Ontario Teachers Pension Plan Board lifted its position in shares of Honeywell International Inc. (NASDAQ:HON - Free Report) by 7.7% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 3,197,717 shares of the conglomerate's stock after buying an additional 228,880 shares during the quarter. Honeywell International makes up 5.6% of Ontario Teachers Pension Plan Board's investment portfolio, making the stock its 5th largest position. Ontario Teachers Pension Plan Board owned about 0.49% of Honeywell International worth $661,000,000 at the end of the most recent quarter.

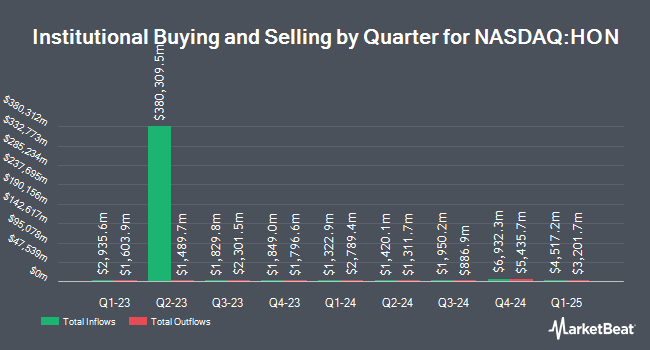

A number of other hedge funds and other institutional investors have also made changes to their positions in HON. RIA Advisory Group LLC acquired a new position in shares of Honeywell International in the 3rd quarter valued at approximately $6,124,000. EP Wealth Advisors LLC increased its stake in Honeywell International by 4.4% during the 2nd quarter. EP Wealth Advisors LLC now owns 337,380 shares of the conglomerate's stock valued at $72,044,000 after buying an additional 14,271 shares during the period. SteelPeak Wealth LLC raised its stake in shares of Honeywell International by 255.2% in the 3rd quarter. SteelPeak Wealth LLC now owns 73,529 shares of the conglomerate's stock worth $15,199,000 after buying an additional 52,830 shares in the last quarter. Los Angeles Capital Management LLC raised its position in Honeywell International by 24.5% in the third quarter. Los Angeles Capital Management LLC now owns 29,213 shares of the conglomerate's stock worth $6,039,000 after acquiring an additional 5,750 shares in the last quarter. Finally, Asset Management One Co. Ltd. boosted its stake in shares of Honeywell International by 2.6% during the 3rd quarter. Asset Management One Co. Ltd. now owns 346,469 shares of the conglomerate's stock worth $71,619,000 after acquiring an additional 8,687 shares in the last quarter. Hedge funds and other institutional investors own 75.91% of the company's stock.

Wall Street Analyst Weigh In

HON has been the topic of a number of recent analyst reports. Royal Bank of Canada lifted their price target on shares of Honeywell International from $213.00 to $253.00 and gave the company a "sector perform" rating in a research report on Wednesday, November 13th. Bank of America upped their target price on Honeywell International from $220.00 to $240.00 and gave the company a "neutral" rating in a research note on Thursday, November 14th. StockNews.com raised Honeywell International from a "hold" rating to a "buy" rating in a report on Sunday, November 3rd. Wells Fargo & Company lifted their price target on shares of Honeywell International from $215.00 to $254.00 and gave the company an "equal weight" rating in a report on Wednesday, November 13th. Finally, Citigroup lowered their target price on Honeywell International from $248.00 to $244.00 and set a "buy" rating for the company in a research note on Friday, October 25th. Nine investment analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, Honeywell International presently has a consensus rating of "Hold" and a consensus target price of $241.45.

Check Out Our Latest Report on Honeywell International

Honeywell International Stock Performance

NASDAQ HON traded down $1.53 on Wednesday, hitting $226.67. 4,632,620 shares of the company traded hands, compared to its average volume of 3,114,002. The company has a current ratio of 1.44, a quick ratio of 1.12 and a debt-to-equity ratio of 1.44. Honeywell International Inc. has a 52-week low of $189.66 and a 52-week high of $242.77. The business's 50 day moving average price is $212.49 and its 200-day moving average price is $208.41. The company has a market capitalization of $147.39 billion, a price-to-earnings ratio of 26.14, a P/E/G ratio of 2.72 and a beta of 1.03.

Honeywell International Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Friday, November 15th will be paid a dividend of $1.13 per share. This represents a $4.52 annualized dividend and a dividend yield of 1.99%. The ex-dividend date is Friday, November 15th. This is an increase from Honeywell International's previous quarterly dividend of $1.08. Honeywell International's payout ratio is currently 52.19%.

Honeywell International Profile

(

Free Report)

Honeywell International Inc engages in the aerospace technologies, building automation, energy and sustainable solutions, and industrial automation businesses in the United States, Europe, and internationally. The company's Aerospace segment offers auxiliary power units, propulsion engines, integrated avionics, environmental control and electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, advanced systems and instruments, satellite and space components, and aircraft wheels and brakes; spare parts; repair, overhaul, and maintenance services; and thermal systems, as well as wireless connectivity services.

Featured Articles

Before you consider Honeywell International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honeywell International wasn't on the list.

While Honeywell International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.