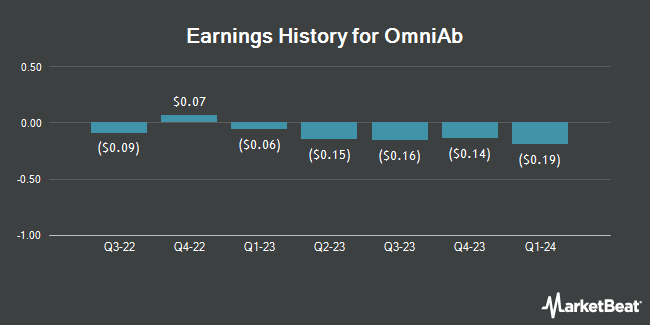

OmniAb (NASDAQ:OABI - Get Free Report) posted its quarterly earnings results on Tuesday. The company reported ($0.12) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.13) by $0.01, Zacks reports. The firm had revenue of $10.80 million for the quarter, compared to analysts' expectations of $10.13 million. OmniAb had a negative net margin of 308.78% and a negative return on equity of 20.97%. During the same period in the prior year, the company posted ($0.14) earnings per share.

OmniAb Stock Performance

Shares of NASDAQ:OABI traded up $0.26 during trading hours on Friday, hitting $2.53. 2,310,985 shares of the company's stock traded hands, compared to its average volume of 539,443. OmniAb has a 52 week low of $2.23 and a 52 week high of $5.63. The company's fifty day simple moving average is $3.34 and its two-hundred day simple moving average is $3.77. The company has a market cap of $357.28 million, a price-to-earnings ratio of -4.08 and a beta of -0.14.

Insider Activity

In other OmniAb news, insider Charles S. Berkman sold 25,489 shares of the company's stock in a transaction dated Tuesday, January 21st. The shares were sold at an average price of $3.24, for a total transaction of $82,584.36. Following the completion of the sale, the insider now directly owns 343,190 shares of the company's stock, valued at approximately $1,111,935.60. This represents a 6.91 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CFO Kurt A. Gustafson sold 7,255 shares of the company's stock in a transaction dated Wednesday, February 19th. The shares were sold at an average price of $3.67, for a total transaction of $26,625.85. Following the sale, the chief financial officer now directly owns 206,211 shares of the company's stock, valued at $756,794.37. This represents a 3.40 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 112,260 shares of company stock worth $376,601. Corporate insiders own 8.60% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on the stock. Benchmark dropped their target price on shares of OmniAb from $8.00 to $6.00 and set a "buy" rating on the stock in a report on Thursday. HC Wainwright reiterated a "buy" rating and issued a $11.00 target price on shares of OmniAb in a research report on Wednesday.

Check Out Our Latest Analysis on OABI

About OmniAb

(

Get Free Report)

OmniAb, Inc, a biotechnology company, engages in the discovery and provision of therapeutic antibody discovery technologies in the United States. The company's technology platform creates and screens diverse antibody repertoires and identify optimal antibodies for partners' drug development efforts.

Recommended Stories

Before you consider OmniAb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OmniAb wasn't on the list.

While OmniAb currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.