Ontario Teachers Pension Plan Board boosted its stake in The Walt Disney Company (NYSE:DIS - Free Report) by 18.3% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 4,972,582 shares of the entertainment giant's stock after purchasing an additional 770,923 shares during the quarter. Walt Disney comprises 4.1% of Ontario Teachers Pension Plan Board's investment portfolio, making the stock its 11th biggest position. Ontario Teachers Pension Plan Board owned 0.27% of Walt Disney worth $478,313,000 as of its most recent filing with the Securities & Exchange Commission.

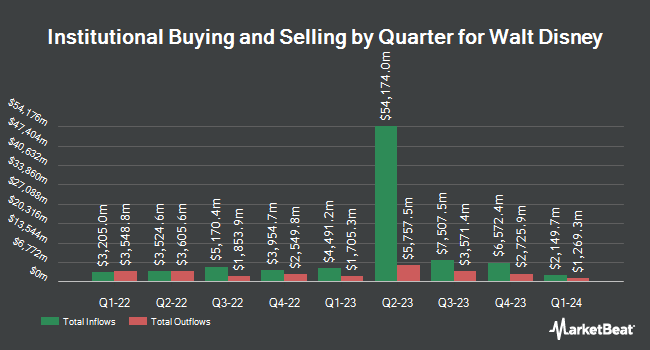

Several other institutional investors and hedge funds have also bought and sold shares of DIS. Transcendent Capital Group LLC boosted its stake in Walt Disney by 1.4% in the first quarter. Transcendent Capital Group LLC now owns 7,912 shares of the entertainment giant's stock valued at $968,000 after buying an additional 108 shares in the last quarter. Connable Office Inc. boosted its stake in shares of Walt Disney by 0.3% in the 3rd quarter. Connable Office Inc. now owns 35,048 shares of the entertainment giant's stock valued at $3,371,000 after purchasing an additional 108 shares during the last quarter. ADE LLC grew its holdings in Walt Disney by 4.6% during the 2nd quarter. ADE LLC now owns 2,509 shares of the entertainment giant's stock worth $249,000 after acquiring an additional 110 shares during the period. Cozad Asset Management Inc. grew its stake in Walt Disney by 1.9% during the third quarter. Cozad Asset Management Inc. now owns 6,017 shares of the entertainment giant's stock worth $579,000 after purchasing an additional 110 shares during the period. Finally, Absher Wealth Management LLC increased its stake in shares of Walt Disney by 0.8% in the 3rd quarter. Absher Wealth Management LLC now owns 14,141 shares of the entertainment giant's stock valued at $1,360,000 after acquiring an additional 111 shares in the last quarter. Institutional investors own 65.71% of the company's stock.

Walt Disney Price Performance

NYSE DIS traded up $1.85 during trading hours on Wednesday, reaching $114.27. 9,315,784 shares of the stock traded hands, compared to its average volume of 11,017,364. The company has a market cap of $206.94 billion, a price-to-earnings ratio of 41.48, a price-to-earnings-growth ratio of 1.85 and a beta of 1.40. The company has a debt-to-equity ratio of 0.37, a current ratio of 0.73 and a quick ratio of 0.67. The Walt Disney Company has a 1 year low of $83.91 and a 1 year high of $123.74. The stock has a 50 day simple moving average of $96.55 and a two-hundred day simple moving average of $96.60.

Analyst Ratings Changes

A number of equities research analysts have commented on the company. TD Cowen raised their price objective on Walt Disney from $108.00 to $123.00 and gave the company a "hold" rating in a research note on Friday, November 15th. Barclays dropped their target price on Walt Disney from $130.00 to $105.00 and set an "overweight" rating on the stock in a report on Thursday, August 8th. Raymond James reiterated a "market perform" rating on shares of Walt Disney in a report on Tuesday, October 1st. Piper Sandler began coverage on shares of Walt Disney in a report on Wednesday, October 16th. They set a "neutral" rating and a $95.00 price objective on the stock. Finally, Guggenheim increased their target price on shares of Walt Disney from $110.00 to $130.00 and gave the company a "buy" rating in a report on Friday, November 15th. Five equities research analysts have rated the stock with a hold rating, eighteen have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, Walt Disney currently has an average rating of "Moderate Buy" and an average price target of $123.83.

View Our Latest Analysis on Walt Disney

Walt Disney Profile

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Read More

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.