Ontario Teachers Pension Plan Board cut its stake in F5, Inc. (NASDAQ:FFIV - Free Report) by 59.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 4,409 shares of the network technology company's stock after selling 6,525 shares during the period. Ontario Teachers Pension Plan Board's holdings in F5 were worth $971,000 as of its most recent SEC filing.

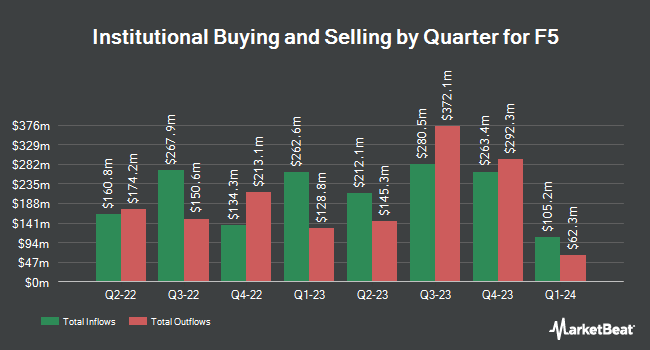

Several other large investors have also recently added to or reduced their stakes in the stock. Connor Clark & Lunn Investment Management Ltd. acquired a new position in F5 during the third quarter worth about $1,428,000. Commerce Bank boosted its position in shares of F5 by 3.2% in the 3rd quarter. Commerce Bank now owns 2,485 shares of the network technology company's stock valued at $547,000 after purchasing an additional 78 shares during the period. B. Metzler seel. Sohn & Co. Holding AG acquired a new stake in shares of F5 during the 3rd quarter valued at about $271,000. Banque Cantonale Vaudoise lifted its holdings in shares of F5 by 21.8% during the 3rd quarter. Banque Cantonale Vaudoise now owns 10,494 shares of the network technology company's stock valued at $2,311,000 after buying an additional 1,876 shares during the last quarter. Finally, LMR Partners LLP acquired a new stake in shares of F5 during the 3rd quarter valued at about $286,000. 90.66% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other F5 news, CEO Francois Locoh-Donou sold 1,450 shares of F5 stock in a transaction that occurred on Thursday, October 3rd. The stock was sold at an average price of $218.26, for a total value of $316,477.00. Following the sale, the chief executive officer now owns 121,122 shares of the company's stock, valued at $26,436,087.72. The trade was a 1.18 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, Director Alan Higginson sold 1,000 shares of the company's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $201.65, for a total value of $201,650.00. Following the completion of the transaction, the director now directly owns 10,707 shares in the company, valued at $2,159,066.55. This trade represents a 8.54 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 3,750 shares of company stock valued at $799,229 in the last quarter. 0.58% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of brokerages recently weighed in on FFIV. Morgan Stanley raised their price objective on F5 from $215.00 to $230.00 and gave the company an "equal weight" rating in a research note on Tuesday, October 29th. Barclays boosted their price objective on F5 from $214.00 to $246.00 and gave the stock an "equal weight" rating in a research note on Tuesday, October 29th. Royal Bank of Canada boosted their target price on F5 from $205.00 to $240.00 and gave the stock a "sector perform" rating in a research report on Tuesday, October 29th. JPMorgan Chase & Co. boosted their price objective on shares of F5 from $225.00 to $250.00 and gave the company a "neutral" rating in a report on Tuesday, October 29th. Finally, Needham & Company LLC boosted their target price on F5 from $220.00 to $235.00 and gave the company a "buy" rating in a research note on Tuesday, July 30th. Seven research analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $233.56.

Get Our Latest Analysis on FFIV

F5 Stock Up 1.3 %

Shares of FFIV traded up $3.20 during trading hours on Thursday, hitting $245.22. The company had a trading volume of 66,851 shares, compared to its average volume of 531,891. The stock's 50 day moving average price is $225.07 and its 200 day moving average price is $195.83. The firm has a market cap of $14.37 billion, a P/E ratio of 25.63, a P/E/G ratio of 3.24 and a beta of 1.05. F5, Inc. has a 52-week low of $159.01 and a 52-week high of $250.46.

F5 (NASDAQ:FFIV - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The network technology company reported $3.67 EPS for the quarter, beating analysts' consensus estimates of $3.45 by $0.22. The firm had revenue of $747.00 million for the quarter, compared to analysts' expectations of $730.43 million. F5 had a net margin of 20.13% and a return on equity of 20.80%. The business's revenue for the quarter was up 5.7% on a year-over-year basis. During the same quarter in the prior year, the company posted $2.76 earnings per share. On average, research analysts expect that F5, Inc. will post 11.01 EPS for the current fiscal year.

F5 declared that its board has initiated a stock buyback plan on Monday, October 28th that authorizes the company to buyback $1.00 billion in outstanding shares. This buyback authorization authorizes the network technology company to reacquire up to 7.9% of its stock through open market purchases. Stock buyback plans are usually an indication that the company's leadership believes its stock is undervalued.

F5 Company Profile

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Further Reading

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.