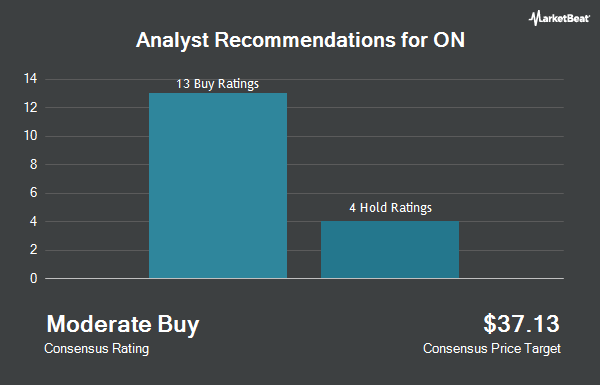

Shares of On Holding AG (NYSE:ONON - Get Free Report) have been given an average recommendation of "Moderate Buy" by the twenty-one analysts that are currently covering the stock, MarketBeat Ratings reports. Four analysts have rated the stock with a hold rating and seventeen have given a buy rating to the company. The average 12 month target price among analysts that have issued ratings on the stock in the last year is $50.37.

Several analysts recently commented on ONON shares. KeyCorp raised their target price on ON from $47.00 to $60.00 and gave the stock an "overweight" rating in a report on Thursday, September 26th. Morgan Stanley boosted their target price on shares of ON from $44.00 to $46.00 and gave the company an "overweight" rating in a research note on Wednesday, August 14th. Truist Financial lifted their price objective on shares of ON from $51.00 to $58.00 and gave the company a "buy" rating in a report on Thursday, October 3rd. Evercore ISI raised shares of ON to an "overweight" rating and increased their target price for the stock from $43.00 to $47.00 in a research note on Monday, August 12th. Finally, Piper Sandler increased their price target on ON from $52.00 to $56.00 and gave the stock an "overweight" rating in a research report on Thursday, October 3rd.

View Our Latest Research Report on ONON

Hedge Funds Weigh In On ON

A number of institutional investors and hedge funds have recently modified their holdings of the company. Blair William & Co. IL acquired a new position in shares of ON during the 1st quarter worth about $502,000. Janney Montgomery Scott LLC boosted its holdings in ON by 1,011.8% in the first quarter. Janney Montgomery Scott LLC now owns 104,185 shares of the company's stock valued at $3,686,000 after purchasing an additional 94,814 shares in the last quarter. Acadian Asset Management LLC purchased a new position in ON in the first quarter valued at approximately $8,094,000. Kayne Anderson Rudnick Investment Management LLC raised its holdings in ON by 100.7% during the second quarter. Kayne Anderson Rudnick Investment Management LLC now owns 1,281,339 shares of the company's stock worth $49,716,000 after purchasing an additional 642,894 shares in the last quarter. Finally, Private Advisor Group LLC purchased a new stake in shares of ON during the 1st quarter worth approximately $521,000. Institutional investors and hedge funds own 33.11% of the company's stock.

ON Stock Up 2.2 %

Shares of NYSE:ONON traded up $1.11 during trading on Friday, hitting $51.49. The stock had a trading volume of 4,770,503 shares, compared to its average volume of 3,027,877. The stock has a 50-day simple moving average of $48.85 and a two-hundred day simple moving average of $42.47. The stock has a market capitalization of $32.42 billion, a price-to-earnings ratio of 97.21 and a beta of 2.25. ON has a 12-month low of $24.15 and a 12-month high of $52.80.

ON (NYSE:ONON - Get Free Report) last released its quarterly earnings data on Tuesday, August 13th. The company reported $0.10 earnings per share for the quarter, missing analysts' consensus estimates of $0.14 by ($0.04). The business had revenue of $627.66 million during the quarter, compared to analyst estimates of $634.43 million. ON had a return on equity of 13.02% and a net margin of 7.42%. As a group, sell-side analysts forecast that ON will post 0.75 earnings per share for the current year.

ON Company Profile

(

Get Free ReportOn Holding AG engages in the development and distribution of sports products worldwide. The company offers athletic footwear, apparel, and accessories for high-performance running, outdoor, training, all-day activities, and tennis. It offers its products through independent retailers and distributors, online, and stores.

Featured Stories

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.