SHYF

About The Shyft Group

(

Free Report)

The Shyft Group, Inc engages in the manufacture and assembly of specialty vehicles for the commercial and recreational vehicle industries in the United States and internationally. It operates in two segments, Fleet Vehicles and Services, and Specialty Vehicles. The Fleet Vehicles and Services segment offers commercial vehicles used in the e-commerce/last mile/parcel delivery, beverage and grocery delivery, laundry and linen, mobile retail, and trades and construction industries.

Featured Stories

Before you consider The Shyft Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Shyft Group wasn't on the list.

While The Shyft Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.