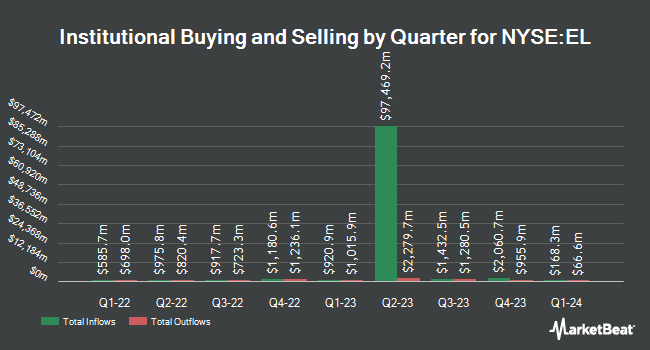

Ontario Teachers Pension Plan Board purchased a new position in shares of The Estée Lauder Companies Inc. (NYSE:EL - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 10,211 shares of the company's stock, valued at approximately $1,018,000.

Other institutional investors also recently added to or reduced their stakes in the company. Aptus Capital Advisors LLC increased its holdings in Estée Lauder Companies by 6.3% during the 2nd quarter. Aptus Capital Advisors LLC now owns 2,144 shares of the company's stock valued at $228,000 after purchasing an additional 127 shares in the last quarter. Canandaigua National Bank & Trust Co. lifted its position in Estée Lauder Companies by 2.1% during the 2nd quarter. Canandaigua National Bank & Trust Co. now owns 7,109 shares of the company's stock worth $756,000 after buying an additional 145 shares in the last quarter. Farther Finance Advisors LLC grew its holdings in Estée Lauder Companies by 30.9% during the 3rd quarter. Farther Finance Advisors LLC now owns 639 shares of the company's stock worth $64,000 after acquiring an additional 151 shares during the last quarter. Horizon Bancorp Inc. IN increased its position in Estée Lauder Companies by 22.3% in the 2nd quarter. Horizon Bancorp Inc. IN now owns 844 shares of the company's stock valued at $90,000 after acquiring an additional 154 shares in the last quarter. Finally, City Holding Co. raised its stake in shares of Estée Lauder Companies by 2.1% in the second quarter. City Holding Co. now owns 7,950 shares of the company's stock worth $846,000 after acquiring an additional 165 shares during the last quarter. 55.15% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

EL has been the topic of several recent research reports. UBS Group decreased their price target on Estée Lauder Companies from $115.00 to $104.00 and set a "neutral" rating on the stock in a report on Tuesday, August 20th. Hsbc Global Res cut shares of Estée Lauder Companies from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 16th. Deutsche Bank Aktiengesellschaft reduced their price target on shares of Estée Lauder Companies from $98.00 to $75.00 and set a "hold" rating on the stock in a research report on Monday, November 4th. HSBC downgraded Estée Lauder Companies from a "buy" rating to a "hold" rating and set a $100.00 price objective on the stock. in a research note on Wednesday, October 16th. Finally, Morgan Stanley decreased their target price on Estée Lauder Companies from $100.00 to $85.00 and set an "equal weight" rating for the company in a research note on Friday, November 1st. Nineteen investment analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, Estée Lauder Companies currently has an average rating of "Hold" and an average price target of $98.57.

Check Out Our Latest Stock Analysis on Estée Lauder Companies

Estée Lauder Companies Stock Performance

NYSE:EL traded up $1.87 during mid-day trading on Thursday, reaching $67.20. 1,068,015 shares of the company's stock were exchanged, compared to its average volume of 3,458,476. The Estée Lauder Companies Inc. has a one year low of $62.29 and a one year high of $159.75. The company has a debt-to-equity ratio of 1.44, a quick ratio of 0.90 and a current ratio of 1.32. The business's fifty day simple moving average is $83.42 and its two-hundred day simple moving average is $99.12. The firm has a market capitalization of $24.12 billion, a PE ratio of 116.68, a price-to-earnings-growth ratio of 3.91 and a beta of 1.05.

Estée Lauder Companies (NYSE:EL - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported $0.14 earnings per share for the quarter, beating analysts' consensus estimates of $0.09 by $0.05. Estée Lauder Companies had a net margin of 1.31% and a return on equity of 17.31%. The company had revenue of $3.36 billion during the quarter, compared to the consensus estimate of $3.37 billion. During the same period in the previous year, the business earned $0.11 earnings per share. The firm's quarterly revenue was down 4.5% on a year-over-year basis. Analysts anticipate that The Estée Lauder Companies Inc. will post 1.59 earnings per share for the current fiscal year.

Estée Lauder Companies Cuts Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Friday, November 29th will be issued a $0.35 dividend. This represents a $1.40 annualized dividend and a yield of 2.08%. The ex-dividend date of this dividend is Friday, November 29th. Estée Lauder Companies's dividend payout ratio is currently 471.43%.

Insider Activity

In other Estée Lauder Companies news, Director Paul J. Fribourg acquired 77,500 shares of the company's stock in a transaction that occurred on Friday, November 15th. The stock was acquired at an average cost of $64.01 per share, for a total transaction of $4,960,775.00. Following the transaction, the director now directly owns 234,500 shares in the company, valued at $15,010,345. This represents a 49.36 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Lynn Forester sold 3,890 shares of Estée Lauder Companies stock in a transaction dated Friday, August 23rd. The shares were sold at an average price of $93.61, for a total value of $364,142.90. Following the completion of the transaction, the director now owns 15,209 shares in the company, valued at approximately $1,423,714.49. This represents a 20.37 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 18,296 shares of company stock worth $1,423,366. 12.78% of the stock is currently owned by corporate insiders.

Estée Lauder Companies Profile

(

Free Report)

The Estée Lauder Companies Inc manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide. It offers skin care products, including moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products; and makeup products, such as lipsticks, lip glosses, mascaras, foundations, eyeshadows, and powders, as well as compacts, brushes, and other makeup tools.

Featured Articles

Before you consider Estée Lauder Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Estée Lauder Companies wasn't on the list.

While Estée Lauder Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report