First Horizon Advisors Inc. boosted its holdings in Omnicom Group Inc. (NYSE:OMC - Free Report) by 3.4% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 223,167 shares of the business services provider's stock after acquiring an additional 7,295 shares during the period. First Horizon Advisors Inc. owned 0.11% of Omnicom Group worth $23,073,000 at the end of the most recent reporting period.

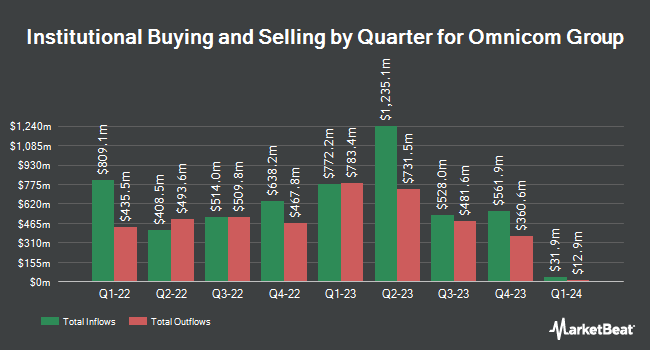

Several other hedge funds also recently added to or reduced their stakes in OMC. Boston Partners grew its holdings in shares of Omnicom Group by 11.0% during the 1st quarter. Boston Partners now owns 3,874,857 shares of the business services provider's stock worth $374,795,000 after purchasing an additional 383,560 shares during the period. Bank of New York Mellon Corp boosted its position in shares of Omnicom Group by 37.0% during the 2nd quarter. Bank of New York Mellon Corp now owns 3,307,882 shares of the business services provider's stock worth $296,717,000 after purchasing an additional 892,494 shares during the period. Lazard Asset Management LLC raised its position in Omnicom Group by 6.3% in the first quarter. Lazard Asset Management LLC now owns 2,787,675 shares of the business services provider's stock valued at $269,734,000 after purchasing an additional 165,136 shares during the period. Cooke & Bieler LP lifted its stake in Omnicom Group by 4.8% during the second quarter. Cooke & Bieler LP now owns 2,399,651 shares of the business services provider's stock worth $215,249,000 after purchasing an additional 109,406 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its position in shares of Omnicom Group by 18.9% during the second quarter. Dimensional Fund Advisors LP now owns 2,293,095 shares of the business services provider's stock worth $205,682,000 after buying an additional 364,665 shares during the period. 91.97% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research analysts recently weighed in on the stock. Macquarie lifted their price objective on shares of Omnicom Group from $110.00 to $120.00 and gave the company an "outperform" rating in a report on Wednesday, October 16th. JPMorgan Chase & Co. lifted their target price on Omnicom Group from $118.00 to $119.00 and gave the company an "overweight" rating in a report on Wednesday, October 16th. Wells Fargo & Company downgraded Omnicom Group from an "overweight" rating to an "equal weight" rating and upped their price target for the stock from $106.00 to $110.00 in a report on Wednesday, October 16th. Barclays lifted their price objective on Omnicom Group from $110.00 to $121.00 and gave the company an "overweight" rating in a research note on Thursday, October 17th. Finally, Bank of America upped their target price on shares of Omnicom Group from $87.00 to $89.00 and gave the stock an "underperform" rating in a research note on Thursday, September 5th. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, Omnicom Group currently has a consensus rating of "Moderate Buy" and an average price target of $110.11.

Check Out Our Latest Stock Analysis on OMC

Insider Buying and Selling at Omnicom Group

In related news, CAO Andrew Castellaneta sold 4,000 shares of the company's stock in a transaction on Friday, October 18th. The stock was sold at an average price of $105.29, for a total transaction of $421,160.00. Following the transaction, the chief accounting officer now owns 23,545 shares of the company's stock, valued at $2,479,053.05. This represents a 14.52 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, VP Rochelle M. Tarlowe sold 3,000 shares of the business's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $99.17, for a total transaction of $297,510.00. Following the sale, the vice president now owns 15,375 shares in the company, valued at $1,524,738.75. The trade was a 16.33 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.30% of the stock is currently owned by corporate insiders.

Omnicom Group Stock Performance

Shares of Omnicom Group stock traded up $1.04 during trading on Wednesday, reaching $99.08. The company's stock had a trading volume of 1,310,804 shares, compared to its average volume of 1,555,120. The company has a 50-day moving average price of $102.12 and a two-hundred day moving average price of $96.64. Omnicom Group Inc. has a fifty-two week low of $78.65 and a fifty-two week high of $107.00. The firm has a market cap of $19.33 billion, a PE ratio of 13.39, a P/E/G ratio of 2.18 and a beta of 0.95. The company has a current ratio of 0.98, a quick ratio of 0.86 and a debt-to-equity ratio of 1.37.

Omnicom Group (NYSE:OMC - Get Free Report) last posted its quarterly earnings data on Tuesday, October 15th. The business services provider reported $2.03 earnings per share for the quarter, topping analysts' consensus estimates of $2.02 by $0.01. The company had revenue of $3.88 billion during the quarter, compared to analysts' expectations of $3.79 billion. Omnicom Group had a return on equity of 36.59% and a net margin of 9.45%. During the same period last year, the firm earned $1.86 EPS. On average, analysts forecast that Omnicom Group Inc. will post 7.94 EPS for the current year.

Omnicom Group Company Profile

(

Free Report)

Omnicom Group Inc, together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of advertising and media, precision marketing, commerce and branding, experiential, execution and support, public relations, and healthcare.

Featured Articles

Before you consider Omnicom Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omnicom Group wasn't on the list.

While Omnicom Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.