Onsemi (NASDAQ:ON - Get Free Report)'s stock had its "buy" rating reaffirmed by stock analysts at Needham & Company LLC in a research note issued on Tuesday,Benzinga reports. They currently have a $87.00 price objective on the semiconductor company's stock. Needham & Company LLC's price objective indicates a potential upside of 30.51% from the stock's previous close.

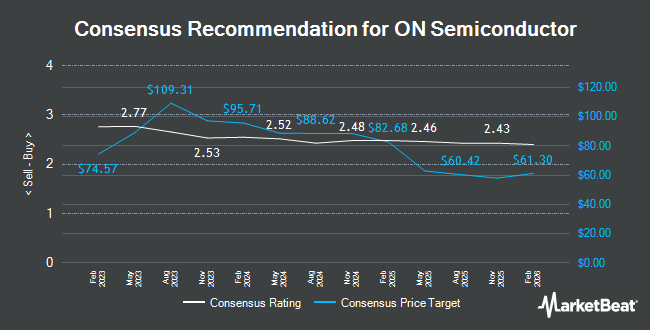

Several other equities research analysts have also recently commented on ON. Deutsche Bank Aktiengesellschaft lifted their target price on Onsemi from $85.00 to $90.00 and gave the company a "buy" rating in a research note on Tuesday, July 30th. Rosenblatt Securities reiterated a "neutral" rating and set a $75.00 price target on shares of Onsemi in a research report on Tuesday, October 29th. Benchmark reaffirmed a "buy" rating and issued a $90.00 price objective on shares of Onsemi in a research note on Tuesday, October 29th. BNP Paribas dropped their target price on shares of Onsemi from $60.00 to $55.00 in a research report on Friday, October 25th. Finally, Mizuho set a $85.00 price target on Onsemi in a research report on Friday, October 18th. Two analysts have rated the stock with a sell rating, six have given a hold rating and sixteen have given a buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $86.30.

Check Out Our Latest Report on ON

Onsemi Price Performance

Shares of NASDAQ ON traded up $0.18 during mid-day trading on Tuesday, hitting $66.66. 2,320,391 shares of the stock were exchanged, compared to its average volume of 6,722,685. The company has a market cap of $28.38 billion, a P/E ratio of 16.50, a PEG ratio of 6.94 and a beta of 1.65. The company has a debt-to-equity ratio of 0.30, a quick ratio of 2.02 and a current ratio of 3.07. Onsemi has a twelve month low of $59.34 and a twelve month high of $86.77. The stock's fifty day simple moving average is $70.37 and its two-hundred day simple moving average is $71.87.

Onsemi (NASDAQ:ON - Get Free Report) last posted its quarterly earnings data on Monday, October 28th. The semiconductor company reported $0.99 EPS for the quarter, topping analysts' consensus estimates of $0.97 by $0.02. Onsemi had a return on equity of 22.38% and a net margin of 23.80%. The company had revenue of $1.76 billion for the quarter, compared to analyst estimates of $1.75 billion. During the same quarter in the previous year, the firm earned $1.39 earnings per share. The business's revenue was down 19.2% on a year-over-year basis. As a group, analysts forecast that Onsemi will post 4 EPS for the current fiscal year.

Insider Activity at Onsemi

In other Onsemi news, CEO Hassane El-Khoury sold 1,500 shares of Onsemi stock in a transaction on Monday, September 16th. The stock was sold at an average price of $70.80, for a total value of $106,200.00. Following the completion of the transaction, the chief executive officer now directly owns 840,620 shares of the company's stock, valued at $59,515,896. The trade was a 0.18 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 0.31% of the stock is owned by company insiders.

Hedge Funds Weigh In On Onsemi

Several hedge funds have recently bought and sold shares of the company. Covestor Ltd boosted its holdings in shares of Onsemi by 24.5% during the 1st quarter. Covestor Ltd now owns 965 shares of the semiconductor company's stock valued at $71,000 after acquiring an additional 190 shares in the last quarter. O Shaughnessy Asset Management LLC grew its holdings in Onsemi by 1.4% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 40,896 shares of the semiconductor company's stock worth $3,008,000 after acquiring an additional 570 shares during the last quarter. Pitcairn Co. increased its position in Onsemi by 393.1% in the 1st quarter. Pitcairn Co. now owns 15,492 shares of the semiconductor company's stock valued at $1,139,000 after acquiring an additional 12,350 shares during the period. EP Wealth Advisors LLC lifted its holdings in shares of Onsemi by 4.2% during the first quarter. EP Wealth Advisors LLC now owns 5,864 shares of the semiconductor company's stock worth $431,000 after purchasing an additional 239 shares during the period. Finally, Axxcess Wealth Management LLC bought a new stake in shares of Onsemi in the first quarter worth $808,000. 97.70% of the stock is owned by institutional investors.

About Onsemi

(

Get Free Report)

onsemi is engaged in disruptive innovations and also a supplier of power and analog semiconductors. The firm offers vehicle electrification and safety, sustainable energy grids, industrial automation, and 5G and cloud infrastructure, with a focus on automotive and industrial end-markets. It operates through the following segments: Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group.

See Also

Before you consider Onsemi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onsemi wasn't on the list.

While Onsemi currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.