Lisanti Capital Growth LLC lessened its stake in shares of On Holding AG (NYSE:ONON - Free Report) by 71.3% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 25,570 shares of the company's stock after selling 63,660 shares during the period. Lisanti Capital Growth LLC's holdings in ON were worth $1,282,000 at the end of the most recent quarter.

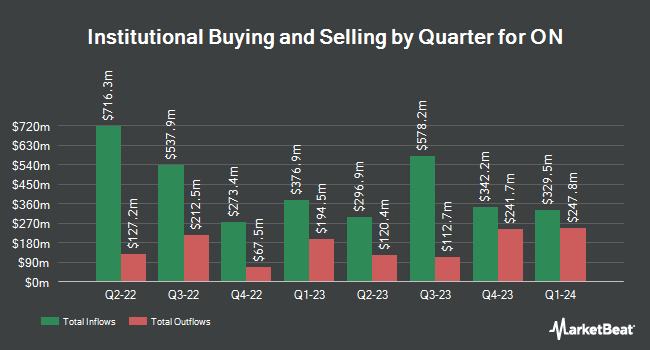

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Blue Trust Inc. increased its holdings in ON by 319.8% during the third quarter. Blue Trust Inc. now owns 529 shares of the company's stock valued at $27,000 after buying an additional 403 shares during the period. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA increased its holdings in ON by 210.5% during the third quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 590 shares of the company's stock valued at $28,000 after buying an additional 400 shares during the period. Quarry LP purchased a new position in ON during the second quarter valued at approximately $32,000. MFA Wealth Advisors LLC purchased a new position in ON during the third quarter valued at approximately $50,000. Finally, Asset Dedication LLC increased its holdings in ON by 25.8% during the second quarter. Asset Dedication LLC now owns 1,592 shares of the company's stock valued at $62,000 after buying an additional 327 shares during the period. Institutional investors own 33.11% of the company's stock.

ON Price Performance

NYSE:ONON traded up $1.22 during mid-day trading on Monday, hitting $52.71. The company's stock had a trading volume of 10,628,639 shares, compared to its average volume of 4,963,169. On Holding AG has a 1 year low of $24.15 and a 1 year high of $53.72. The stock has a market cap of $33.19 billion, a price-to-earnings ratio of 97.15 and a beta of 2.25. The business's fifty day moving average is $48.85 and its two-hundred day moving average is $42.61.

ON (NYSE:ONON - Get Free Report) last posted its quarterly earnings results on Tuesday, August 13th. The company reported $0.10 EPS for the quarter, missing the consensus estimate of $0.14 by ($0.04). ON had a net margin of 7.42% and a return on equity of 13.02%. The business had revenue of $627.66 million during the quarter, compared to analysts' expectations of $634.43 million. Analysts anticipate that On Holding AG will post 0.75 EPS for the current fiscal year.

Analyst Ratings Changes

ONON has been the topic of several analyst reports. UBS Group lifted their price target on shares of ON from $55.00 to $61.00 and gave the stock a "buy" rating in a report on Monday, November 4th. Piper Sandler lifted their price target on shares of ON from $52.00 to $56.00 and gave the stock an "overweight" rating in a report on Thursday, October 3rd. Raymond James initiated coverage on shares of ON in a report on Wednesday, July 31st. They issued an "outperform" rating and a $46.00 price target on the stock. Evercore ISI raised shares of ON to an "overweight" rating and lifted their price target for the stock from $43.00 to $47.00 in a report on Monday, August 12th. Finally, KeyCorp lifted their price target on shares of ON from $47.00 to $60.00 and gave the stock an "overweight" rating in a report on Thursday, September 26th. Four investment analysts have rated the stock with a hold rating and seventeen have given a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $50.37.

View Our Latest Stock Analysis on ON

ON Profile

(

Free Report)

On Holding AG engages in the development and distribution of sports products worldwide. The company offers athletic footwear, apparel, and accessories for high-performance running, outdoor, training, all-day activities, and tennis. It offers its products through independent retailers and distributors, online, and stores.

Read More

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.