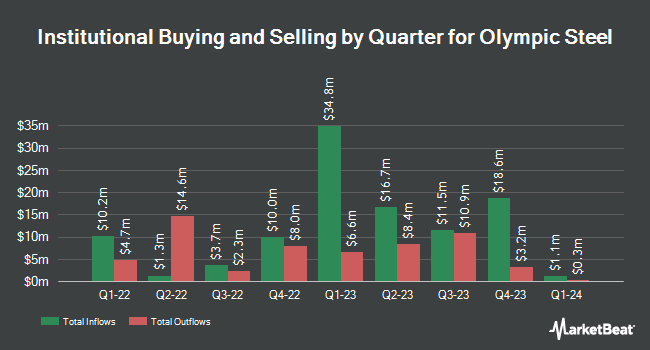

AlphaQuest LLC boosted its holdings in shares of Olympic Steel, Inc. (NASDAQ:ZEUS - Free Report) by 63.4% during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 25,174 shares of the basic materials company's stock after acquiring an additional 9,763 shares during the period. AlphaQuest LLC owned about 0.23% of Olympic Steel worth $826,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the business. JPMorgan Chase & Co. grew its holdings in Olympic Steel by 136.1% during the 3rd quarter. JPMorgan Chase & Co. now owns 214,493 shares of the basic materials company's stock worth $8,365,000 after acquiring an additional 123,632 shares in the last quarter. Jane Street Group LLC grew its holdings in Olympic Steel by 1,165.8% during the 3rd quarter. Jane Street Group LLC now owns 202,163 shares of the basic materials company's stock worth $7,884,000 after acquiring an additional 186,192 shares in the last quarter. Bank of New York Mellon Corp grew its holdings in Olympic Steel by 23.1% during the 4th quarter. Bank of New York Mellon Corp now owns 122,269 shares of the basic materials company's stock worth $4,012,000 after acquiring an additional 22,908 shares in the last quarter. Walleye Capital LLC bought a new position in Olympic Steel during the 3rd quarter worth about $3,978,000. Finally, Empowered Funds LLC grew its holdings in Olympic Steel by 5.1% during the 4th quarter. Empowered Funds LLC now owns 60,805 shares of the basic materials company's stock worth $1,995,000 after acquiring an additional 2,934 shares in the last quarter. 87.07% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts have commented on the stock. KeyCorp increased their price target on shares of Olympic Steel from $42.00 to $43.00 and gave the company an "overweight" rating in a research report on Monday, February 24th. StockNews.com lowered shares of Olympic Steel from a "buy" rating to a "hold" rating in a research report on Saturday, March 1st.

Read Our Latest Stock Analysis on ZEUS

Olympic Steel Stock Up 1.6 %

Shares of ZEUS stock traded up $0.48 during mid-day trading on Tuesday, hitting $31.41. 117,150 shares of the stock traded hands, compared to its average volume of 113,148. The stock has a market cap of $349.78 million, a P/E ratio of 15.94 and a beta of 1.48. The stock's fifty day moving average is $33.96 and its two-hundred day moving average is $37.08. Olympic Steel, Inc. has a 52-week low of $30.29 and a 52-week high of $73.27. The company has a debt-to-equity ratio of 0.35, a current ratio of 3.52 and a quick ratio of 1.26.

Olympic Steel (NASDAQ:ZEUS - Get Free Report) last announced its quarterly earnings data on Thursday, February 20th. The basic materials company reported $0.13 EPS for the quarter, beating the consensus estimate of $0.08 by $0.05. The firm had revenue of $418.78 million during the quarter, compared to analyst estimates of $441.60 million. Olympic Steel had a net margin of 1.18% and a return on equity of 3.31%. Equities analysts predict that Olympic Steel, Inc. will post 2.69 EPS for the current year.

Olympic Steel Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, March 17th. Investors of record on Monday, March 3rd will be given a $0.16 dividend. This is a positive change from Olympic Steel's previous quarterly dividend of $0.15. This represents a $0.64 annualized dividend and a dividend yield of 2.04%. The ex-dividend date is Monday, March 3rd. Olympic Steel's dividend payout ratio (DPR) is presently 32.49%.

About Olympic Steel

(

Free Report)

Olympic Steel, Inc processes, distributes, and stores metal products primarily in the United States, Canada, and Mexico. It operates in three segments: Carbon Flat Products; Specialty Metals Flat Products; and Tubular and Pipe Products. The company offers stainless steel and aluminum coil and sheet products, angles, rounds, and flat bars; alloy, heat treated, and abrasion resistant coils, sheets and plates; coated metals, including galvanized, galvannealed, electro galvanized, advanced high strength steels, aluminized, and automotive grades of steel; commercial quality, advanced high strength steel, drawing steel, and automotive grades cold rolled steel coil and sheet products; hot rolled carbon comprising hot rolled coil, pickled and oiled sheet and plate steel products, automotive grades, advanced high strength steels, and high strength low alloys; tube, pipe, and bar products, including round, square, and rectangular mechanical and structural tubing; hydraulic and stainless tubing; boiler tubing; carbon, stainless, and aluminum pipes; valves and fittings; and tin mill products, such as electrolytic tinplate, electrolytic chromium coated steel, and black plates.

See Also

Before you consider Olympic Steel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Olympic Steel wasn't on the list.

While Olympic Steel currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.