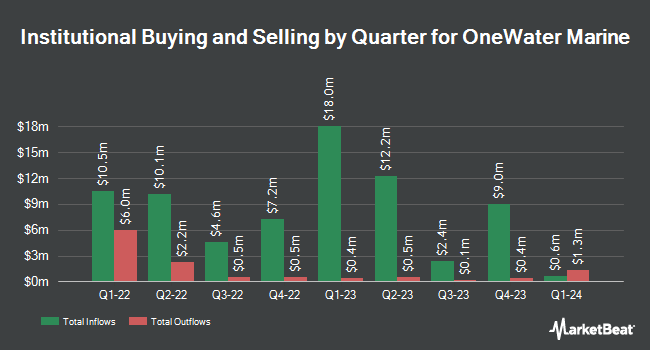

Royce & Associates LP boosted its holdings in shares of OneWater Marine Inc. (NASDAQ:ONEW - Free Report) by 9.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,637,378 shares of the company's stock after purchasing an additional 144,926 shares during the quarter. Royce & Associates LP owned about 10.20% of OneWater Marine worth $39,150,000 at the end of the most recent quarter.

Several other hedge funds have also recently added to or reduced their stakes in ONEW. Private Management Group Inc. lifted its holdings in shares of OneWater Marine by 0.9% during the third quarter. Private Management Group Inc. now owns 632,380 shares of the company's stock worth $15,120,000 after buying an additional 5,916 shares during the last quarter. Vanguard Group Inc. boosted its holdings in OneWater Marine by 2.0% in the 1st quarter. Vanguard Group Inc. now owns 581,355 shares of the company's stock valued at $16,365,000 after purchasing an additional 11,227 shares during the period. Dimensional Fund Advisors LP grew its position in OneWater Marine by 6.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 431,355 shares of the company's stock worth $11,892,000 after purchasing an additional 24,364 shares during the last quarter. NBW Capital LLC increased its holdings in shares of OneWater Marine by 1.6% during the 1st quarter. NBW Capital LLC now owns 253,079 shares of the company's stock worth $7,124,000 after purchasing an additional 4,100 shares during the period. Finally, Sei Investments Co. raised its position in shares of OneWater Marine by 1.1% during the second quarter. Sei Investments Co. now owns 190,182 shares of the company's stock valued at $5,243,000 after buying an additional 2,124 shares during the last quarter. Institutional investors own 94.32% of the company's stock.

Insider Activity at OneWater Marine

In other news, COO Anthony M. Aisquith acquired 5,000 shares of the company's stock in a transaction on Friday, September 6th. The stock was purchased at an average cost of $21.75 per share, with a total value of $108,750.00. Following the acquisition, the chief operating officer now owns 724,316 shares of the company's stock, valued at $15,753,873. This trade represents a 0.70 % increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO Philip Austin Jr. Singleton purchased 6,700 shares of the stock in a transaction dated Thursday, September 5th. The shares were acquired at an average price of $22.39 per share, with a total value of $150,013.00. Following the transaction, the chief executive officer now owns 620,217 shares in the company, valued at $13,886,658.63. This trade represents a 1.09 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders purchased a total of 20,034 shares of company stock valued at $441,828 over the last quarter. Corporate insiders own 18.70% of the company's stock.

OneWater Marine Price Performance

Shares of NASDAQ:ONEW traded down $1.23 during midday trading on Friday, reaching $20.00. The company's stock had a trading volume of 229,934 shares, compared to its average volume of 89,102. The business's fifty day simple moving average is $22.71 and its 200-day simple moving average is $24.58. The company has a market capitalization of $321.20 million, a P/E ratio of -3.11 and a beta of 2.58. The company has a debt-to-equity ratio of 1.04, a current ratio of 1.29 and a quick ratio of 0.35. OneWater Marine Inc. has a fifty-two week low of $19.66 and a fifty-two week high of $35.86.

Analysts Set New Price Targets

A number of brokerages recently commented on ONEW. Stifel Nicolaus cut their target price on OneWater Marine from $34.00 to $31.00 and set a "buy" rating for the company in a research note on Friday. Benchmark reiterated a "hold" rating on shares of OneWater Marine in a research report on Friday. Finally, KeyCorp cut their price objective on OneWater Marine from $29.00 to $27.00 and set an "overweight" rating for the company in a report on Friday. Two research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat, OneWater Marine has a consensus rating of "Moderate Buy" and a consensus price target of $30.00.

Read Our Latest Research Report on ONEW

About OneWater Marine

(

Free Report)

OneWater Marine Inc operates as a recreational boat retailer in the United States. The company offers new and pre-owned recreational boats and yachts, as well as related marine products, such as parts and accessories. It provides boat repair and maintenance services. In addition, the company arranges boat financing and insurance; and other ancillary services, including indoor and outdoor storage, and marina services.

Further Reading

Before you consider OneWater Marine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OneWater Marine wasn't on the list.

While OneWater Marine currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.