Ontario Teachers Pension Plan Board reduced its position in shares of Azenta, Inc. (NASDAQ:AZTA - Free Report) by 56.7% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 21,975 shares of the company's stock after selling 28,803 shares during the period. Ontario Teachers Pension Plan Board's holdings in Azenta were worth $1,064,000 at the end of the most recent reporting period.

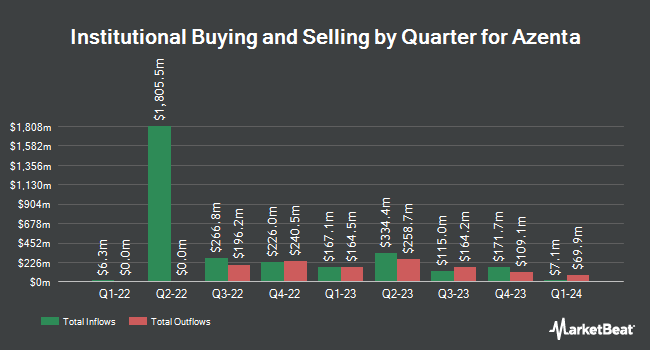

A number of other institutional investors and hedge funds have also recently modified their holdings of AZTA. Redwood Investment Management LLC acquired a new position in shares of Azenta during the 1st quarter worth about $1,497,000. Wesbanco Bank Inc. lifted its stake in Azenta by 72.2% during the third quarter. Wesbanco Bank Inc. now owns 31,000 shares of the company's stock worth $1,502,000 after purchasing an additional 13,000 shares during the last quarter. American Century Companies Inc. boosted its holdings in Azenta by 66.3% in the second quarter. American Century Companies Inc. now owns 69,955 shares of the company's stock valued at $3,681,000 after purchasing an additional 27,882 shares in the last quarter. Premier Fund Managers Ltd purchased a new position in Azenta in the third quarter valued at approximately $686,000. Finally, Royce & Associates LP raised its holdings in Azenta by 7.8% during the third quarter. Royce & Associates LP now owns 739,977 shares of the company's stock worth $35,844,000 after purchasing an additional 53,584 shares in the last quarter. Institutional investors and hedge funds own 99.08% of the company's stock.

Insider Buying and Selling at Azenta

In other news, CEO John Marotta bought 12,717 shares of the stock in a transaction dated Monday, November 18th. The shares were acquired at an average price of $39.48 per share, with a total value of $502,067.16. Following the completion of the acquisition, the chief executive officer now directly owns 99,612 shares in the company, valued at approximately $3,932,681.76. The trade was a 14.63 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Herman Cueto sold 712 shares of the stock in a transaction dated Tuesday, November 19th. The stock was sold at an average price of $40.07, for a total transaction of $28,529.84. Following the transaction, the chief financial officer now directly owns 23,892 shares of the company's stock, valued at $957,352.44. This represents a 2.89 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 3,018 shares of company stock worth $126,689. 1.77% of the stock is currently owned by insiders.

Analysts Set New Price Targets

Several research analysts have recently issued reports on the stock. Needham & Company LLC lowered their target price on shares of Azenta from $69.00 to $55.00 and set a "buy" rating for the company in a report on Wednesday, November 13th. Evercore ISI decreased their price objective on shares of Azenta from $53.00 to $50.00 and set an "in-line" rating for the company in a research note on Tuesday, October 1st. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $63.60.

Read Our Latest Report on Azenta

Azenta Trading Up 1.9 %

AZTA stock traded up $0.86 on Thursday, hitting $45.51. The company's stock had a trading volume of 1,041,134 shares, compared to its average volume of 513,855. The stock has a market cap of $2.23 billion, a price-to-earnings ratio of -15.32 and a beta of 1.48. The firm has a 50 day moving average of $45.29 and a two-hundred day moving average of $50.19. Azenta, Inc. has a 1 year low of $38.82 and a 1 year high of $69.16.

Azenta (NASDAQ:AZTA - Get Free Report) last announced its earnings results on Tuesday, November 12th. The company reported $0.18 EPS for the quarter, beating analysts' consensus estimates of $0.10 by $0.08. Azenta had a negative net margin of 25.01% and a positive return on equity of 1.03%. The business had revenue of $170.00 million during the quarter, compared to analysts' expectations of $169.66 million. During the same period in the prior year, the company earned $0.13 earnings per share. The business's revenue was down 1.2% compared to the same quarter last year. As a group, equities analysts forecast that Azenta, Inc. will post 0.4 EPS for the current fiscal year.

About Azenta

(

Free Report)

Azenta, Inc provides biological and chemical compound sample exploration and management solutions for the life sciences market in North America, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally. The company operates in two reportable segments, Life Sciences Products and Life Sciences Services.

Featured Articles

Before you consider Azenta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Azenta wasn't on the list.

While Azenta currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.