Olstein Capital Management L.P. trimmed its position in shares of First Hawaiian, Inc. (NASDAQ:FHB - Free Report) by 26.0% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 74,000 shares of the bank's stock after selling 26,000 shares during the period. Olstein Capital Management L.P. owned 0.06% of First Hawaiian worth $1,713,000 as of its most recent filing with the Securities and Exchange Commission.

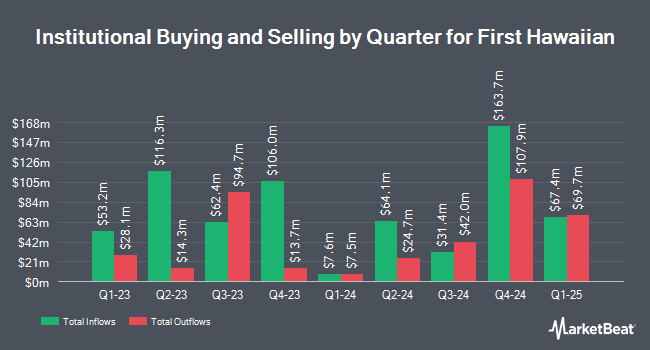

A number of other institutional investors have also added to or reduced their stakes in FHB. Whittier Trust Co. boosted its position in First Hawaiian by 68.7% during the second quarter. Whittier Trust Co. now owns 1,245 shares of the bank's stock worth $26,000 after purchasing an additional 507 shares during the period. Versant Capital Management Inc boosted its position in First Hawaiian by 55.7% during the second quarter. Versant Capital Management Inc now owns 1,895 shares of the bank's stock worth $39,000 after purchasing an additional 678 shares during the period. Blue Trust Inc. boosted its position in First Hawaiian by 51.5% during the third quarter. Blue Trust Inc. now owns 1,838 shares of the bank's stock worth $43,000 after purchasing an additional 625 shares during the period. Abich Financial Wealth Management LLC boosted its position in First Hawaiian by 48.9% during the first quarter. Abich Financial Wealth Management LLC now owns 1,984 shares of the bank's stock worth $44,000 after purchasing an additional 652 shares during the period. Finally, GAMMA Investing LLC boosted its position in First Hawaiian by 50.3% during the second quarter. GAMMA Investing LLC now owns 2,122 shares of the bank's stock worth $44,000 after purchasing an additional 710 shares during the period. 97.63% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

FHB has been the subject of a number of recent research reports. Keefe, Bruyette & Woods boosted their target price on shares of First Hawaiian from $25.00 to $26.00 and gave the company a "market perform" rating in a research report on Monday, July 29th. JPMorgan Chase & Co. reduced their target price on shares of First Hawaiian from $24.00 to $23.00 and set an "underweight" rating for the company in a research report on Wednesday, October 9th. The Goldman Sachs Group boosted their target price on shares of First Hawaiian from $21.00 to $24.00 and gave the company a "sell" rating in a research report on Monday, July 29th. Wells Fargo & Company boosted their target price on shares of First Hawaiian from $20.00 to $21.00 and gave the company an "underweight" rating in a research report on Monday, October 28th. Finally, Piper Sandler upped their price objective on shares of First Hawaiian from $22.00 to $27.00 and gave the stock a "neutral" rating in a research report on Monday, July 29th. Four investment analysts have rated the stock with a sell rating and three have given a hold rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Reduce" and an average target price of $24.33.

Get Our Latest Report on FHB

First Hawaiian Stock Performance

Shares of First Hawaiian stock traded down $1.30 on Thursday, hitting $27.00. The stock had a trading volume of 922,755 shares, compared to its average volume of 650,511. The stock has a 50 day moving average of $23.83 and a 200 day moving average of $22.67. First Hawaiian, Inc. has a twelve month low of $17.95 and a twelve month high of $28.38. The firm has a market capitalization of $3.45 billion, a P/E ratio of 15.43 and a beta of 0.96.

First Hawaiian Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, November 29th. Investors of record on Monday, November 18th will be issued a $0.26 dividend. This represents a $1.04 annualized dividend and a yield of 3.85%. The ex-dividend date of this dividend is Monday, November 18th. First Hawaiian's payout ratio is presently 59.43%.

About First Hawaiian

(

Free Report)

First Hawaiian, Inc operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States. It operates in three segments: Retail Banking, Commercial Banking, and Treasury and Other. The company offers various deposit products, including checking, savings, and time deposit accounts, and other deposit accounts.

Featured Stories

Before you consider First Hawaiian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Hawaiian wasn't on the list.

While First Hawaiian currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.