ON (NYSE:ONON - Get Free Report) was upgraded by Williams Trading from a "hold" rating to a "buy" rating in a research note issued to investors on Wednesday,Benzinga reports. The firm presently has a $60.00 price objective on the stock, up from their prior price objective of $40.00. Williams Trading's target price points to a potential upside of 13.83% from the stock's previous close.

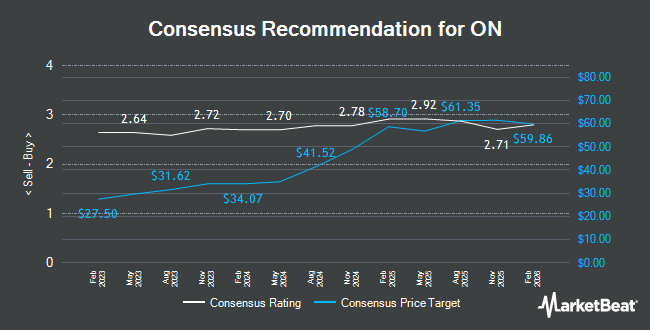

A number of other research firms have also recently weighed in on ONON. KeyCorp lifted their price objective on shares of ON from $47.00 to $60.00 and gave the company an "overweight" rating in a report on Thursday, September 26th. HSBC initiated coverage on shares of ON in a research report on Thursday, September 5th. They issued a "hold" rating and a $52.00 target price on the stock. UBS Group boosted their target price on shares of ON from $55.00 to $61.00 and gave the company a "buy" rating in a report on Monday, November 4th. Piper Sandler upped their target price on shares of ON from $52.00 to $56.00 and gave the stock an "overweight" rating in a research note on Thursday, October 3rd. Finally, The Goldman Sachs Group boosted their price target on shares of ON from $50.00 to $57.00 and gave the stock a "buy" rating in a report on Wednesday. Four analysts have rated the stock with a hold rating and twenty have issued a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $53.50.

View Our Latest Research Report on ONON

ON Trading Up 0.2 %

Shares of NYSE ONON traded up $0.09 during midday trading on Wednesday, reaching $52.71. The company had a trading volume of 6,096,381 shares, compared to its average volume of 4,995,677. The business's 50-day simple moving average is $49.10 and its 200 day simple moving average is $42.90. ON has a 1 year low of $24.15 and a 1 year high of $56.44. The stock has a market cap of $33.19 billion, a P/E ratio of 126.07 and a beta of 2.25.

ON (NYSE:ONON - Get Free Report) last issued its earnings results on Tuesday, August 13th. The company reported $0.10 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.14 by ($0.04). ON had a return on equity of 11.02% and a net margin of 5.87%. The business had revenue of $627.66 million for the quarter, compared to analysts' expectations of $634.43 million. Analysts predict that ON will post 0.75 earnings per share for the current year.

Institutional Investors Weigh In On ON

Institutional investors have recently bought and sold shares of the stock. Private Trust Co. NA purchased a new stake in ON in the third quarter valued at approximately $26,000. Blue Trust Inc. grew its stake in ON by 319.8% during the third quarter. Blue Trust Inc. now owns 529 shares of the company's stock worth $27,000 after buying an additional 403 shares during the period. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA grew its stake in ON by 210.5% during the third quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 590 shares of the company's stock worth $28,000 after buying an additional 400 shares during the period. MidAtlantic Capital Management Inc. purchased a new stake in ON during the third quarter worth approximately $29,000. Finally, Quarry LP bought a new stake in ON during the second quarter valued at $32,000. 33.11% of the stock is currently owned by hedge funds and other institutional investors.

About ON

(

Get Free Report)

On Holding AG engages in the development and distribution of sports products worldwide. The company offers athletic footwear, apparel, and accessories for high-performance running, outdoor, training, all-day activities, and tennis. It offers its products through independent retailers and distributors, online, and stores.

Recommended Stories

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.