Swiss National Bank grew its stake in shares of Onsemi (NASDAQ:ON - Free Report) by 0.9% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,277,000 shares of the semiconductor company's stock after purchasing an additional 11,700 shares during the period. Swiss National Bank owned approximately 0.30% of Onsemi worth $92,723,000 as of its most recent SEC filing.

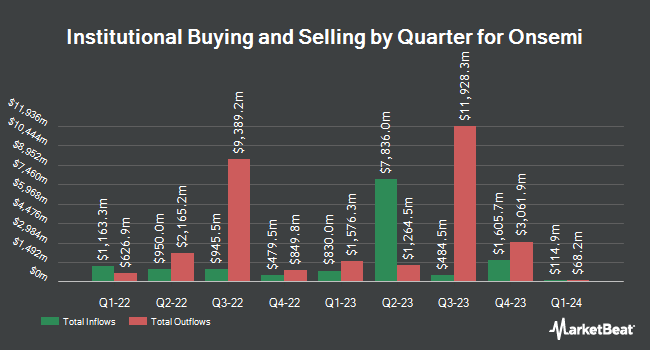

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. Capital Performance Advisors LLP bought a new stake in Onsemi during the third quarter worth about $27,000. Ashton Thomas Securities LLC bought a new position in Onsemi during the 3rd quarter valued at approximately $33,000. GHP Investment Advisors Inc. raised its stake in Onsemi by 12,850.0% during the third quarter. GHP Investment Advisors Inc. now owns 518 shares of the semiconductor company's stock valued at $38,000 after buying an additional 514 shares during the last quarter. Massmutual Trust Co. FSB ADV boosted its holdings in Onsemi by 36.7% in the second quarter. Massmutual Trust Co. FSB ADV now owns 629 shares of the semiconductor company's stock worth $43,000 after acquiring an additional 169 shares in the last quarter. Finally, International Assets Investment Management LLC purchased a new stake in shares of Onsemi in the second quarter worth $43,000. Hedge funds and other institutional investors own 97.70% of the company's stock.

Insider Buying and Selling at Onsemi

In other Onsemi news, CEO Hassane El-Khoury sold 1,500 shares of the stock in a transaction on Tuesday, October 15th. The shares were sold at an average price of $72.71, for a total transaction of $109,065.00. Following the completion of the transaction, the chief executive officer now owns 839,210 shares in the company, valued at $61,018,959.10. This trade represents a 0.18 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Insiders own 0.31% of the company's stock.

Onsemi Price Performance

Shares of Onsemi stock traded up $0.18 during trading hours on Tuesday, hitting $66.66. The company's stock had a trading volume of 2,320,391 shares, compared to its average volume of 6,722,685. The company has a market cap of $28.38 billion, a PE ratio of 16.50, a PEG ratio of 6.94 and a beta of 1.65. The company has a debt-to-equity ratio of 0.30, a quick ratio of 2.02 and a current ratio of 3.07. The business has a 50 day moving average price of $70.37 and a two-hundred day moving average price of $71.87. Onsemi has a 12-month low of $59.34 and a 12-month high of $86.77.

Onsemi (NASDAQ:ON - Get Free Report) last released its quarterly earnings data on Monday, October 28th. The semiconductor company reported $0.99 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.97 by $0.02. The firm had revenue of $1.76 billion for the quarter, compared to analysts' expectations of $1.75 billion. Onsemi had a net margin of 23.80% and a return on equity of 22.38%. The company's revenue for the quarter was down 19.2% compared to the same quarter last year. During the same quarter last year, the business posted $1.39 earnings per share. Analysts expect that Onsemi will post 4 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages recently issued reports on ON. Truist Financial dropped their price target on shares of Onsemi from $97.00 to $89.00 and set a "buy" rating on the stock in a research note on Tuesday, October 29th. Benchmark reiterated a "buy" rating and set a $90.00 price target on shares of Onsemi in a report on Tuesday, October 29th. StockNews.com upgraded shares of Onsemi from a "sell" rating to a "hold" rating in a report on Tuesday, October 29th. Morgan Stanley lifted their target price on Onsemi from $63.00 to $64.00 and gave the stock an "underweight" rating in a report on Tuesday, October 29th. Finally, Mizuho set a $85.00 price target on Onsemi in a report on Friday, October 18th. Two analysts have rated the stock with a sell rating, six have given a hold rating and sixteen have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $86.30.

Check Out Our Latest Analysis on ON

About Onsemi

(

Free Report)

onsemi is engaged in disruptive innovations and also a supplier of power and analog semiconductors. The firm offers vehicle electrification and safety, sustainable energy grids, industrial automation, and 5G and cloud infrastructure, with a focus on automotive and industrial end-markets. It operates through the following segments: Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group.

Further Reading

Before you consider Onsemi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onsemi wasn't on the list.

While Onsemi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.