StockNews.com lowered shares of Omnicell (NASDAQ:OMCL - Free Report) from a buy rating to a hold rating in a research report released on Tuesday.

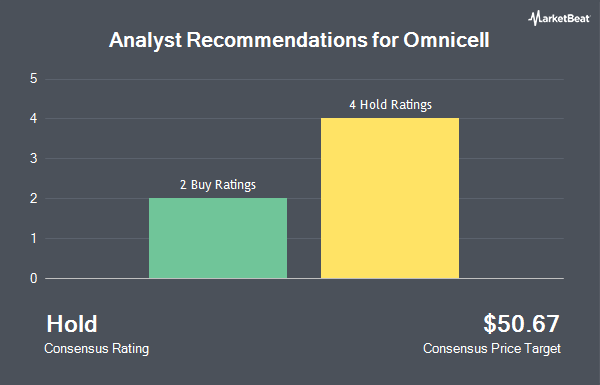

A number of other research analysts have also commented on the company. Barclays upped their target price on Omnicell from $39.00 to $58.00 and gave the company an "equal weight" rating in a research note on Thursday, October 31st. Wells Fargo & Company increased their price objective on shares of Omnicell from $30.00 to $41.00 and gave the company an "equal weight" rating in a research note on Monday, October 14th. Benchmark reiterated a "buy" rating and set a $48.00 target price on shares of Omnicell in a research report on Wednesday, October 9th. JPMorgan Chase & Co. increased their price target on shares of Omnicell from $37.00 to $44.00 and gave the stock a "neutral" rating in a research report on Thursday, November 21st. Finally, Craig Hallum raised their price target on shares of Omnicell from $45.00 to $64.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Five investment analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat, Omnicell presently has a consensus rating of "Hold" and a consensus price target of $52.00.

View Our Latest Analysis on OMCL

Omnicell Trading Up 0.1 %

OMCL traded up $0.04 on Tuesday, hitting $47.14. 303,898 shares of the stock traded hands, compared to its average volume of 538,204. The business has a fifty day moving average price of $44.97 and a two-hundred day moving average price of $38.69. The firm has a market capitalization of $2.18 billion, a PE ratio of -120.87, a P/E/G ratio of 34.95 and a beta of 0.78. Omnicell has a 52 week low of $25.12 and a 52 week high of $55.74.

Hedge Funds Weigh In On Omnicell

Several institutional investors have recently added to or reduced their stakes in OMCL. Pacer Advisors Inc. increased its holdings in shares of Omnicell by 32.6% during the second quarter. Pacer Advisors Inc. now owns 2,070,434 shares of the company's stock worth $56,047,000 after buying an additional 508,789 shares in the last quarter. Dimensional Fund Advisors LP grew its position in Omnicell by 0.3% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,180,503 shares of the company's stock worth $31,955,000 after acquiring an additional 3,570 shares during the last quarter. Victory Capital Management Inc. increased its holdings in Omnicell by 11,982.3% during the 3rd quarter. Victory Capital Management Inc. now owns 1,148,426 shares of the company's stock valued at $50,071,000 after purchasing an additional 1,138,921 shares in the last quarter. ArrowMark Colorado Holdings LLC raised its position in Omnicell by 27.1% in the 3rd quarter. ArrowMark Colorado Holdings LLC now owns 1,140,873 shares of the company's stock valued at $49,742,000 after purchasing an additional 243,353 shares during the last quarter. Finally, Geode Capital Management LLC raised its position in Omnicell by 0.3% in the 3rd quarter. Geode Capital Management LLC now owns 1,104,745 shares of the company's stock valued at $48,176,000 after purchasing an additional 2,877 shares during the last quarter. 97.70% of the stock is owned by institutional investors.

About Omnicell

(

Get Free Report)

Omnicell, Inc, together with its subsidiaries, provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally. The company offers point of care automation solutions to improve clinician workflows in patient care areas of the healthcare system; XT Series automated dispensing systems for medications and supplies used in nursing units and other clinical areas of the hospital, as well as specialized automated dispensing systems for operating room; and robotic dispensing systems for handling the stocking and retrieval of boxed medications.

Further Reading

Before you consider Omnicell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omnicell wasn't on the list.

While Omnicell currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.